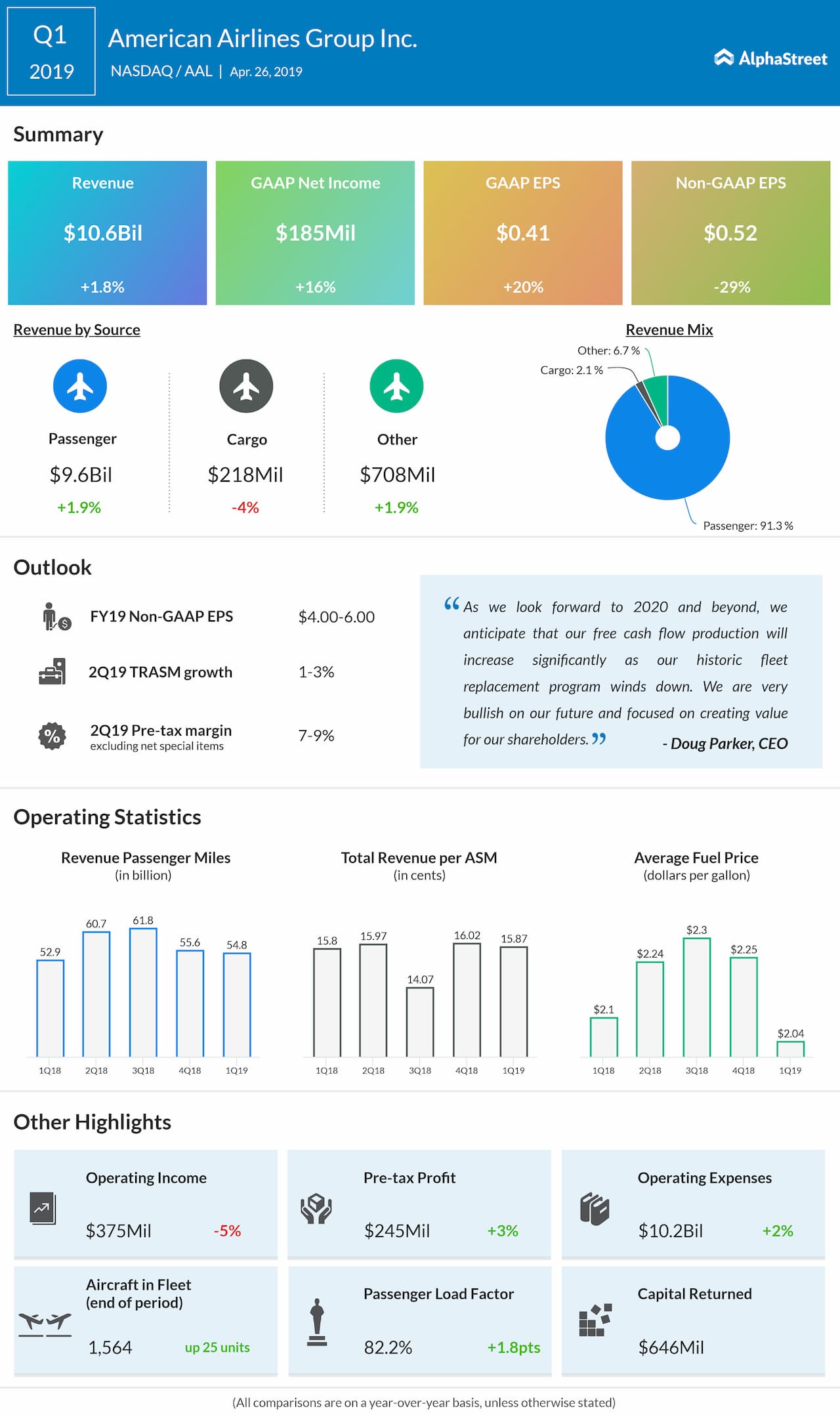

GAAP net income improved to $185 million, or $0.41 per share, from $159 million, or $0.34 per share, in the prior-year period. Adjusted net income was $237 million, or $0.52 per share.

Chairman and CEO Doug Parker said, “Our near-term earnings forecast has been affected by the grounding of our Boeing 737 MAX fleet, which we have removed from scheduled flying through Aug. 19. We presently estimate the grounding of the 737 MAX will impact our 2019 pre-tax earnings by approximately $350 million. With the recent run-up in oil prices, fuel expenses for the year are also expected to be approximately $650 million higher than we forecast just three months ago. Even with these challenges, we expect our 2019 earnings per diluted share excluding net special items to grow approximately 10% versus 2018.”

Passenger revenue per available seat mile (PRASM) grew 0.6% to 14.49 cents, helped by a passenger load factor of 82.2%. Cargo revenue fell 4% to $218 million, partly due to a 9.1% decrease in cargo ton miles. TRASM rose by 0.5% to 15.87 cents on a 1.3% increase in total available seat miles, marking the 10th consecutive quarter of TRASM growth for the airline.

Total operating cost per available seat mile (CASM) was 15.31 cents, up 0.7% from last year. Excluding fuel and special items, CASM was 11.88 cents, up 2.7% year-over-year, driven mainly by a higher volume of heavy maintenance checks.

On March 13, the Federal Aviation Administration grounded all US-registered 737 MAX aircraft. American Airlines estimates that the impact to its first quarter pre-tax income from these grounded aircraft and related flight cancellations was approx. $80 million.

American Airlines declared a dividend of $0.10 per share to be paid on May 22, to stockholders of record as of May 8.

For the second quarter of 2019, American Airlines expects TRASM to be up 1-3% year-over-year. The company also expects pre-tax margin, excluding net special items, to be between 7-9%. For full-year 2019, American expects adjusted EPS to be between $4.00 and $6.00, which is lower than the previous range of $5.50 to $7.50.