Total net investment income dropped by 20% as it was significantly impacted by market performance. Net investment income from its insurance companies, including the Legacy insurance portfolios, decreased 18.1% due to the net losses on alternative and equity securities.

Net catastrophe losses were $630 million or $0.71 per share for the fourth quarter, which was consistent with the previously disclosed range.

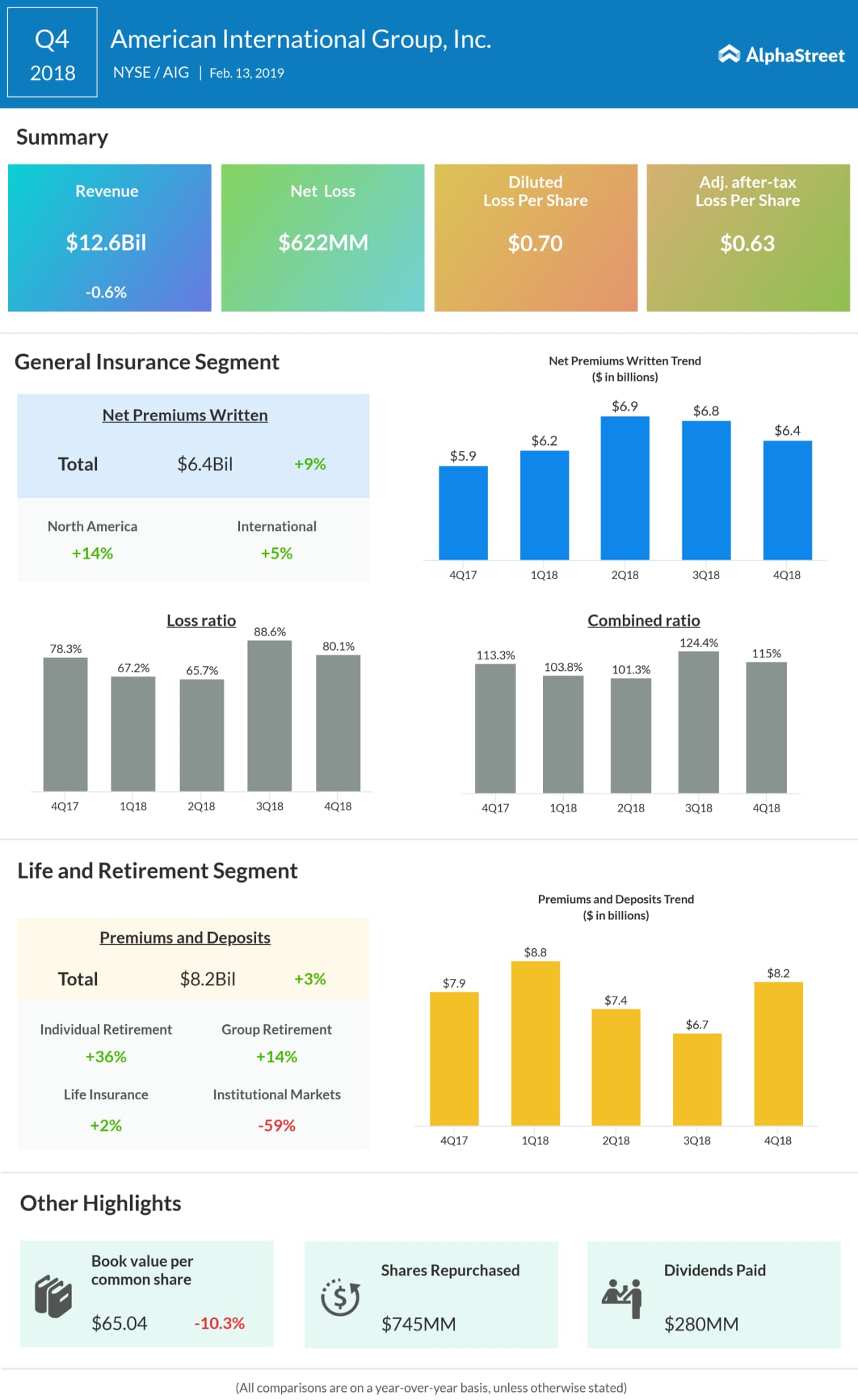

The results showed positive improvements in General Insurance, reflecting actions the company took throughout the year to reposition and strengthen the business, and Life and Retirement remains a stable source of earnings with attractive returns. Results were negatively impacted by performance in both equity and credit markets, catastrophe losses, as well as modest net unfavorable prior year loss reserve development.

During the quarter, total premium and deposits rose by 2.5% to $8.2 billion. AIG’s book value per share plunged to $65.04 from $72.49 in the fourth quarter of 2017. In mostly all the business segments, underwriting loss widened compared to last year.

Separately, the company’s board of directors declared a quarterly dividend of $0.32 per share on AIG Common Stock, par value $2.50 per share. The dividend is payable on March 29, 2019, to stockholders of record at the close of business on March 15, 2019.

Shares of AIG ended Wednesday’s regular session up 0.80% at $44.18 on the NYSE. The stock has fallen over 25% in the past year while it has risen over 4% in the past three months.