The prevailing dip in the stock has prompted the executive chief Doug Parker to assure investors that the world’s biggest airline could grow profits despite escalating fuel prices. On Tuesday, the company confirmed that about 2,100 flights were canceled due to Hurricane Florence, which lowered the third quarter revenue by $55 million.

Also, the carrier lifted its fuel costs expectations for the third quarter to the range of $2.28 to $2.33 per gallon from the prior forecast of $2.22 to $2.27 per gallon. But the company increased its revenue per seat mile growth estimate to a range of 2% to 3% from the previous forecast range of 1% to 3%.

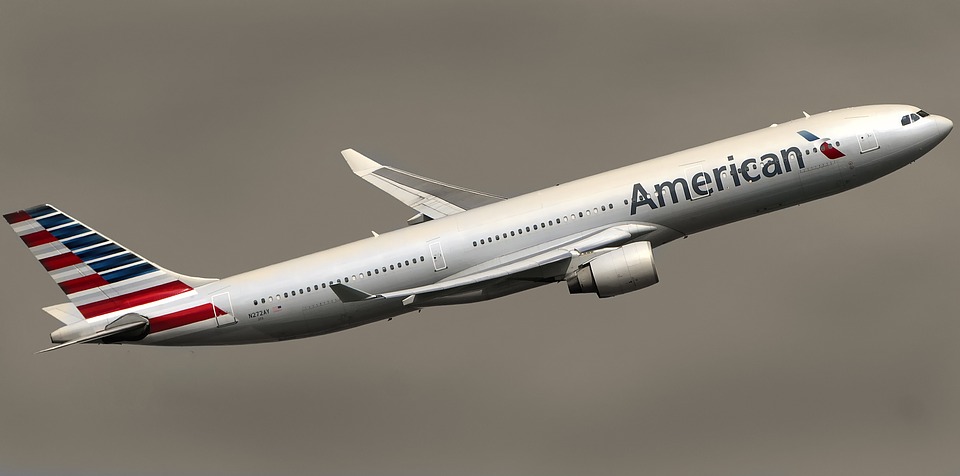

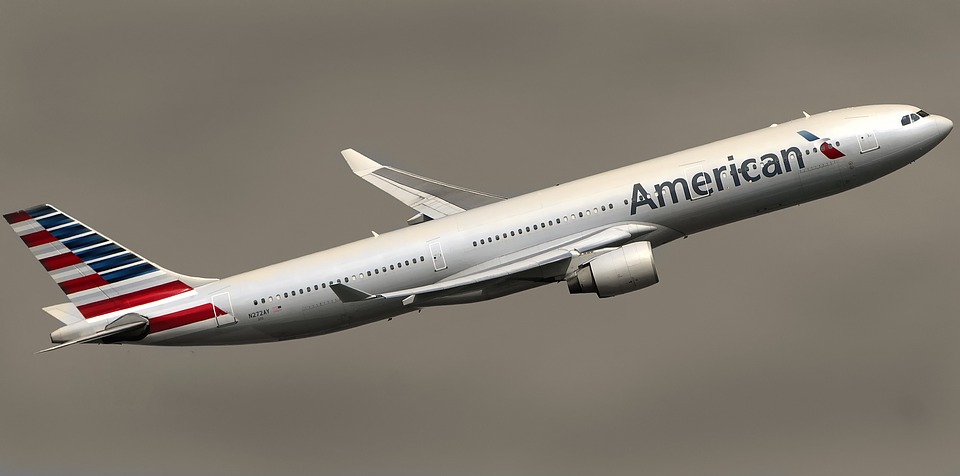

This year, the airlines industry has been struggling largely due to the rise in fuel, which remains the second-largest expense for airlines after employee pay. The rise in fuel has prompted airline companies to cut international routes. American Airlines is planning to cut 11 routes in total by this year and early next year.

Few airline companies have taken the hard rule of transferring the fuel price burden to their customers. Apart from this, the US airlines are likely to face stiff competition from the Chinese carriers, which are undergoing changes in their aviation policies.

Airline shares were down broadly on Tuesday and Wednesday. On Wednesday, United Continental Holdings (UAL), Alaska Air Group (ALK), and Southwest Airlines (LUV) each shed more than 3%. Delta Air Lines (DAL) ended the day down over 2%, while American Airlines fell more than 5%.