Amkor Q4 2025 Earnings: Market Context

Amkor Q4 2025 Earnings: Financial Results

Net sales reached $1888 million in Q4 2025. This rose 16% from $1629 million in Q4 2024. Furthermore, demand exceeded analyst forecasts. Q4 was the best-performing quarter of the year. Analysts noted the strength. Growth was across both segments.

Net income was $172 million. That is up sharply from last year. So profit margins expanded significantly. Also, advanced products showed 16% growth year-over-year.

Full Year 2025 Results

Full year 2025 net sales hit $6708 million. This rose 6% from 2024. Plus, Q4 showed acceleration versus earlier quarters. This momentum reflects rising chip demand globally.

Gross profit was $939 million. Besides, operating income reached $467 million. Net income totaled $374 million. So the firm delivered robust results.

Amkor Q4 2025 Quarterly Revenue Trend

Chart: Amkor quarterly revenue trend from Q1 2024 to Q4 2025

Overall, revenue rose steadily year-over-year. Notably, Q4 showed the best-performing quarter of the year.

Advanced Products Drive Growth

Advanced products brought in $1580 million in Q4. This rose 16% from $1357 million last year. Besides, smartphone demand picked up. In fact, data center chips also drove growth. So advanced packages now power AI trends.

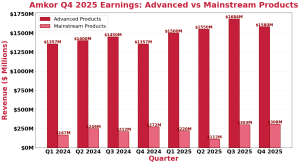

Advanced vs Mainstream Products

Chart: Amkor advanced and mainstream revenue from Q1 2024 to Q4 2025

Notably, advanced products account for 84% of revenue. Still, this exposure to AI and data centers is strategic.

Amkor Q4 2025 Cash Generation Accelerates

Operating cash flow hit $1100 million. Thus, free cash flow reached $308 million. As a result, the firm has robust cash generation. This enables meaningful investment in capacity. Capital expenditures were $792 million in 2025. For 2026, the firm targets $2.5 billion-$3.0 billion CapEx. Clearly, this supports fab expansion for future demand.

Q1 2026 Guidance

Q1 2026 revenue is guided at $1.60 billion-$1.70 billion. Meanwhile, gross margin is seen at 12.5%-13.5%. However, some moderation is expected from Q4 peaks. The company still signals positive secular trends.

Amkor Q4 2025 Key Takeaways

Amkor Q4 2025 earnings reflect robust chip demand. Net sales rose 16% in Q4 to $1888 million. Beyond that, each segment showed growth. Specifically, advanced products led the way.

Yet full year revenue rose only 6% to $6708 million. So Q4 marked a clear acceleration. This momentum should continue in 2026.

In fact, advanced products are 84% of sales. Still, AI and data center demand drives growth. This positions the firm well.

For more details, see the Amkor Q4 2025 earnings press release.

Also, visit Yahoo Finance for AMKR stock data for detailed metrics.

Click Here to visit the AlphaStreet website.