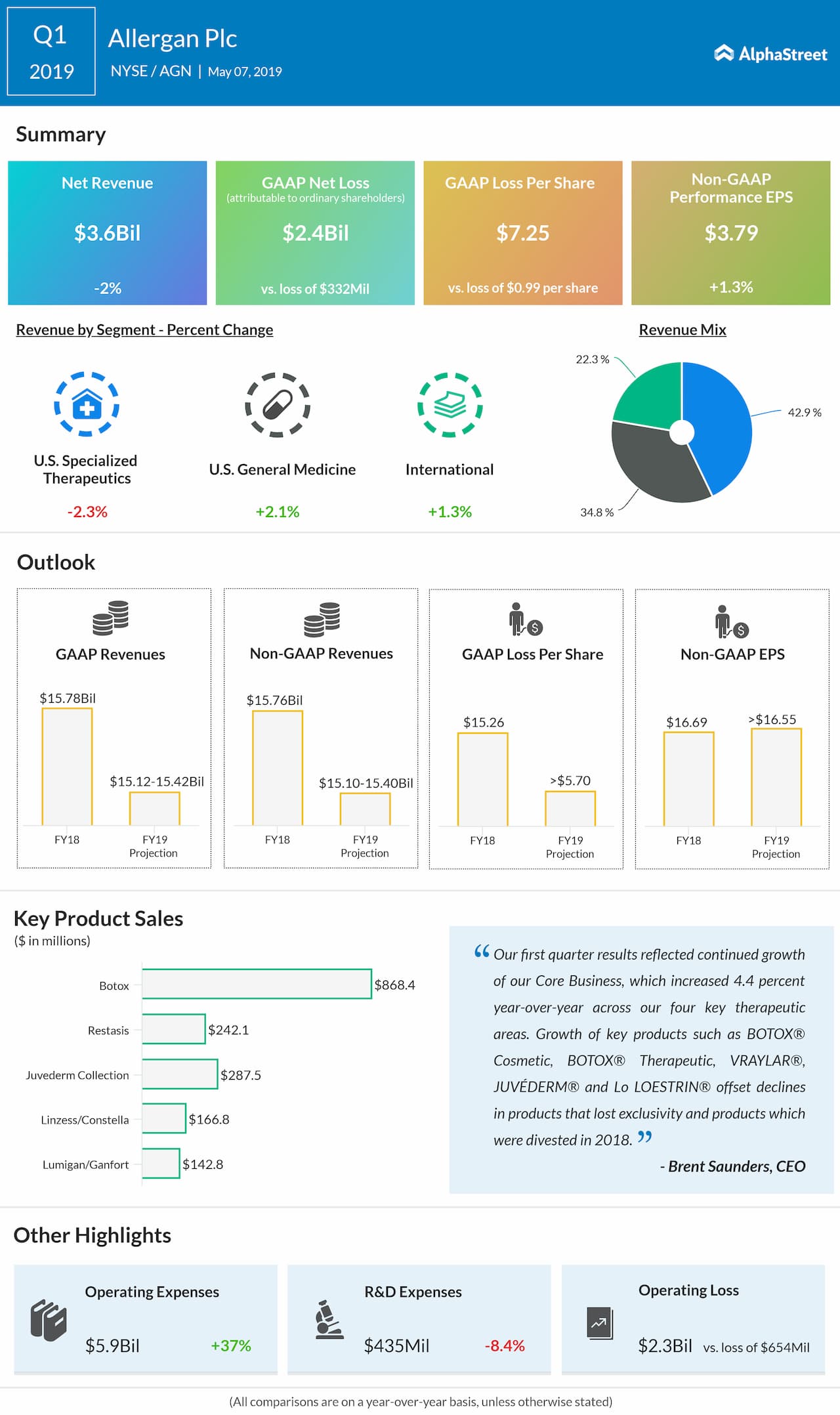

GAAP net loss attributable to ordinary shareholders was $2.4 billion, or $7.25 per share, versus $332.5 million, or $0.99 per share, in the year-ago period. Adjusted EPS grew 1.3% to $3.79.

In US Specialized Therapeutics, revenues decreased 2.3% year-over-year to $1.54 billion due to lower revenues in CoolSculpting and RESTASIS as well as the divestiture of the Medical Dermatology business, which offset the demand growth in BOTOX and JUVEDERM.

US General Medicine revenues grew 2.1% to $1.25 billion, primarily due to growth in VRAYLAR and Lo LOESTRIN. International revenues grew 1.3% to $801.5 million, due to growth in Facial Aesthetics.

Also see: Allergan Q1 2019 Earnings Conference Call Transcript

Allergan raised its outlook for the full year of 2019, and now expects GAAP net revenues to be in the range of $15.12 billion to $15.42 billion. Adjusted revenues are expected to be $15.10 billion to $15.40 billion. GAAP loss is expected to be $5.70 per share while adjusted EPS is expected to be $16.55.

For the second quarter of 2019, GAAP revenues are expected to be $3.87 billion to $4.02 billion. Adjusted revenues are expected to be $3.85 billion to $4.00 billion. GAAP EPS is expected to come in the range of $0.50-0.70 while adjusted EPS is expected to be $4.20-4.40.