Net income was $2.9 billion, down 4%, and earnings per share was $4.08, down 2%, compared to last year. Adjusted EPS of $4.08 was up 17% YoY.

For full-year 2025, the company expects revenue growth of 8-10% and EPS of $15.00-15.50.

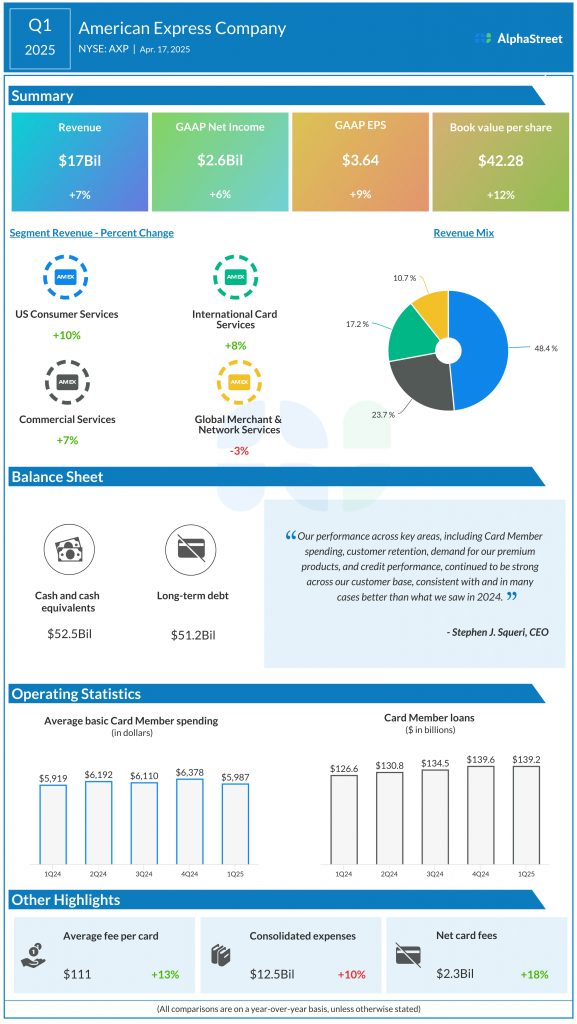

Prior performance

American Express Company (NYSE: AXP) reported its second quarter 2025 earnings results today. Consolidated total revenues, net of interest expense, were $17.9 billion, up 9% year-over-year, driven by increased Card Member spending, higher net interest income, and strong card fee growth. Net income was $2.9 billion, down 4%, and earnings per share was $4.08, down […]

“American Express Company (NYSE: AXP) reported its second quarter 2025 earnings results today. Consolidated total revenues, net of interest expense, were $17.9 billion, up 9% year-over-year, driven by increased Card Member spending, higher net interest income, and strong card fee growth. Net income was $2.9 billion, down 4%, and earnings per share was $4.08, down […]

· July 18, 2025

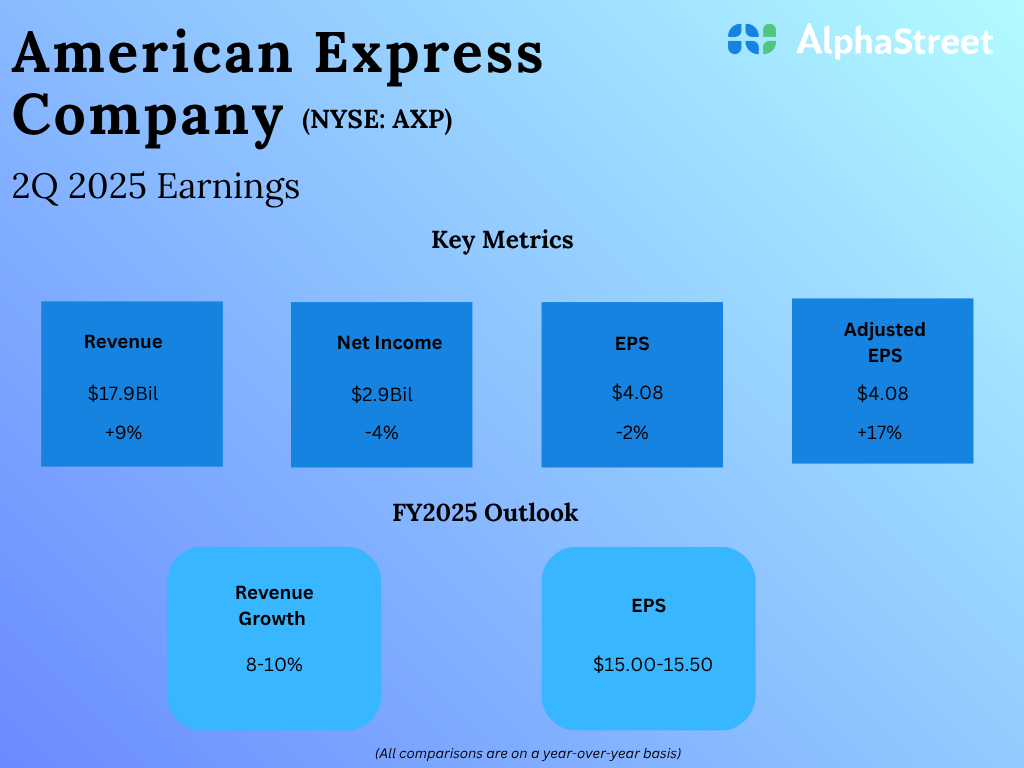

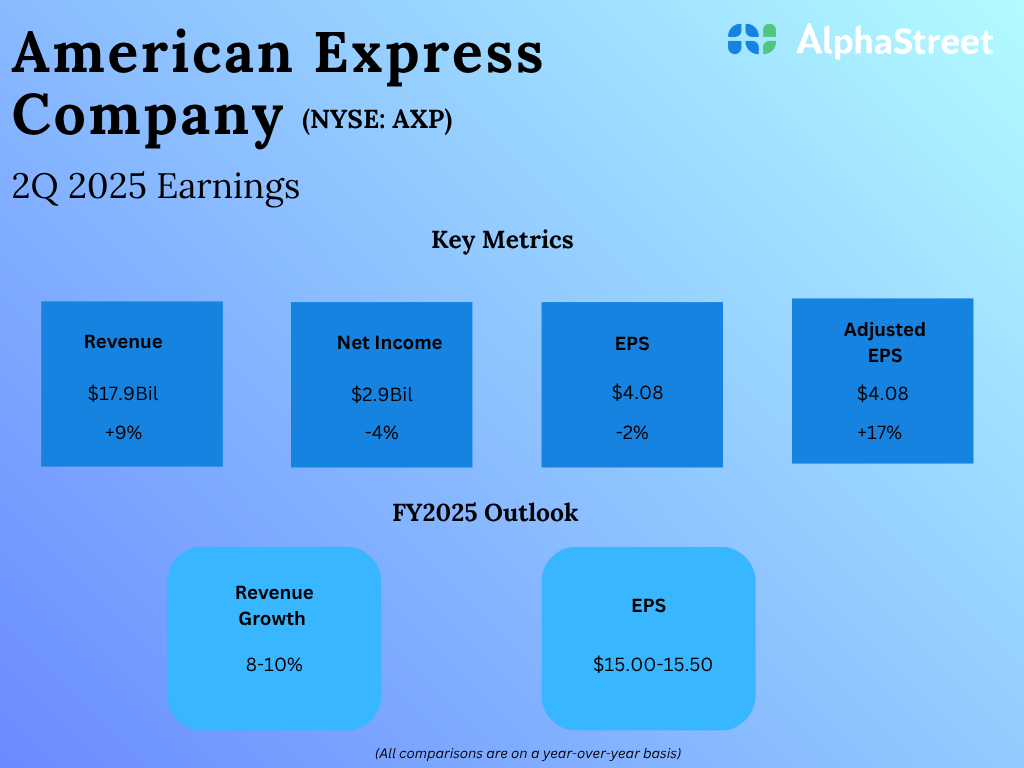

American Express Company (NYSE: AXP) reported its second quarter 2025 earnings results today.

Consolidated total revenues, net of interest expense, were $17.9 billion, up 9% year-over-year, driven by increased Card Member spending, higher net interest income, and strong card fee growth.

Net income was $2.9 billion, down 4%, and earnings per share was $4.08, down 2%, compared to last year. Adjusted EPS of $4.08 was up 17% YoY.

For full-year 2025, the company expects revenue growth of 8-10% and EPS of $15.00-15.50.