Nikola-VectoIQ combination

In early March, Nikola Corporation announced that it has merged with VectoIQ Acquisition Corp. (NASDAQ: VTIQ), a publicly-traded special purpose acquisition company. As the transaction was completed on June 3, the combined company started to trade on NASDAQ under ticker symbol NKLA on June 4. Nikola plans to use the cash proceeds raised from this transaction to fund operations, support growth and for other general corporate purposes.

Stock movement

Even before the launch of its product, Nikola shares jumped more than 100% on Monday after its Founder and Executive Chairman Trevor Milton tweeted that the company would open up the reservation for its Badger truck on June 29. Yesterday morning, trading of NKLA stock was halted for quite a while when its price peaked to $93.99. Nikola stock ended up 9% at $79.73 yesterday with a whopping trading volume of 70.5 million compared to its debut day trading volume of 16.5 million.

[irp posts=”59450″]

Nikola overview

Nikola designs and manufactures battery-electric vehicles (BEV), fuel cell electric vehicles (FCEV), electric vehicle drivetrains, energy storage systems, and hydrogen fueling stations. Nikola’s core product offering is centered on its BEVs and FCEV Class 8 semi-trucks. The company operates in three business units: Truck, Energy and Powersports.

Financial performance

For the year ended December 31, 2019, the Phoenix,

Arizona-based firm generated revenue of $482,000 and net loss attributable to

common stockholders stood at $105.4 million. Costs and expenses totaled $88.5

million in 2019 and the company had cash and cash equivalents of $85.7 million

as of December 31, 2019.

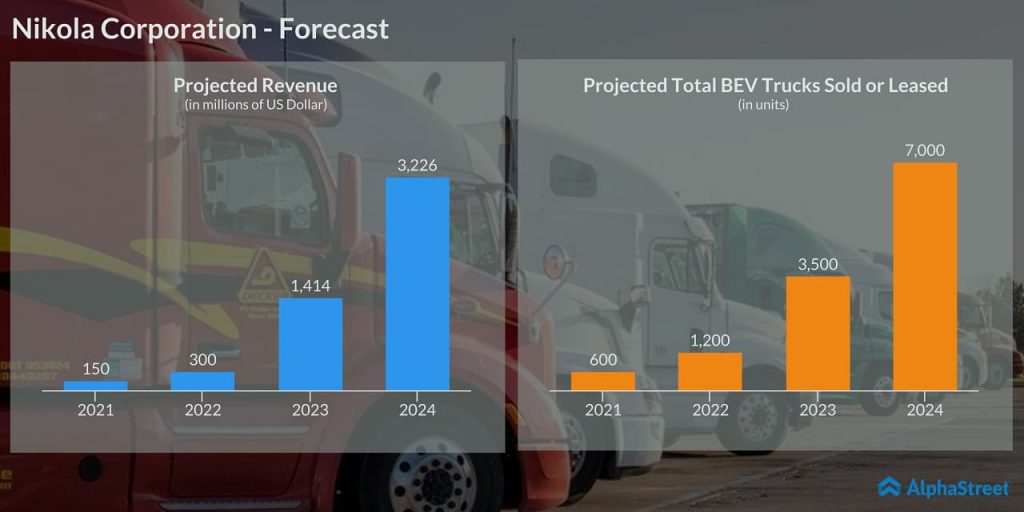

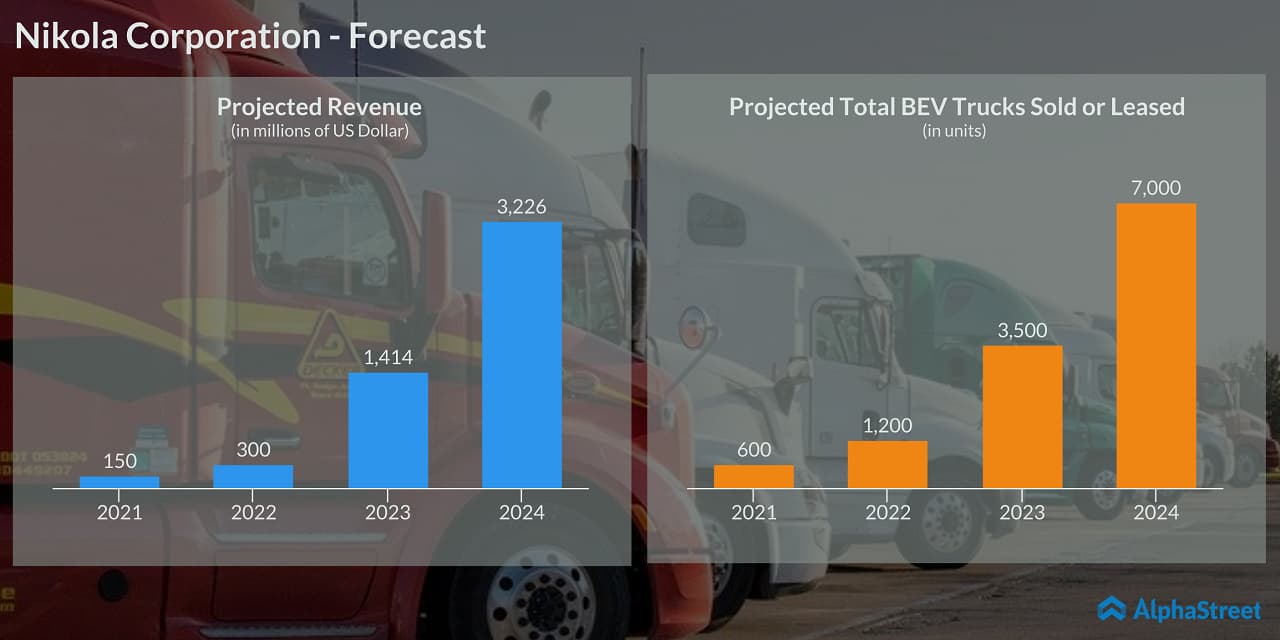

In an SEC filing, Nikola had projected its revenue to be

$150 million in 2021, $300 million in 2022, $1.41 billion in 2023, and $3.23

billion in 2024. The company eyes to sell or lease 600 BEV trucks in 2021,

1,200 trucks in 2022, 3,500 trucks in 2023, and 7,000 trucks in 2024.

Production and orders

As of December 31, 2019, Nikola had approximately 14,000 reservations for its FCEV trucks. This represents more than two years of production and over $10 billion of potential revenue.

The company plans to produce and sell BEV and FCEV trucks in

North America and Europe. In the third quarter of 2020, Nikola plans to begin

construction of the initial phase of its approximately 1 million square foot

battery-electric and hydrogen fuel cell electric truck manufacturing plant in

Coolidge, Arizona.

In 2019, Nikola partnered with Iveco, a subsidiary of CNHI, to manufacture the Nikola Tre truck at the Iveco manufacturing plant in Ulm, Germany through a joint venture with CNHI, which is expected to start operations in the third quarter of 2020. Nikola expects to begin production of the Nikola Tre BEV at the Iveco plant in 2021, with deliveries beginning in the same year.

[irp posts=”56482″]

Beginning in 2021, Nikola expects to utilize existing excess capacity at Iveco’s Ulm, Germany plant to begin production of the Nikola Tre BEV for the U.S. delivery. These first trucks will be imported into the U.S. to fulfill launch customer orders.

In an email communication to AlphaStreet, Nikola’s spokesperson Nicole Rose said,

“Regarding sales in countries outside North America and Europe, these regions are our first focus, but we anticipate selling globally eventually. We have not yet announced a priority list of countries or dates of introduction outside North America/Europe.”

ADVERTISEMENT

However, the spokesperson didn’t give a direct answer to a

query regarding the company achieving profitability.

Competition

Today, Ford Motors joined hands with Volkswagen to produce medium pickup trucks. Ford had planned to add battery electric versions of Transit and F-150 in the next 24 months for commercial customers. According to CNBC, Tesla CEO Elon Musk had asked the company employees to begin the volume production of its Semi commercial trucks. Two months back, Tesla delayed production and deliveries of all-electric vehicles until 2021.

Market observers expect the early hype created by the speculative traders for Nikola to come down and the stock price to fall below from the current level. While Nikola stock slumped 18.46%, it’s worth noting that TSLA stock hit a new all-time high ($1027.48) today. This is the first time that Tesla stock had surpassed the $1,000 mark.