Analysts expect the company to report revenues of $1.03 billion, which is 7.7% higher compared to the year-ago period

A post-earnings dip will be a buying opportunity that is worth trying, especially considering the low stock price. Most of the analysts maintain outperform or buy rating on the stock and have set an average target price of $27. It needs to be noted that the positive earnings surprises in recent quarters and robust same-store sales helped the company outperform the industry so far this year.

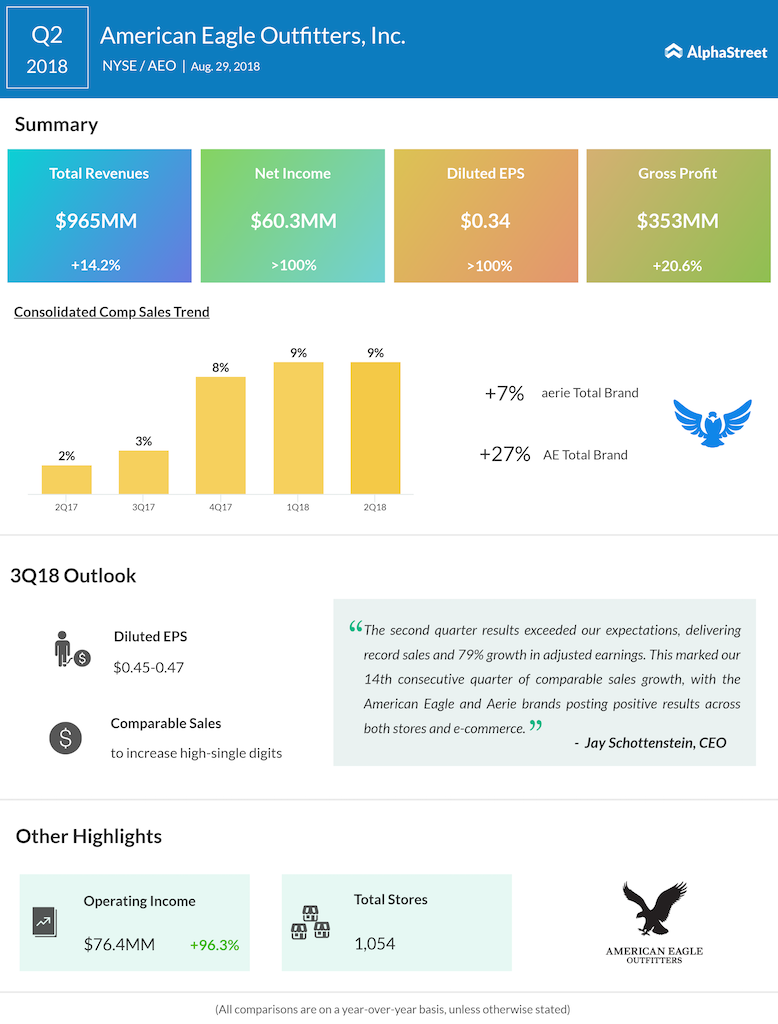

The second quarter was one of the best for American Eagle Outfitters in terms of performance, with adjusted earnings surging about 80% to $0.34 per share supported by broad-based revenue growth. At $964.85 million, revenues rose 14% helped in part by a favorable shift in the retail calendar.

Also see: American Eagle Outfitters Q2 2018 Earnings Conference Call Transcript

Brightening its long-term outlook, American Eagle has invested heavily in its store network and online platform in the recent past and the process is continuing. More initiatives are expected on that front, as the management seeks to address the mounting competition in the clothing industry and the fast-changing shopping trends.

Among rivals, Gap Inc. (GPS) reported stronger than expected earnings for its most recent quarter helped by strong demand that pushed up revenues by 7%. Meanwhile, comparable store sales were flat, amidst continued weakness in the Gap brand.

American Eagle’s stock is yet to recover from the downturn that began after the previous earnings release. The stock, which dropped about 9% over the past six months, traded higher throughout Monday’s regular session.