GAAP net loss was $3.5 million, or $0.01 per share, compared to a loss of $24.5 million, or $0.08 per share, last year. Adjusted net income was $4.5 million, or $0.01 per share. Analysts had forecast adjusted loss of $0.05 per share.

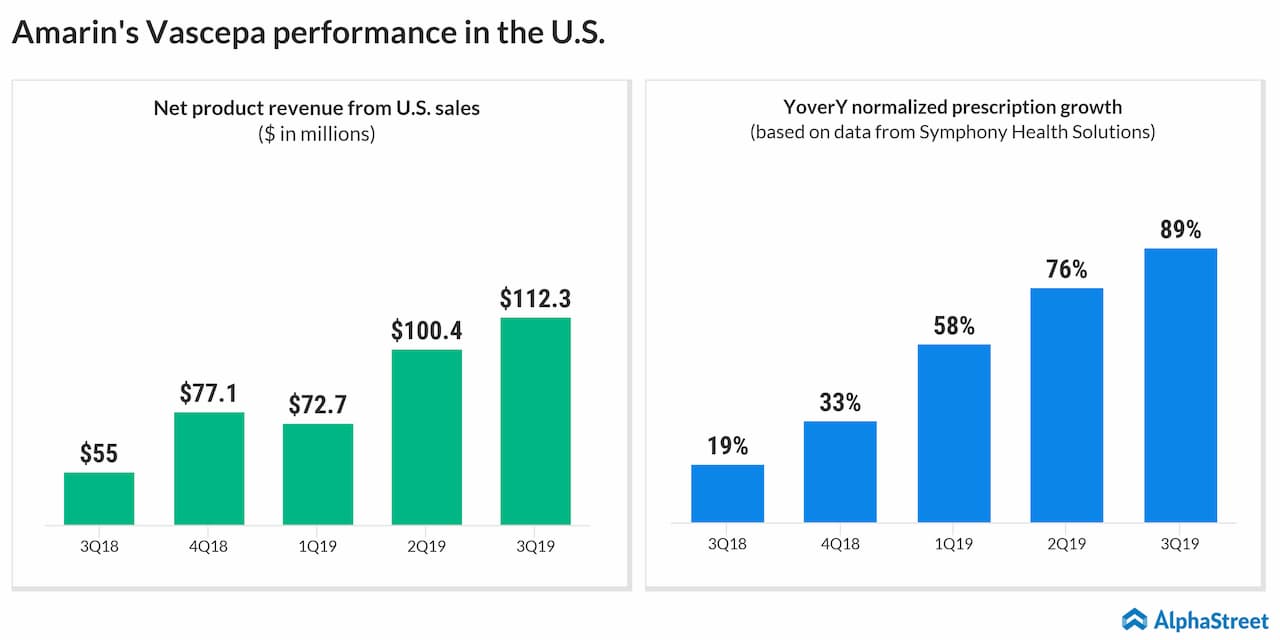

Net product revenue increased 104% year-over-year to $112.3 million, driven mainly by an increase in total Vascepa prescriptions in the US. The increased prescription levels reflect both a higher number of Vascepa prescribers and an increase in the average prescriptions per prescriber.

Based on data provided by Symphony Health and IQVIA, the estimated number of normalized total Vascepa prescriptions for the quarter were approx. 865,000 and 787,000, respectively, reflecting increases of 89% over the year-ago period. The increase in prescriptions were mainly across the US.

Gross margin on net product revenue was 77% in the third quarter compared to 75% in the same period a year earlier.

R&D expense decreased 37% year-over-year to $8.9 million, mainly due to the decline in REDUCE-IT related costs.

For full-year 2019, Amarin expects revenues to be $380 million to $420 million.

Get access to timely and accurate verbatim transcripts that are published within hours of the event.