Estimates

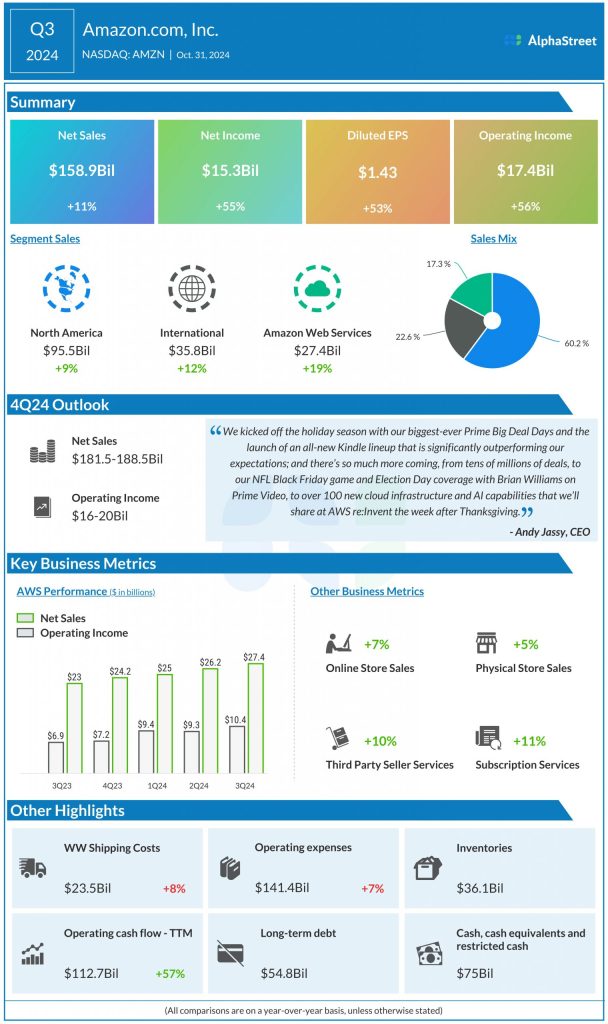

As per guidance issued by the company a few weeks ago, December-quarter revenue is expected to be in the range of $181.5 billion to $188.5 billion. Market watchers predict Q4 revenue of $187.25 billion, which is above the mid-point of the management’s forecast. Analysts predict earnings of $1.49 per share for the quarter, compared to $1.0 per share in Q4 2023. The earnings report is scheduled for release on Thursday, February 6, at 4:00 pm ET.

In the third quarter, net sales increased 11% year-over-year to $158.9 billion and topped expectations, after missing estimates in the preceding quarter. Sales in North America, the largest business segment that accounts for more than 60% of total sales, grew 9%. Revenues of Amazon Web Services, the company’s cloud business that dominates the market, grew an impressive 19%.

Benefitting from the strong revenue performance, net income climbed to $15.3 billion or $1.43 per share in Q3 from $9.9 billion or $0.94 per share in the prior year period. Earnings beat estimates for the seventh consecutive quarter.

Capex

The top priority of the company’s estimated $75-billion capex for 2024 is to support the growing need for technology infrastructure, especially to meet the high demand for AI-enabled AWS. Another key area of investment is the fulfillment and transportation network, to support growth, improve delivery speeds, and reduce cost.

“We’re seeing strength in our established countries like the U.K. and Germany as we continue to drive efficiencies to improve on-road productivity in our transportation network and better execution in our fulfillment centers. Our emerging countries are growing revenue at a healthy rate also, and they are leveraging their cost structures on investing strategically in Prime benefits. We have confidence that our focus on the inputs, coupled with the strength of our global teams, will continue to drive improvement over time,” Amazon’s CFO Brian Olsavsky said at the third-quarter earnings call.

The stock traded lower early Monday after moving sideways in recent sessions, indicating a possible dip in investor confidence ahead of the earnings.