“We have advanced our ALXN1210 programs with the goal of improving the standard of care for patients and have filed regulatory submissions for PNH in the U.S. and EU, and pending regulatory approval, plan to launch next year.” CEO Ludwig Hantson said in a statement.

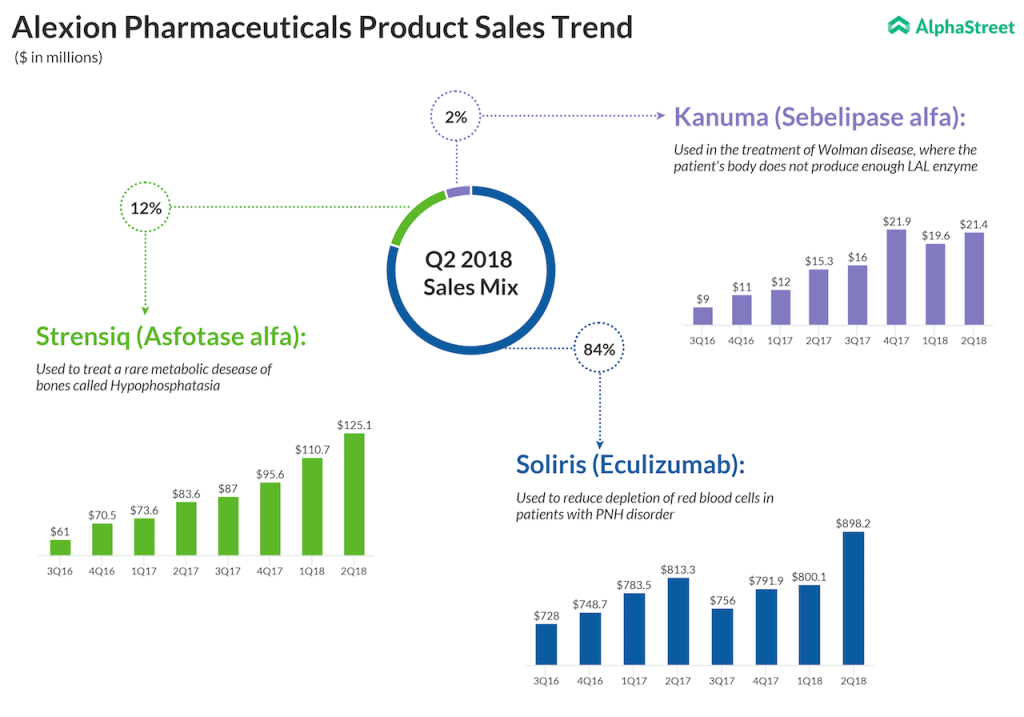

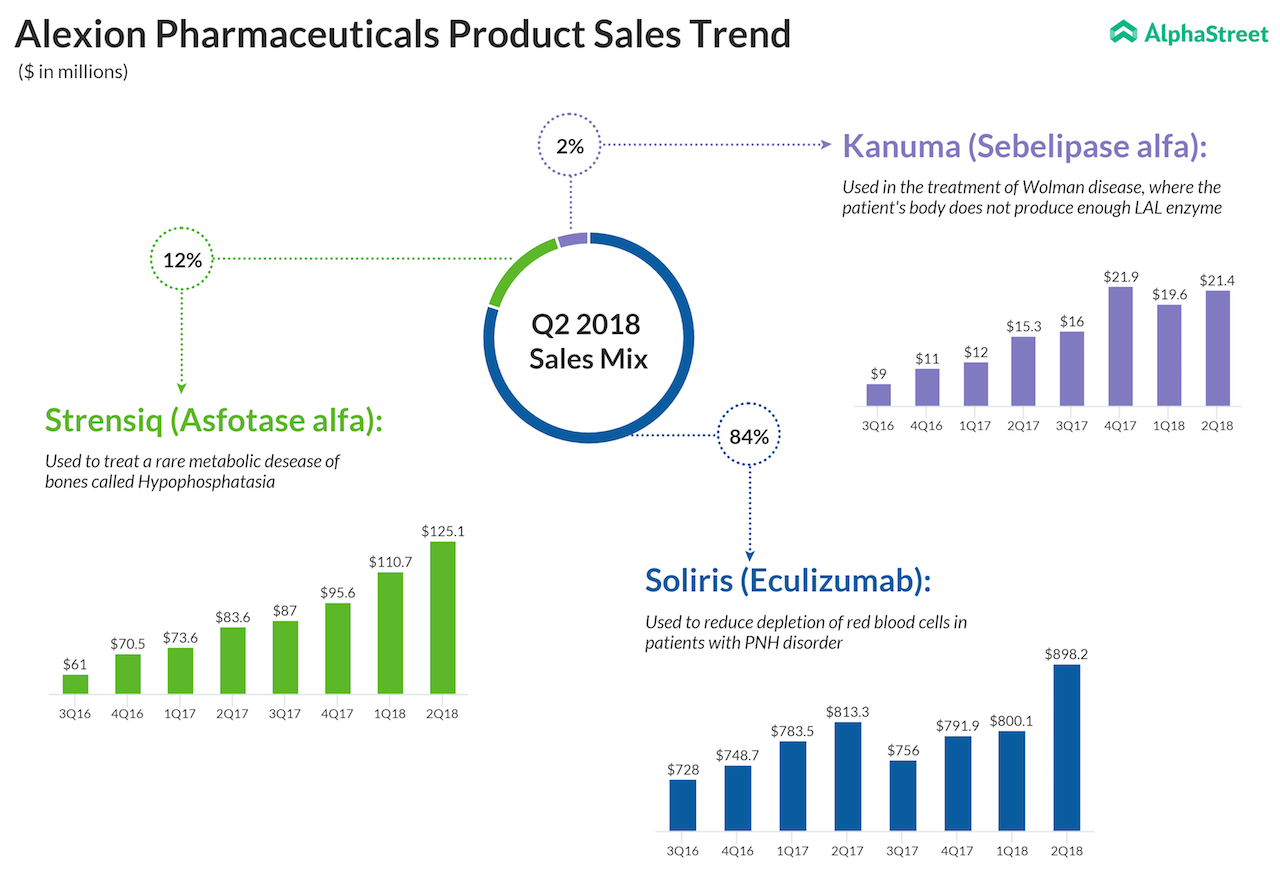

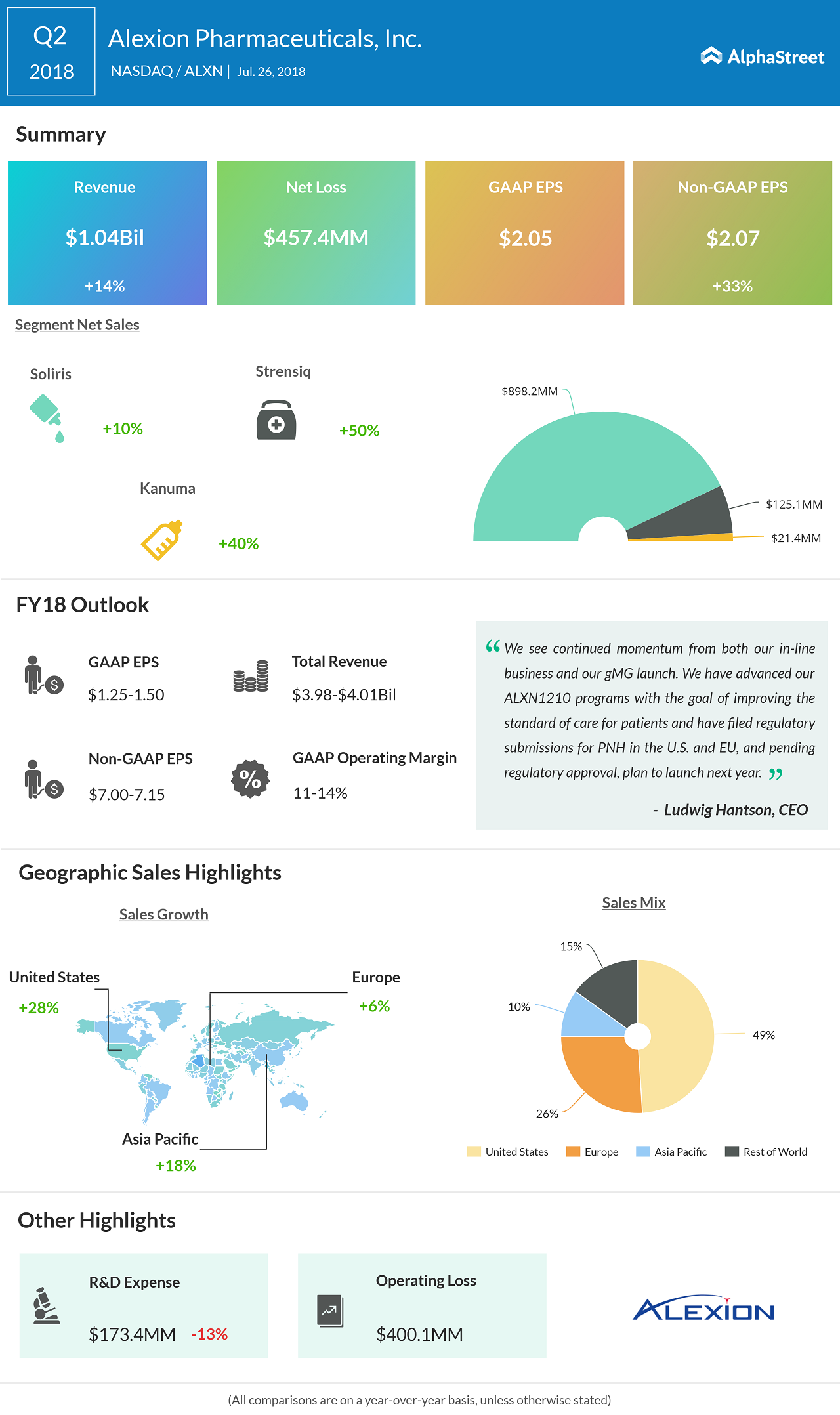

During the quarter, sales of the company’s flagship Soliris drug, used in the treatment of rare blood-related diseases, increased 10% to $898.2 million. Volume improved 11% year-over-year.

Elated by the strong performance in the second quarter, the Connecticut-based company raised its revenue and income expectations for the full year. The company now expects non-GAAP earnings in the range of $7.00 to $7.15 per share on a total revenue of $3.98 billion to $4.01 billion for FY18.

Earlier, the company had projected non-GAAP earnings of $6.75 to $6.90 per share on revenue of $3.925 billion to $3.985 billion. Alexion stock gained over 2% in pre-market trading on Thursday.