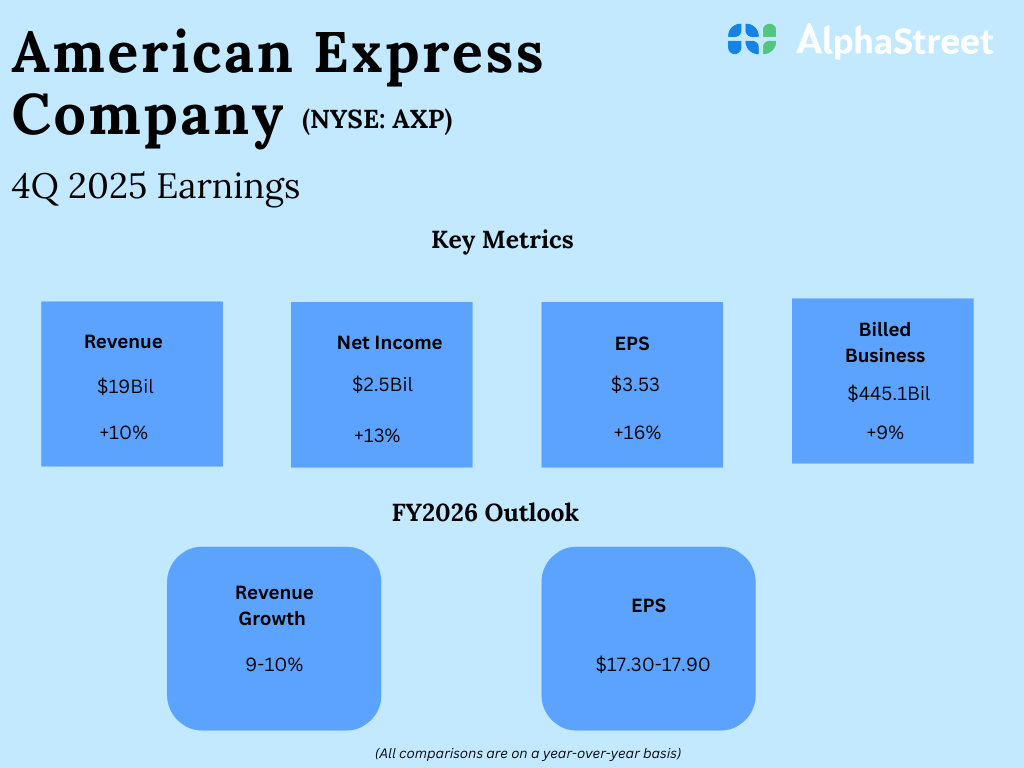

Latest quarterly results (Q4 FY25)

Net income for the quarter was $2,462 million. Diluted EPS for the quarter was $3.53.

Year‑over‑year revenue change: +10%. Year‑over‑year net income change: +17%.

Segment highlights (Q4 FY25):

– Discount revenue: $9,884 million

– Net card fees: $2,629 million

– Service fees and other revenue: $1,945 million

– Net interest income: $4,522 million

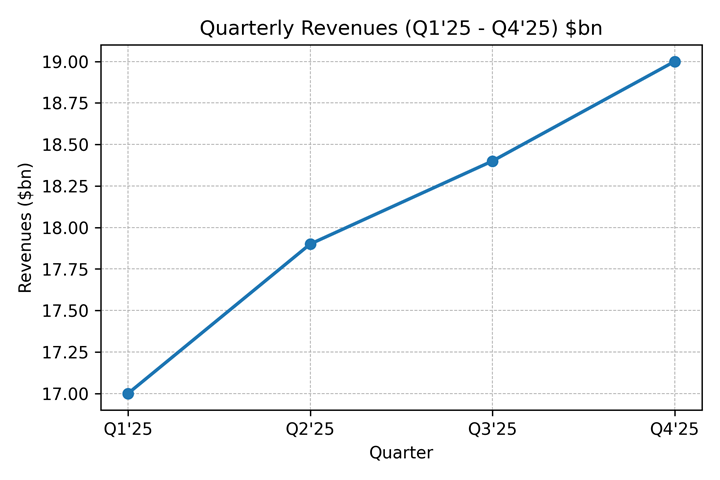

Financial trends

Chart 1 — Operating Performance: Quarterly revenue trend (Q1’25–Q4’25)

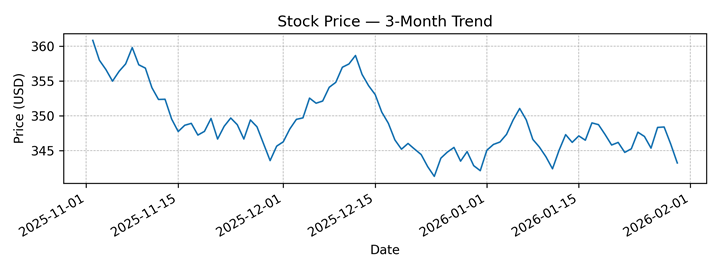

Chart 2 — Market Performance: 3‑month stock price trend

Full‑year results context

For fiscal 2025, consolidated revenues net of interest expense were $72,229 million, up year‑over‑year. Net income for the year totaled $10,833 million, also higher than the prior year. Directional trend: growth in both revenue and profit.

Business & operations update

During the quarter, American Express expanded premium services and digital features. The company opened a Centurion Lounge at Salt Lake City International Airport, bringing its global lounge network to more than 30 locations. It introduced dining‑related digital features and continued investments in payments and data infrastructure. The board approved an increase in the quarterly common dividend to $0.95 per share.

M&A or strategic moves

No material acquisitions or divestments were announced in the quarter. Management reiterated investments in technology, premium card products, and commerce partnerships.

Equity analyst commentary

Institutional research commentary following the results noted the year‑over‑year revenue increase and identified elevated operating expenses as a factor in quarterly profit variance. Analysts referenced higher customer engagement costs and investment spending disclosed by management.

Guidance & outlook — what to watch for

Management issued fiscal 2026 guidance calling for revenue growth of roughly 9%–10% and earnings per share in a specified range. What to watch: card member spending trends, net interest income tied to revolving balances, and expense trends related to investment programs.

Performance summary

Shares closed marginally lower. Fourth‑quarter revenue rose year‑over‑year. Full‑year revenue and net income increased. Operational updates emphasized premium services, digital features, and network expansion.