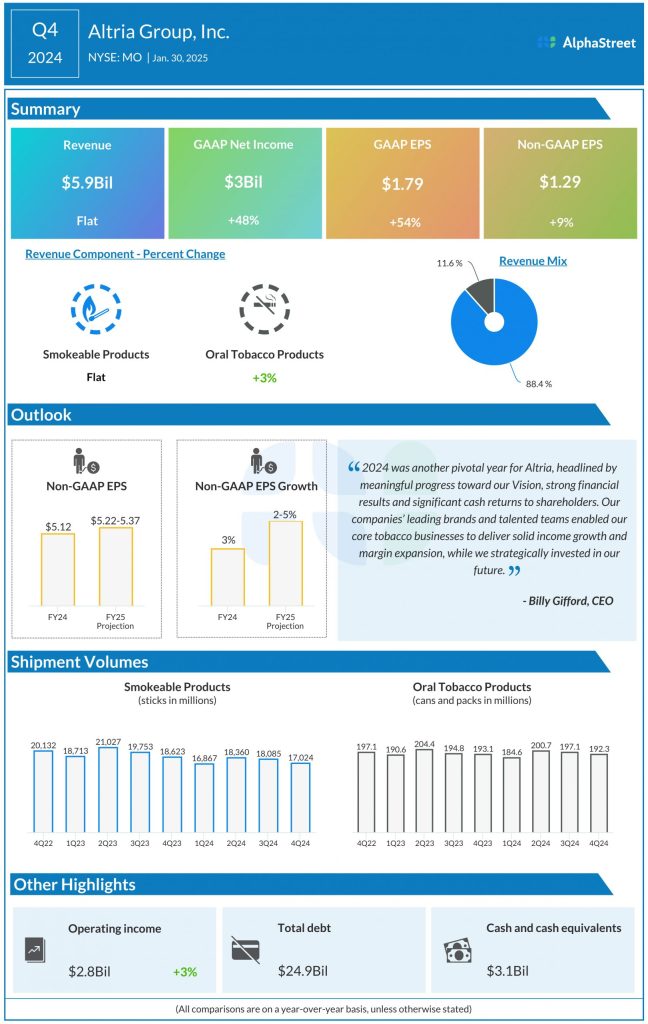

Q4 numbers

NJOY and on! lead smoke-free growth

Altria continued to see growth in its smoke-free business led by its NJOY e-vapor products and on! nicotine pouches. In Q4, NJOY consumables shipment volume increased over 15% year-over-year to 12.8 million units and devices shipment volume grew over 22% to 1.1 million units. NJOY retail share of consumables increased 2.8 share points versus the prior year to 6.4%.

The e-vapor category continues to be plagued by illicit products. On its conference call, Altria said that illicit products make up over 60% of this category. The widespread availability of these illicit products pose challenges to the company’s smoke-free business.

In the oral tobacco category, oral nicotine pouches grew 9.6 share points in Q4 versus the previous year and accounted for 45.7% of the category. Shipment volume for on! nicotine pouches grew over 44% YoY to nearly 44 million cans in Q4. on! grew its share of the oral tobacco category by 2 share points YoY to 8.9%, and its share of the nicotine pouch category was 19.5% in Q4.

In the fourth quarter, Altria’s revenues from its oral tobacco products segment increased 2.7% YoY to $692 million, driven by higher pricing.

Cigarettes continue to fall

Altria continues to face headwinds in its smokeable products business. In Q4, revenues of $5.26 billion dipped slightly YoY, as lower shipment volume and higher promotional investments were partly offset by higher pricing.

Domestic cigarette shipment volume decreased 8.8% in the quarter, due to a decline in the industry rate amid headwinds from the growth of illicit products and pressures on consumers’ discretionary incomes. In Q4, Marlboro retail share of the total cigarette category dipped 1 share point YoY to 41.3% while its share of the premium segment rose by 0.1 share point to 59.4%.

Outlook

Altria expects adjusted EPS for the full year of 2025 to range between $5.22-5.37, representing a growth of 2-5% from 2024.