Diversification

After launching a crackdown on password sharing, the company has been building its ad-supported service lately though that business is unlikely to drive revenue growth meaningfully this year. As part of expanding live programming, the company plans to stream professional wrestling program WWE Raw live on the platform, exclusively in the US, Canada, UK, and Latin America, starting in January 2025.

While staying focused on enhancing profitability, the company’s growth plan for 2024 includes forging partnerships with more content creators, but it does not see any acquisitions in the near future. Going forward, the company will continue investing in content, at a time when most of its competitors cut back on content spending to safeguard margins. Netflix is also foraying into the gaming business, which is in the early stages.

Content Power

The strong subscriber growth in the fourth quarter can be attributed to the strength of Netflix’s content, with popular action features like Leave the World Behind and David Fincher’s The Killer attracting a large number of viewers. The top shows also include the final season of the long-running royal drama The Crown.

From Netflix’s Q4 2023 earnings call:

“If we continue to improve our core offering, that means more diversity and more quality from our members’ perspective and our films and series. Now, adding the live events programming to add even more value, continuing to grow gains in the entertainment value that we’re delivering through those, then our paid-sharing work and our ads work creates a more effective engine to translate all that value into revenue growth and will support increased conversion of our addressable market in many years to come.”

Solid Results

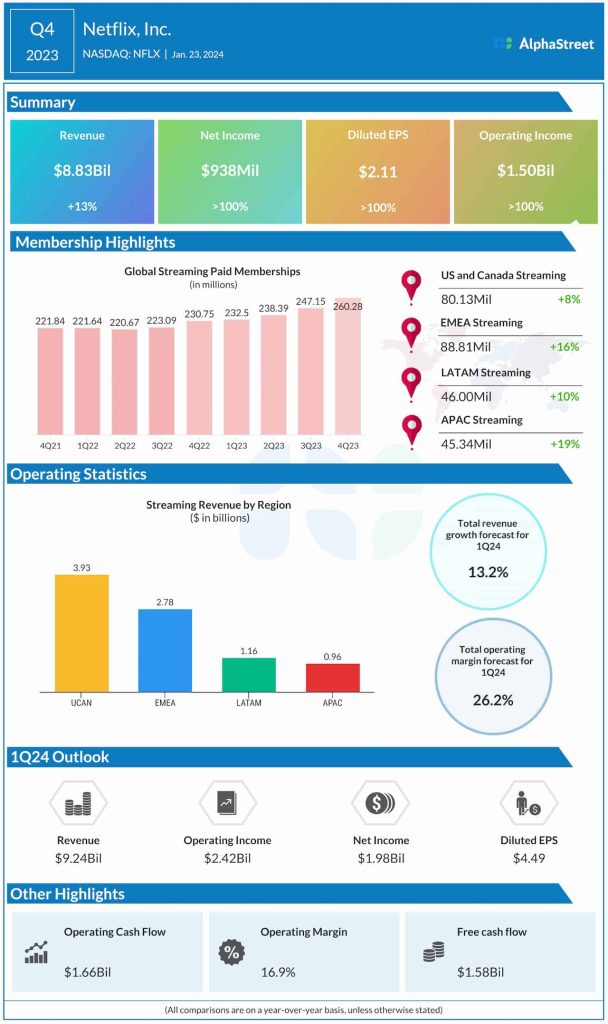

In the December quarter, net income increased multi-fold to $938 million or $2.11 per share from $55 million or $0.12 per share in the corresponding period of 2022. However, the bottom line missed the market’s projection, after three consecutive beats. The strong earnings growth reflects a 12.5% jump in revenues to $8.83 billion in Q4. Analysts had forecast a slower growth. The company had a total of 260.28 million paid members at the end of the quarter, up 13% year-over-year.

Extending the post-earnings rally, Netflix’s stock traded sharply higher during Wednesday’s regular session. It is up 18% since the beginning of the year.