Spending Recovery

There has been a steady increase in card member loans, and average spending rose sequentially and year-over-year in the most recent quarter. The trend should continue, catalyzing revenue growth going forward amid rising interest rates. Despite high inflation and economic uncertainties, spending on travel and entertainment is very high across the world, especially among the young population. Recent data showed that bookings through the company’s consumer travel business reached the highest level since the pandemic-era travel ban.

Meanwhile, American Express reported a sharp increase in provisions for credit losses last quarter, reflecting high net write-offs and higher net reserve build. However, the company maintains a high credit standard and follows a distinctive business model that ensures adequate security.

“Our high-spending cardmembers attract a wide range of merchants and business partners, giving our customers and partners even more reasons to stay with us, which fuels a virtuous cycle of growth. Partnerships play an important role in our model. We have a long history of partnering with brands who share our values of backing customers with world-class products and services and who value developing broad-based and long-term relationships with us. Hilton is one of those long-standing partnerships,” American Express CEO Steve Squeri said in a recent statement.

American Express is preparing to publish results for the third quarter of 2023 on October 20, at 7:00 AM ET. Analysts are bullish on the company’s performance in the September quarter and predict a 19% growth in earnings to $2.94 per share. Revenues are expected to be around $15.36 billion, which is up 13% year-over-year.

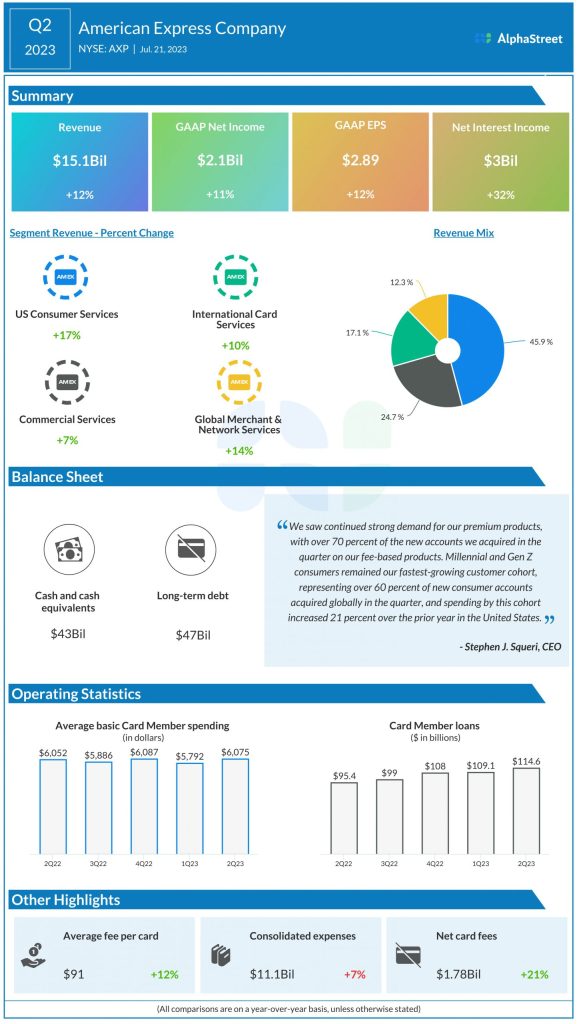

Mixed Q2

In the second quarter, the company’s earnings rose 12% to $2.89 per share and beat estimates, after two consecutive misses. Revenues increased in double-digits and reached $15.1 billion but fell short of expectations. Interestingly, all operating segments – US Consumer Services, International Card Services, Commercial Services, and Global Merchant and Network Services – expanded during the quarter. Based on the good performance in the first half, the management reaffirmed its full-year revenue growth guidance at 15-17% and earnings/share forecast between $11.00 and $11.40.

The stock ended the last session below its 52-week average and traded lower in the early hours of Wednesday. AXP is up 10% since last year.