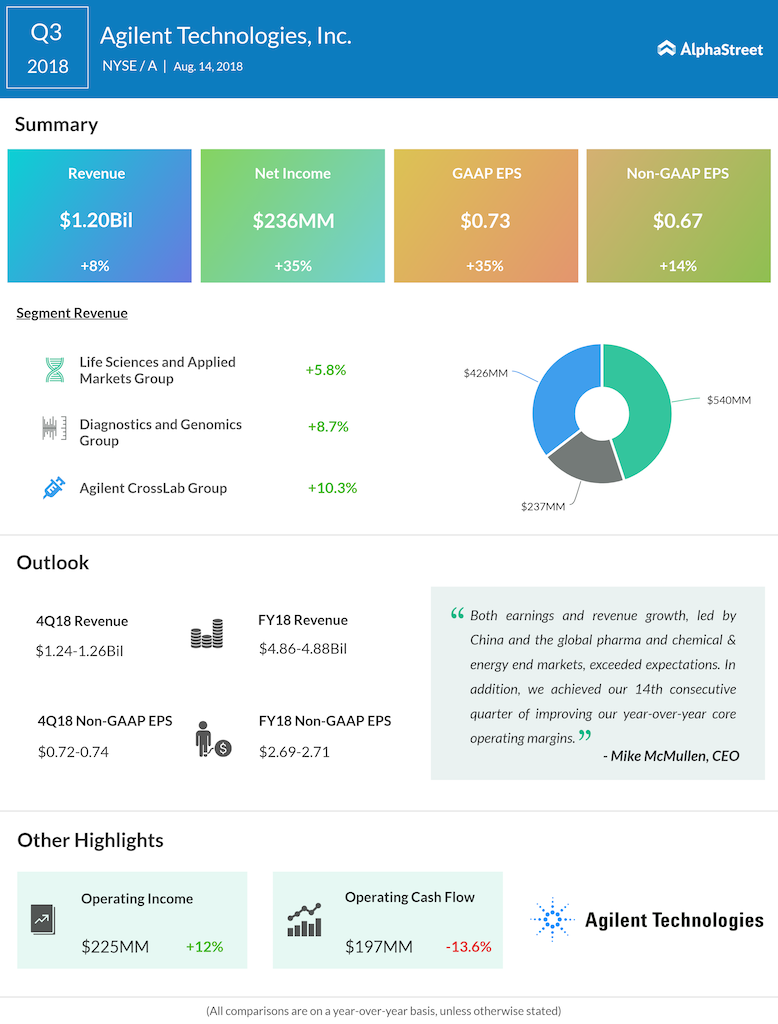

Revenue grew by 8% year-over-year to $1.2 billion helped by the strength across its business segments.

Looking ahead into the fourth quarter, the company expects revenue to be in the range of $1.24 billion to $1.26 billion, and non-GAAP earnings in the range of $0.72 to $0.74 per share.

For the fiscal year 2018, Agilent lifted revenue outlook to the range of $4.86 billion to $4.88 billion from the previous estimate of $4.85 billion to $4.87 billion. Adjusted earnings guidance was lifted up to the range of $2.69 to $2.71 per share from prior forecast of $2.63 to $2.67 per share.

Revenue from Agilent’s Life Sciences and Applied Markets Group for the third quarter rose by 6% year-over-year helped by the strength in the chemical & energy and pharma end markets. Revenue from Agilent CrossLab Group grew 10% as both services and consumables saw strong growth across all end markets and geographies. Revenue from Agilent’s Diagnostics and Genomics Group increased 9% driven by the strength in genomics and China.

During the third quarter of 2018, the company repurchased $243 million in shares, paid $48 million in dividends, and invested $430 million in mergers and acquisitions.

As of July 31, 2018, Agilent has spent more cash in the daily running of the business as the balance sheet showed a 20% dip in cash and cash equivalent from October 31, 2017. Long-term investments have fallen by 49%, while goodwill and other intangible assets rose by 16%.

The company had paid off all of the short-term debt and also reduced long-term debt by 0.1%. An increase in accumulated deficit has dragged total equity lower by 5.5%.

Shares of Agilent ended Tuesday’s regular trading up 1.23% at $66.75 on the NYSE. The stock has fallen more than 3% for the past three months, while it has risen by more than 11% for the past year.