Under the terms of the agreement and subject to the closing conditions, Amgen will acquire OTEZLA and related intellectual property, including any patents that primarily cover apremilast, as well as other assets and liabilities related to OTEZLA. The agreement includes the transfer of Celgene employees primarily dedicated to OTEZLA.

“This agreement represents an important step toward completing our pending merger with Celgene. It also demonstrates the tremendous achievement of the Celgene team in establishing OTEZLA as an important medicine for patients with psoriasis, psoriatic arthritis and Behçet’s Disease,” said Bristol-Myers CEO Giovanni Caforio.

Also read: Bristol-Myers Q2 earnings, revenue top Street; stock dips on weak guidance

ADVERTISEMENT

Shareholders of Celgene and Bristol-Myers approved the merger in April. In light of the concerns expressed by the U.S. Federal Trade Commission (FTC), Bristol-Myers announced its plan to divest OTEZLA business in June. The next month, European Commission approved the merger.

When Celgene reported its Q2 results, the company projected OTEZLA sales to be about $1.9 billion in 2019. Sales of OTEZLA surged 31% to $493 million in the second quarter ended June 30, 2019.

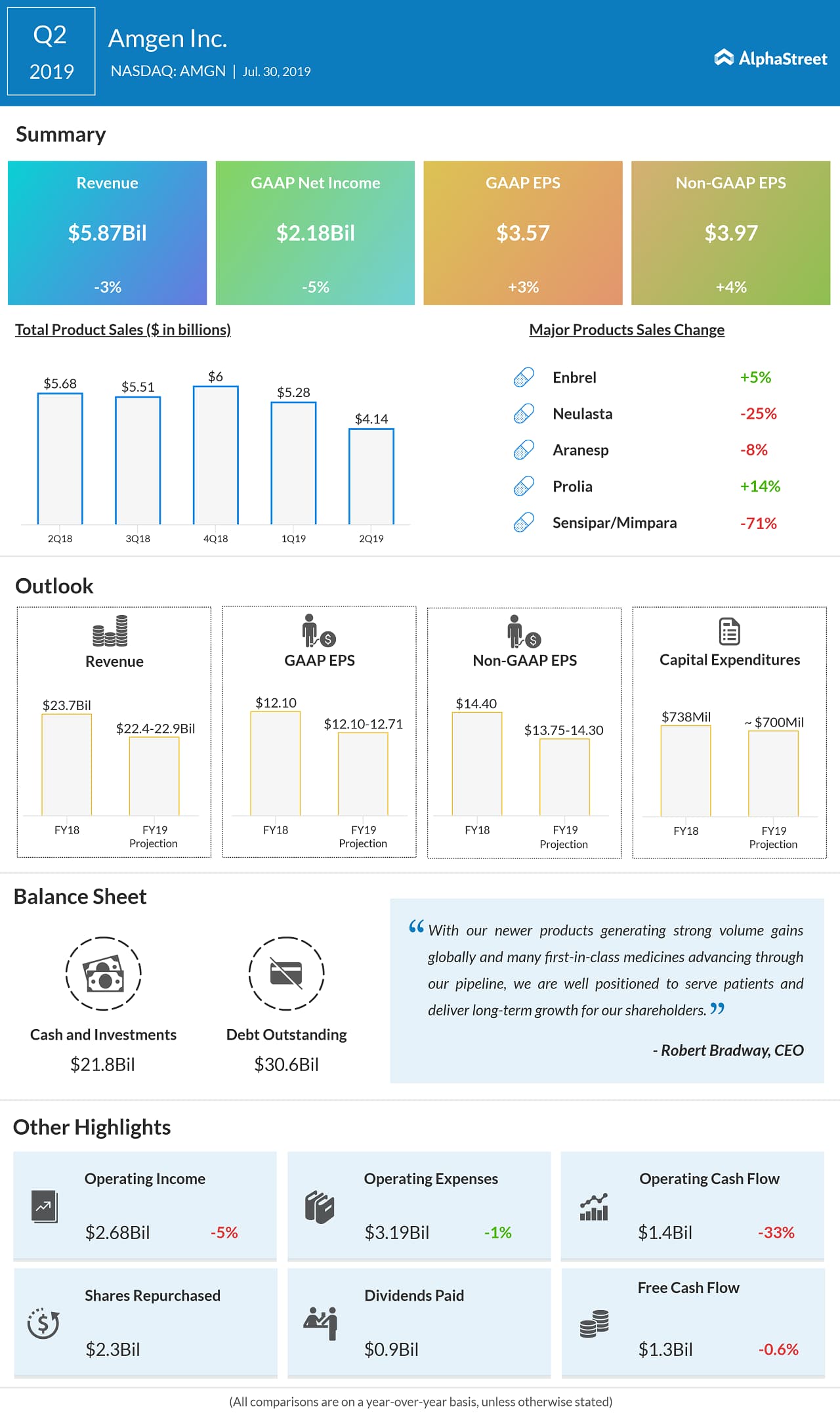

Amgen expects the addition of OTEZLA to positively impact its financial results, including an immediate accretion to its non-GAAP EPS. Bristol-Myers plans to prioritize the use of proceeds from the OTEZLA divestiture for its debt reduction.

Bristol-Myers Squibb also announced that it is increasing its previously planned $5 billion accelerated share repurchase to $7 billion. The share repurchase will be executed following closing of the pending Bristol-Myers Squibb merger with Celgene, subject to Board approval.