Analog Devices (NASDAQ: ADI) surpassed the bottom line and top-line estimates for the third quarter of 2019. However, the weaker-than-expected guidance for the fourth quarter dragged ADI shares into the negative territory.

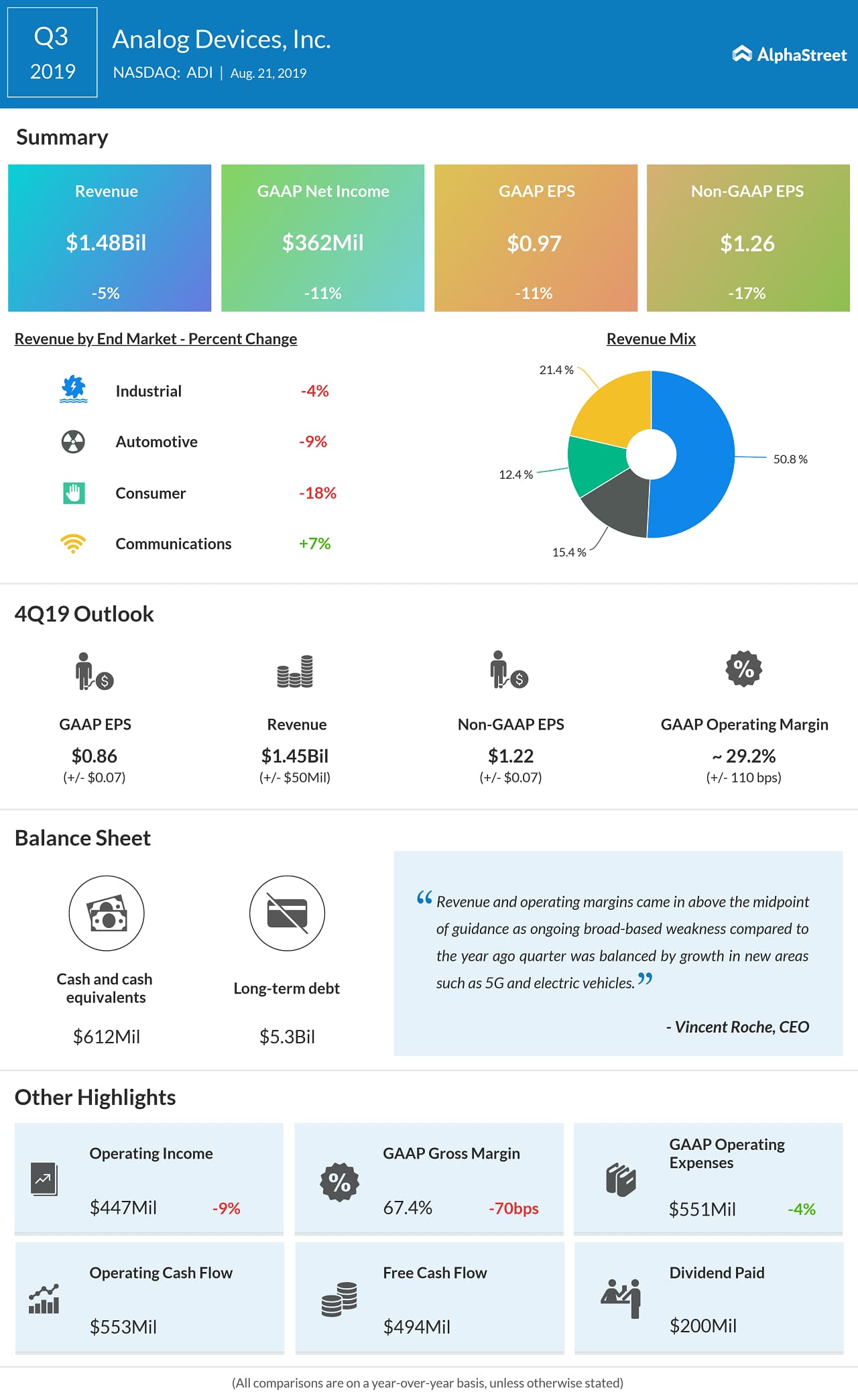

The semiconductor maker reported adjusted earnings of $1.26 per share on revenue of $1.48 billion. Wall Street had expected the company to post earnings of $1.22 per share on revenue of $1.45 billion. ADI shares slid about 2% in the pre-market trading hours.

Analog Devices’ net income for the quarter ended August 3, 2019, dropped to $362.4 million or $0.97 per share from a net income of $408.6 million or $1.08 per share in the prior-year quarter.

You may also like: Analog Devices (ADI) Q3 2019 Earnings Conference Call Transcript

ADVERTISEMENT

“Revenue and operating margins came in above the midpoint of guidance as ongoing broad-based weakness compared to the year ago quarter was balanced by growth in new areas such as 5G and electric vehicles,” said CEO Vincent Roche.

He added, “While these uncertain times do not seem to be abating in the near term, ADI has successfully navigated macroeconomic challenges many times before.”

For the fourth quarter of fiscal 2019, Analog Devices expects revenue to be $1.45 billion, +/- $50 million. The company estimates GAAP EPS to be $0.86, +/- $0.07, and adjusted EPS to be $1.22, +/- $0.07.

The Board of Directors declared a quarterly cash dividend of $0.54 per share, which will be paid on September 11, 2019 to all shareholders of record as of August 30, 2019. The company returned over $300 million to shareholders in the third quarter through dividends and share repurchases.

ADI stock, which reached its 52-week high ($124.79) on July 24, has advanced 29% so far this year and 18% in the past 52 weeks.