Based on a report by IATA, global

passenger demand in 2021 is expected to be 24% below 2019 levels. The report

also states that 2019 levels are not expected to be exceeded until 2023. If

restrictions continue, leading to a delay in the opening of economies, global

revenue passenger kilometers (RPK) in 2021 could be 34% lower than 2019 levels.

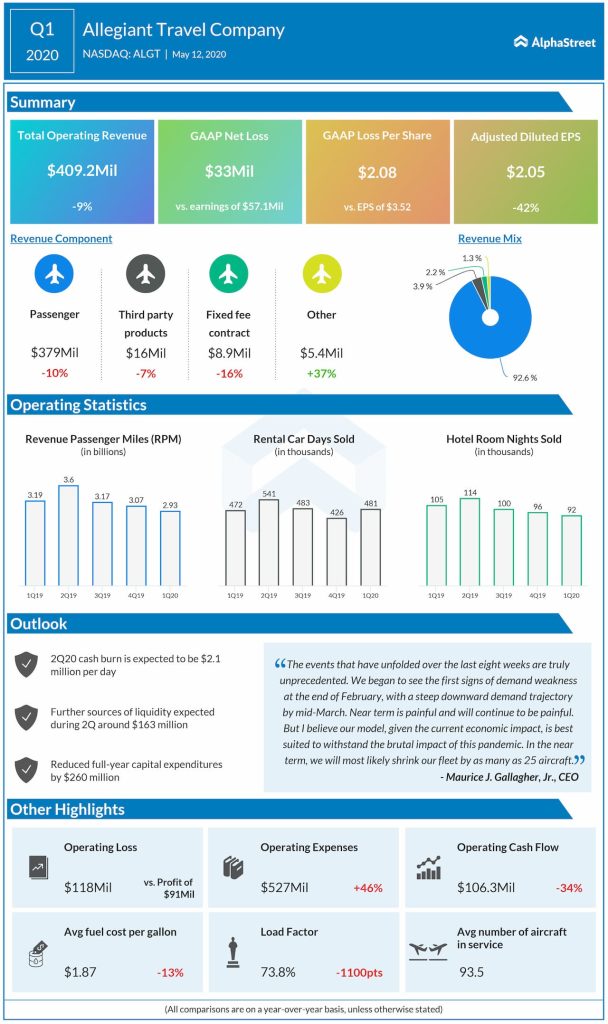

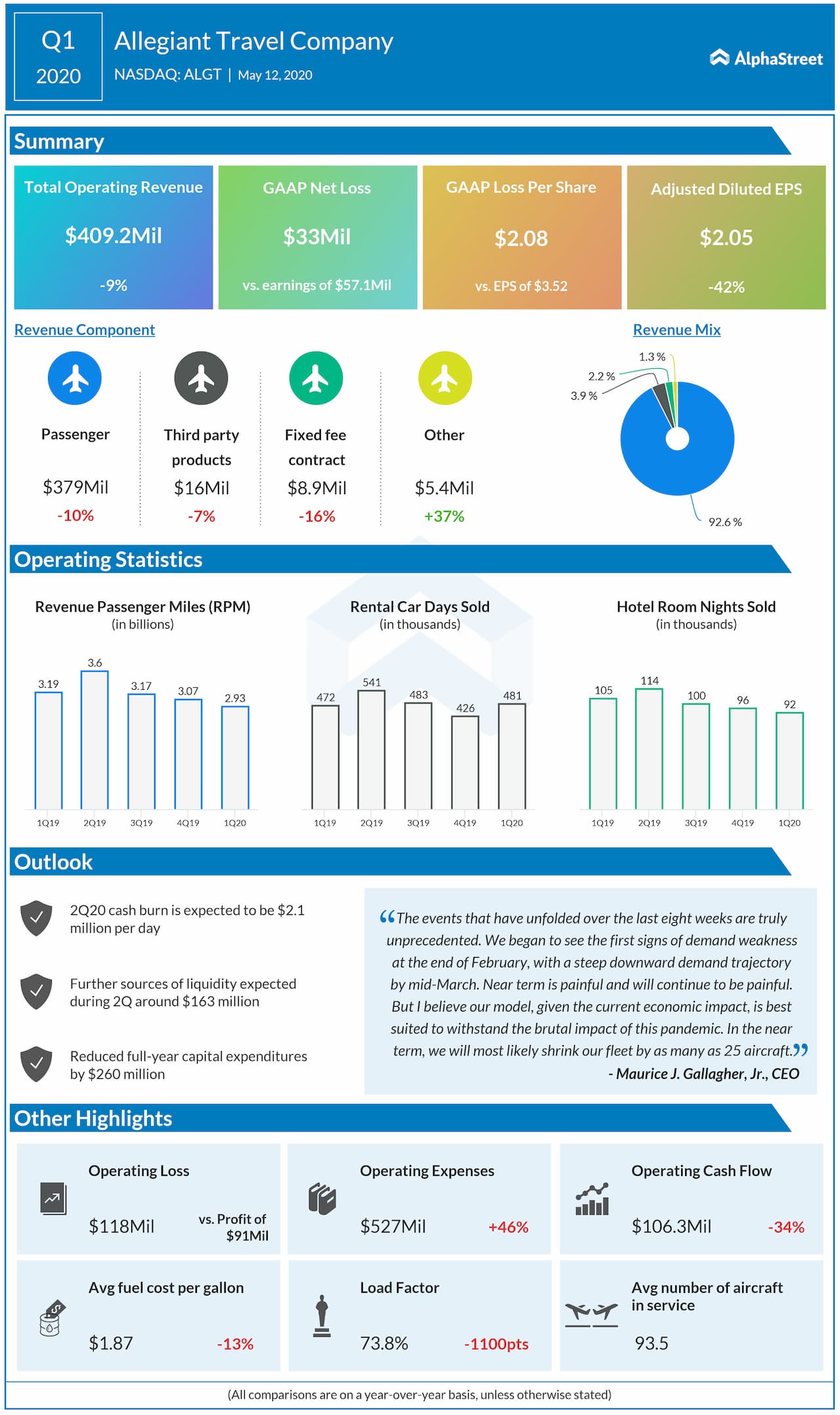

In January, Allegiant reported a nearly 12% increase in capacity year-over-year along with a slight increase in load factor while in February, capacity rose 20.5% but load factor dipped by 1.5 points. In March, capacity fell by over 12% while load factor declined over 27 points. For the first quarter, capacity increased 4%.

Allegiant reduced its April capacity by 87.4% and the

company expects significant capacity cuts in May and June due to lower leisure

demand trends. However, on its quarterly conference call, the company said it believes

leisure travel is more likely to get back on track faster compared to

international and business travel. Allegiant added that it has been seeing a

slight pickup in leisure travel in recent weeks.

The company has seen a slight uptick in bookings in select

markets over the past couple of weeks corresponding to the opening of beaches

in Florida. Allegiant believes the next step in demand recovery is dependent on

the reopening of theme parks, casino resorts and NFL stadiums in Orlando and

Las Vegas, which are two of the company’s largest summer travel destinations.

The company believes international and business travel could

take more time to resume as most companies have adapted to remote work and web

conferencing. This could reduce the need for business meetings and other

work-related travel meaningfully. The company believes these shifts could lead

to a structural change in the post COVID-19 business world. It can be assumed

that reduced business travel could take a meaningful toll on the company and

its airline peers.

Allegiant’s main competitor Spirit Airlines (NYSE: SAVE) reported its

first quarter 2020 results last week and the company saw a sharp drop in

passenger demand and bookings due to the pandemic-related restrictions. The airline

reduced its April capacity by around 75% while the capacity for May and June

was cut by approx. 95%.

Allegiant, meanwhile, is preparing for the worst over the coming months. The company is planning to retire around 10-15 aircraft in order to save cash. It is also looking to park as many as 10 aircraft due to softness in demand. Allegiant has also halted the construction of the Sunseeker resort indefinitely and has decided not to put any more capital into the project for at least the next 18 months.

Allegiant’s shares have fallen 53% over the past three months. The stock was up 5% in afternoon hours on Wednesday.