The topline numbers are likely to benefit from cardmember

spending and revenues from fee-based products. The results might also be helped

by a growth in the small and medium-sized enterprise sector as well as in consumer

spending.

Last quarter, revenue growth was driven by a balanced mix of cardmember spending, loans and membership revenues from fee-based products, which grew 19% and exceeded $1 billion for the first time. The company also added 2.9 million new proprietary card members during the period.

Also read: American Express Q3 2019 Earnings Call Transcript

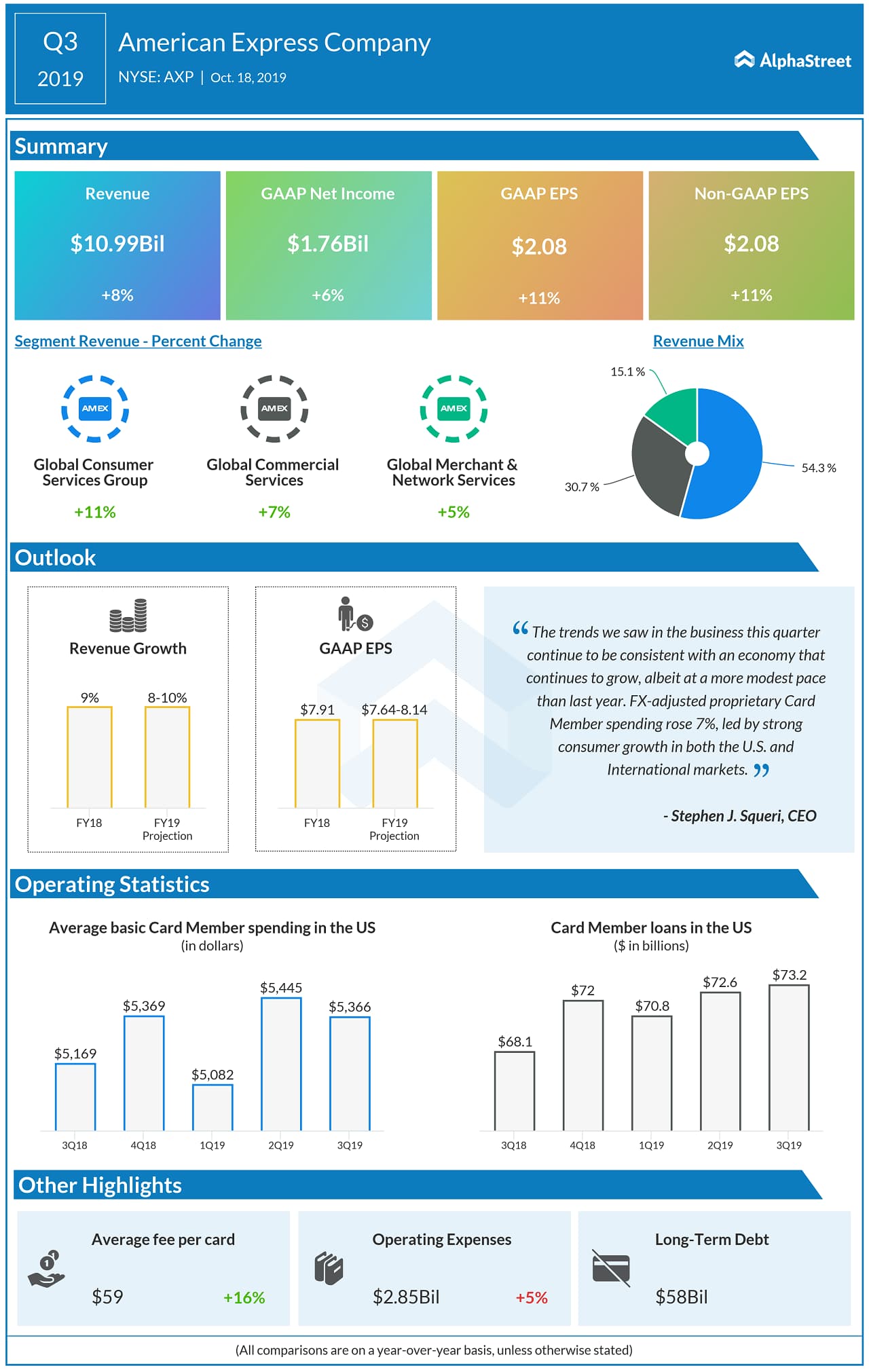

In the third quarter of 2019, American Express topped revenue and earnings estimates, with revenue growing 8% to $10.99 billion and adjusted EPS increasing 11% to $2.08. The company saw revenue growth across all its segments as well.

For the fourth quarter, American Express has guided for revenue growth of 8-10%. For the full year of 2019, the company expects GAAP EPS of $7.64-8.14 and adjusted EPS of $7.85-8.35.

Shares of American Express have gained 31% in the past one year and over 4% in the past one month. The majority of analysts have rated the stock as Buy and it has an average price target of $137.88.