Smith & Wesson gunmaker American Outdoor Brands (AOBC) is expected to announce second-quarter earnings results on Thursday, Dec. 6.

For the three-month period, American Outdoor Brands anticipates adjusted earnings of $0.11-$0.15 per share, with revenues of $150-$160 million. However, the Street expects earnings of $0.14 per share on revenue of $154 million.

With the company launching many ventures and products in the first quarter, AOBC looks to start gaining from them in its latest results. The acquisition of Bubba Blade last year is also expected to have a positive impact on the second-quarter results.

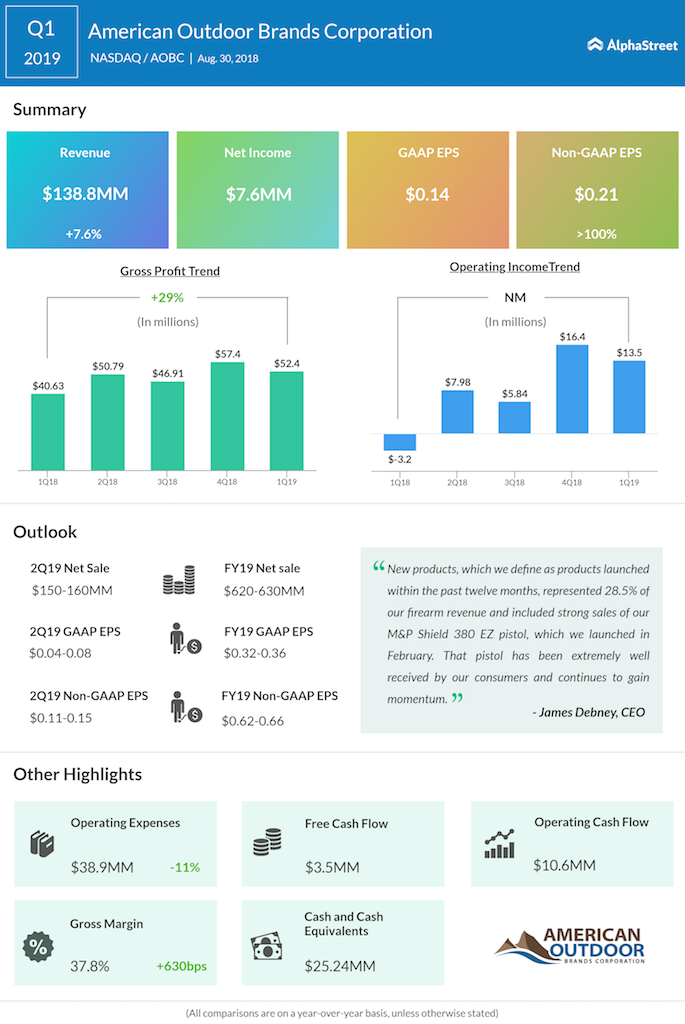

Despite the demand for firearms falling in the wake of recent restrictions on sales, American Outdoor Brands in August reported above-consensus earnings for the first quarter. The company’s stock gained more than 18% following the report.

Net income, on an adjusted basis, rose to $11.7 million or $0.21 per share during the three-month period from $1.2 million or $0.02 per share a year earlier, exceeding expectations. Reported earnings were $0.14 per share, compared to a loss of $0.04 per share last year.

In recent quarters, American Outdoor Brands faced challenges in its key markets, mainly due to muted demand. Gun manufacturers have been under fire from regulators and social groups following widespread protests triggered by a series of shootings that shook the country, including the Jacksonville incident.

Early in the quarter, a district court also imposed a ban on blueprints of 3D-printed weapons that can be downloaded from the internet.

All eyes will also be on how the Trump slump is impacting the industry, and the steps AOBC is taking to diversify its product line.