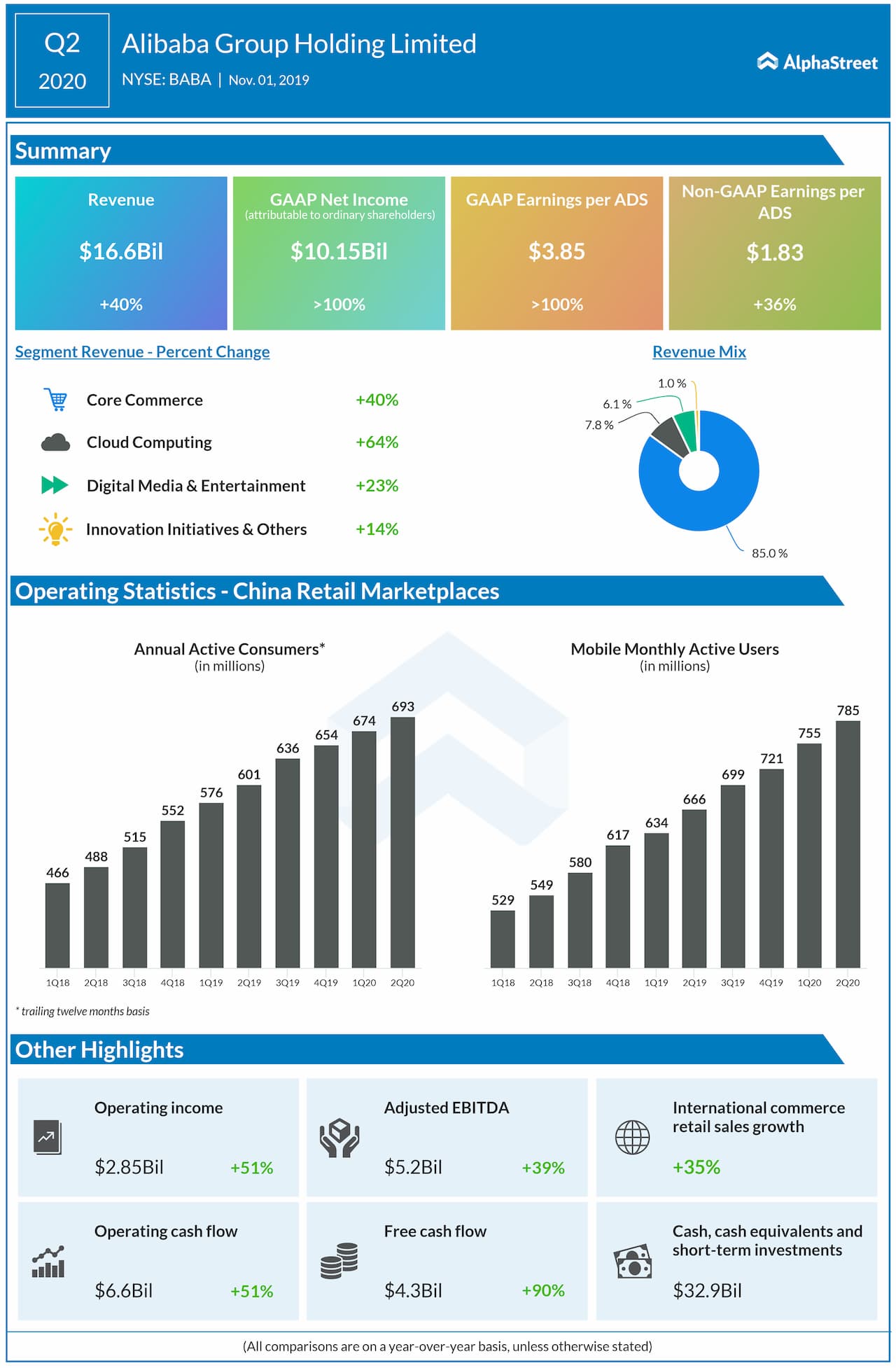

Net income attributable to ordinary shareholders was RMB72.5 billion ($10.1 billion). Adjusted net income was RMB32.7 billion ($4.5 billion).

Diluted earnings per ADS was RMB27.51 ($3.85). Adjusted diluted earnings per ADS was RMB13.10 ($1.83). Analysts had forecast adjusted EPS of $1.50.

Annual active customers on the company’s China retail marketplaces reached 693 million, up 19 million from the 12-month period ended June 30, 2019. Mobile MAUs on the China retail marketplaces reached 785 million in September 2019, up 30 million over June 2019.

Revenue from the China commerce retail business increased 40% year-over-year to RMB75.7 billion ($10.6 billion). Revenue from the China commerce wholesale business rose 31% year-over-year to RMB3.2 billion ($459 million). Revenues from the international commerce retail and wholesale businesses rose 35% and 20% respectively versus the year-ago period.

Cloud computing revenue grew 64% year-over-year to RMB9.2 billion ($1.3 billion) during the quarter, driven mainly by an increase in average revenue per customer. Revenue from the digital media and entertainment business grew 23% year-over-year. Average daily subscribers for the Youku online video platform increased 47% year-over-year.

In September, Alibaba acquired NetEase’s import e-commerce platform Kaola and the company sees opportunities for user, revenue and cost synergies for the combined Tmall Global and Kaola businesses. Alibaba also became a 33% equity stakeholder in Ant Financial and the company recognized a one-time gain of RMB69.2 billion ($9.7 billion) upon the receipt of the equity interest in Ant Financial.

Listen to on-demand earnings calls and hear how management responds to analysts’ questions