Alphabet Inc. (NASDAQ: GOOGL) reported a 19% increase in earnings for the fourth quarter of 2019 helped by higher revenue. The bottom line exceeded analysts’ expectations while the top line missed consensus estimates.

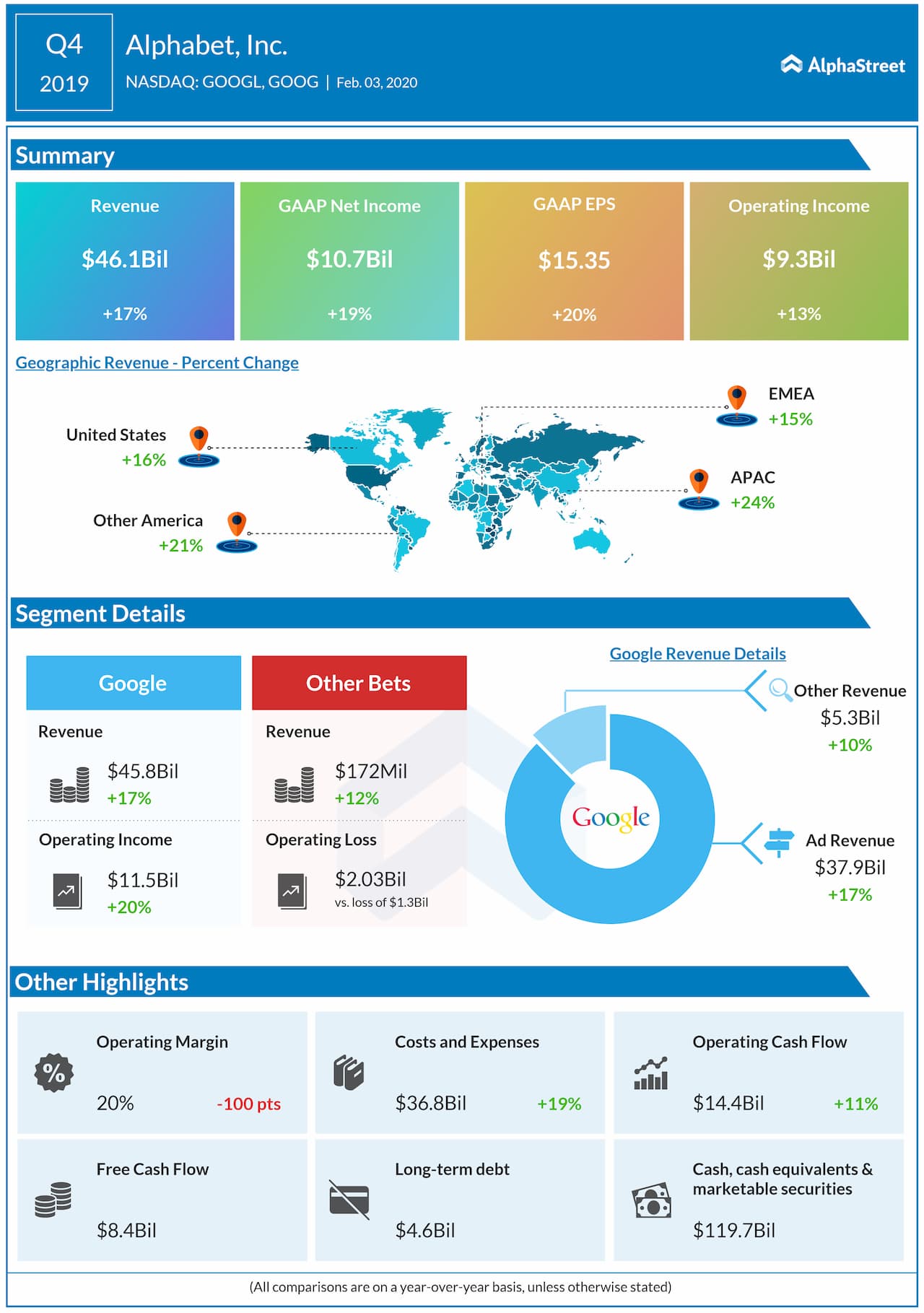

Net income increased by 19% to $10.67 billion or $15.35 per share. Revenue grew by 17% to $46.08 billion. Analysts had expected the parent of Google to report earnings of $12.53 per share on revenue of $46.94 billion for the fourth quarter.

Revenue from the Google segment grew by 17.5%. Revenue from the Other Bets division, which includes Waymo and Verily, rose 12%. The company said its investments in deep computer science, including artificial intelligence, ambient computing, and cloud computing provide a strong base for continued growth and new opportunities across Alphabet.

For the fourth quarter, revenue from Google Search grew by 17% while that from YouTube ads jumped by 31%. Revenue from Google advertising increased by 16.7% while that from Google Cloud soared by 53%. However, hedging gains declined by 27%.

Total traffic acquisition costs (TAC) to network members and distribution partners totaled $8.5 billion in the quarter. Total TAC, as a percentage of advertising revenues, was 22%.

Read: Marvell Technology stock remains bullish on 5G opportunity

The company continues to improvize its segments based on its long-term investment in artificial intelligence. The AI has helped Alphabet to understand the people’s queries in Google Search, which continued to dominate the search engine market over the past five years.

Alphabet’s Cloud solutions continue to experience a spike in retailers due to the seamless and personalized shopping experience and easier streamlining of the operations. The increase in advertising has been attributed to the strengths in machine learning as it helps advertisers to build their ad campaigns.