Under Armour Inc. (NYSE: UAA) is scheduled to report earnings results for the third quarter of 2019 on Monday, November 4, before the market opens. Analysts expect the company to report earnings of $0.18 per share on revenue of $1.41 billion.

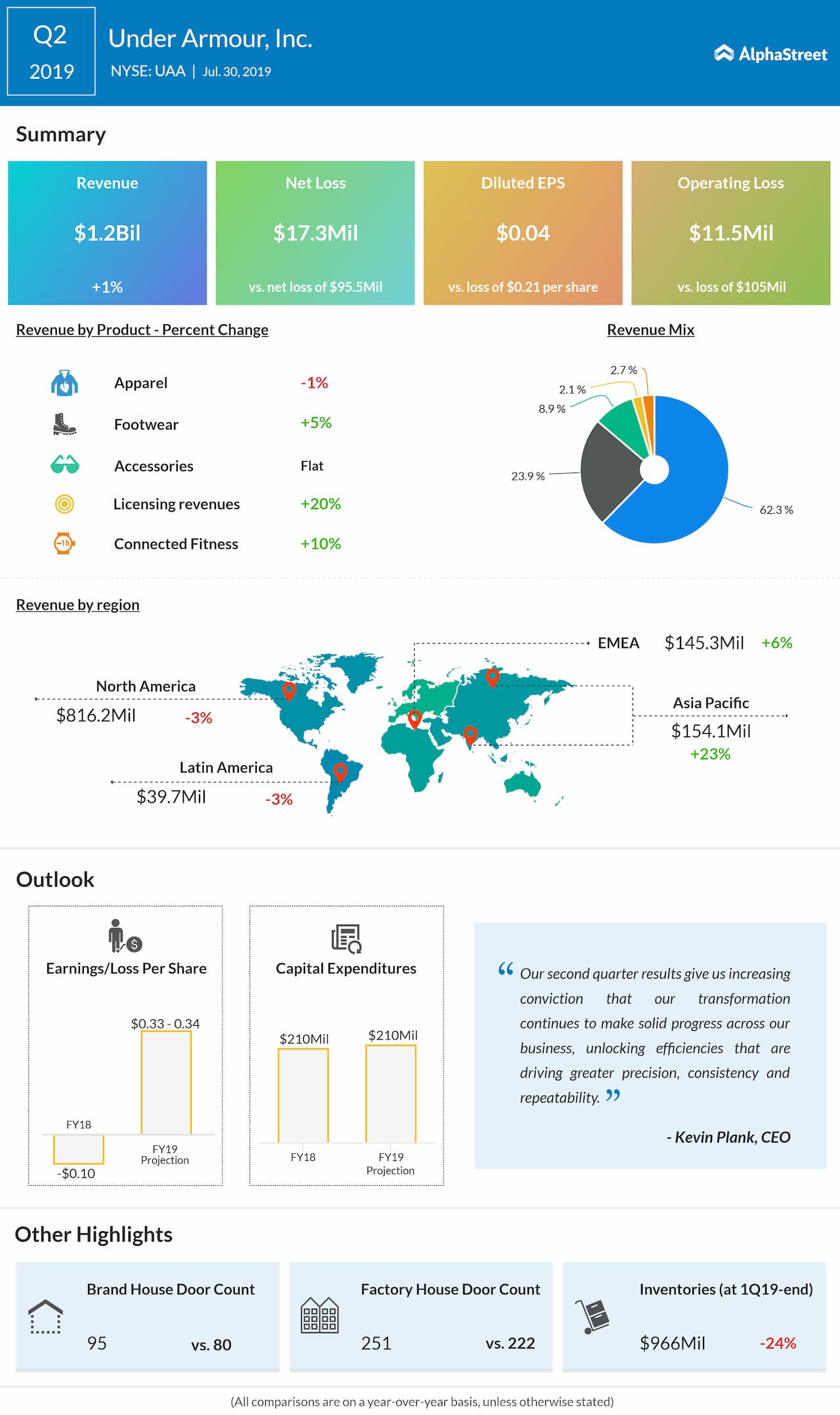

The company has been seeing weakness in the North America region and this is likely to weigh on third quarter results. However, strength in the international business might help offset this decline. Last quarter, the North America segment revenue decreased 3% while international revenues grew 12%.

The wholesale division might also see slight weakness during the third quarter which could impact the topline. Last quarter, wholesale revenue fell 1%. The footwear business is likely to continue the momentum seen in past quarters. Last quarter, the footwear business was up 5%.

Under Armour is expected to benefit from its strategy of focusing more on its fitness-based business, amid the growing health awareness among sportspersons. Last quarter, the connected fitness business grew 10%.

Earlier this month, Under Armour’s founder and CEO Kevin Plank announced that he would move on to the position of Executive Chairman and Brand Chief, while Patrik Frisk would take over as the new CEO, effective January 1, 2020.

In the second quarter of 2019, Under Armour missed revenue estimates while net loss was narrower-than-expected. Revenue inched up by 1% to $1.2 billion and net loss narrowed to $0.04 per share from $0.21 per share in the year-ago period.

Under Armour expects full-year 2019 revenue to grow 3-4%, reflecting a slight decline in North America and a low to mid-teen percentage rate increase in the international business. EPS is expected to come in the range of $0.33 to $0.34.

Under Armour’s shares have gained 16% year-to-date and 3% in the past one month. The stock was down over 1% in morning hours on Thursday.