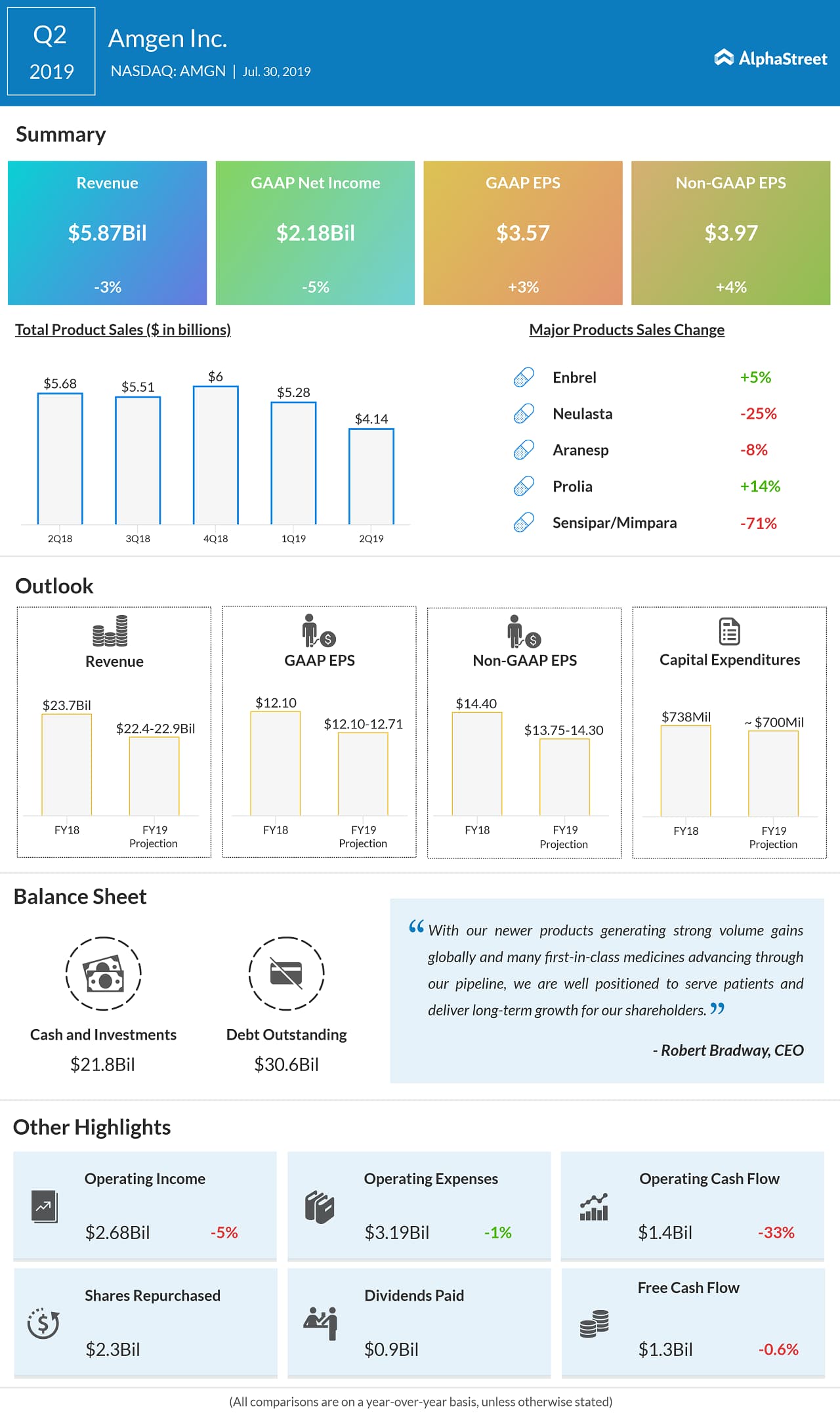

“With our newer products generating strong volume gains globally and many first-in-class medicines advancing through our pipeline, we are well positioned to serve patients and deliver long-term growth for our shareholders,” said CEO Robert Bradway.

Related: Advaxis’ revenue declines in Q2 as Amgen terminaties collaboration agreement

For full-year 2019, Amgen lifted its lower end of revenue outlook. The company now expects revenue to be in the range of $22.4 billion to $22.9 billion versus the prior estimaate of $22 billion to $22.9 billion.

FY19 GAAP earnings per share outlook revised to $12.10-$12.71 versus the prior outlook of $11.68-12.73 per share. The company also lifted its lower end of adjusted EPS outlook to a range of $13.75-14.30 from the earlier forecast of $13.25-14.30 per share.

While peers Pfizer (NYSE: PFE) reported its second quarter results yesterday, Eli Lilly (NYSE: LLY) and Merck (NYSE: MRK) reported their Q2 earnings results today morning. While Pfizer’s results failed to impress the market, Eli Lilly’s Q2 profit beat estimates. Merck’s second quarter results were far ahead of analysts’ expectations.

Amgen stock had given a negative return of 9% since the beginning of this year and dropped 8% in the trailing 12 months.