Analog Devices Inc. (NASDAQ: ADI) missed revenue and earnings estimates for the fourth quarter of 2019, causing shares to fall over 2% in premarket hours on Tuesday.

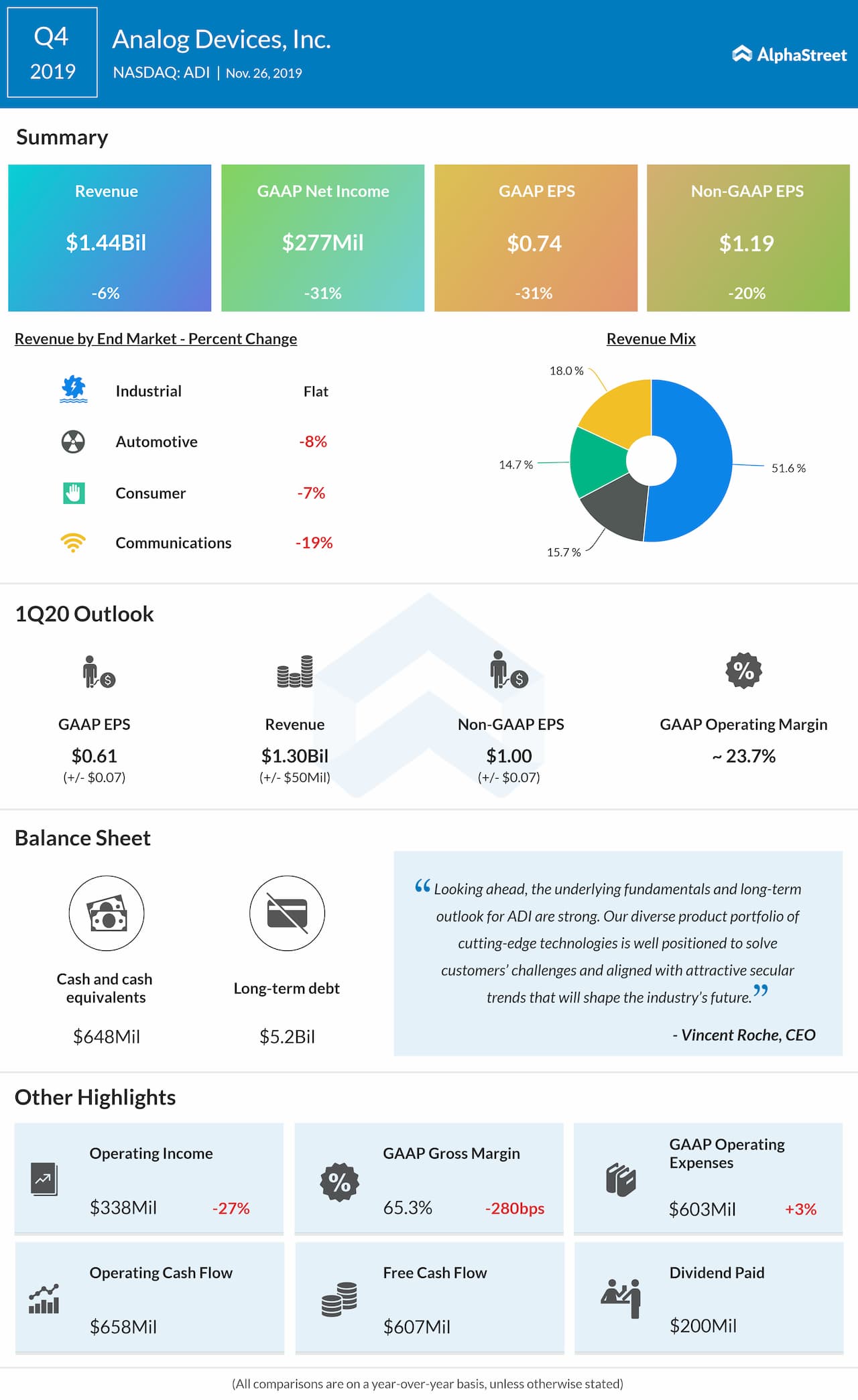

The company reported a 6% year-over-year decline in total revenues to $1.44 billion, which also fell below the consensus target of $1.45 billion.

Net income was $277 million, or $0.74 per share, compared to

$404 million, or $1.08 per share, in the same period last year. Adjusted EPS declined

20% year-over-year to $1.19, missing forecasts of $1.22.

Vincent Roche, President and

CEO, stated, “ADI delivered solid fourth quarter and full-year results amidst

continued trade and macro uncertainty. Over the course of the year, we

generated revenue of $6 billion and effectively managed costs, while continuing

to prioritize strategic investments to drive innovation.”

During the quarter, revenues in the Industrial segment remained flat at $744 million compared to the same period last year. Revenues declined across all the remaining three segments.

Also read: Analog Devices Q4 Earnings Preview

For the first quarter of

fiscal 2020, the company expects revenue of $1.30

billion, plus or minus $50 million. Reported EPS is expected to be $0.61, plus or minus $0.07, and adjusted EPS

to be $1.00, plus or minus $0.07.

The Board of Directors declared a cash dividend of $0.54 per common share, payable on December 17, 2019 to all shareholders of record as of December 6, 2019.

Get access to timely and accurate verbatim transcripts that are published within hours of the event.