Q1 Report Due

When the chipmaker publishes its first-quarter report on May 6, after the closing bell, the market will be expecting adjusted earnings of $0.93 per share on revenues of $7.12 billion. The revenue estimate broadly matches the guidance issued by the company recently. In the corresponding quarter of fiscal 2024, the company reported earnings of $0.62 per share on revenues of $5.47 billion.

From AMD’s Q4 2024 earnings call:

“Looking forward, we’re continuing to accelerate our software investments to improve the out-of-the-box experience for a growing number of customers adopting Instinct to power their diverse AI workloads. For example, in January we began delivering biweekly container releases that provide more frequent performance and feature updates and ready-to-deploy packages, and we continue adding resources dedicated to the open-source community that enable us to build, test, and launch new software enhancements at a faster pace.”

Q4 Results Beat

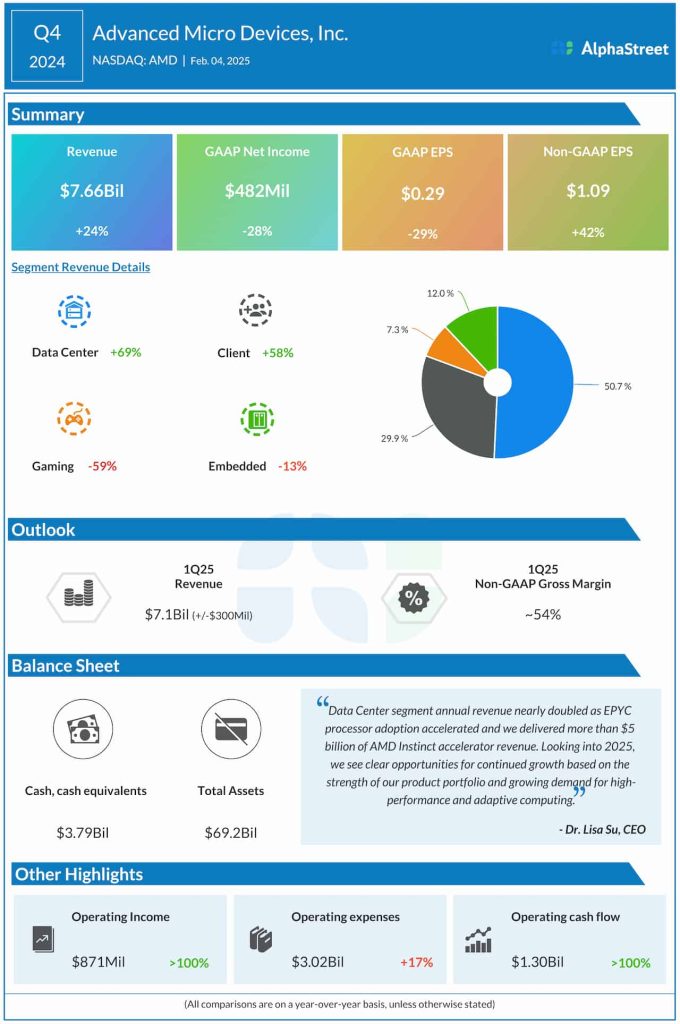

In the fourth quarter of 2024, AMD’s earnings rose sharply to $1.09 per share from $0.77 per share a year earlier, excluding special items. It was above the average forecast of Wall Street analysts. On a reported basis, net income was $482 million or $0.29 per share, compared to $667 million or $0.41 per share in Q4 2023. The bottom line benefitted from a 24% YoY increase in December-quarter revenues to $7.66 billion, with most of the growth coming from the core Data Center segment. Revenue beat estimates.

The steady growth in the demand for AI-enabled server processors and graphic processor units bodes well for AMD, as the company has been ramping up its server products and data center GPU product line.

AMD shares traded higher during Thursday’s session, hovering near the $100 mark. It has maintained an uptrend in recent sessions, gaining about 4% during the week.