Apple (NASDAQ: AAPL) reported yet another quarter of disappointing product sales as it announced third-quarter earnings results on Tuesday. Revenue from Apple products fell 1.7% year-over-year to $42.35 billion.

iPhone net sales fell 12% in Q3 to $25.98 billion.

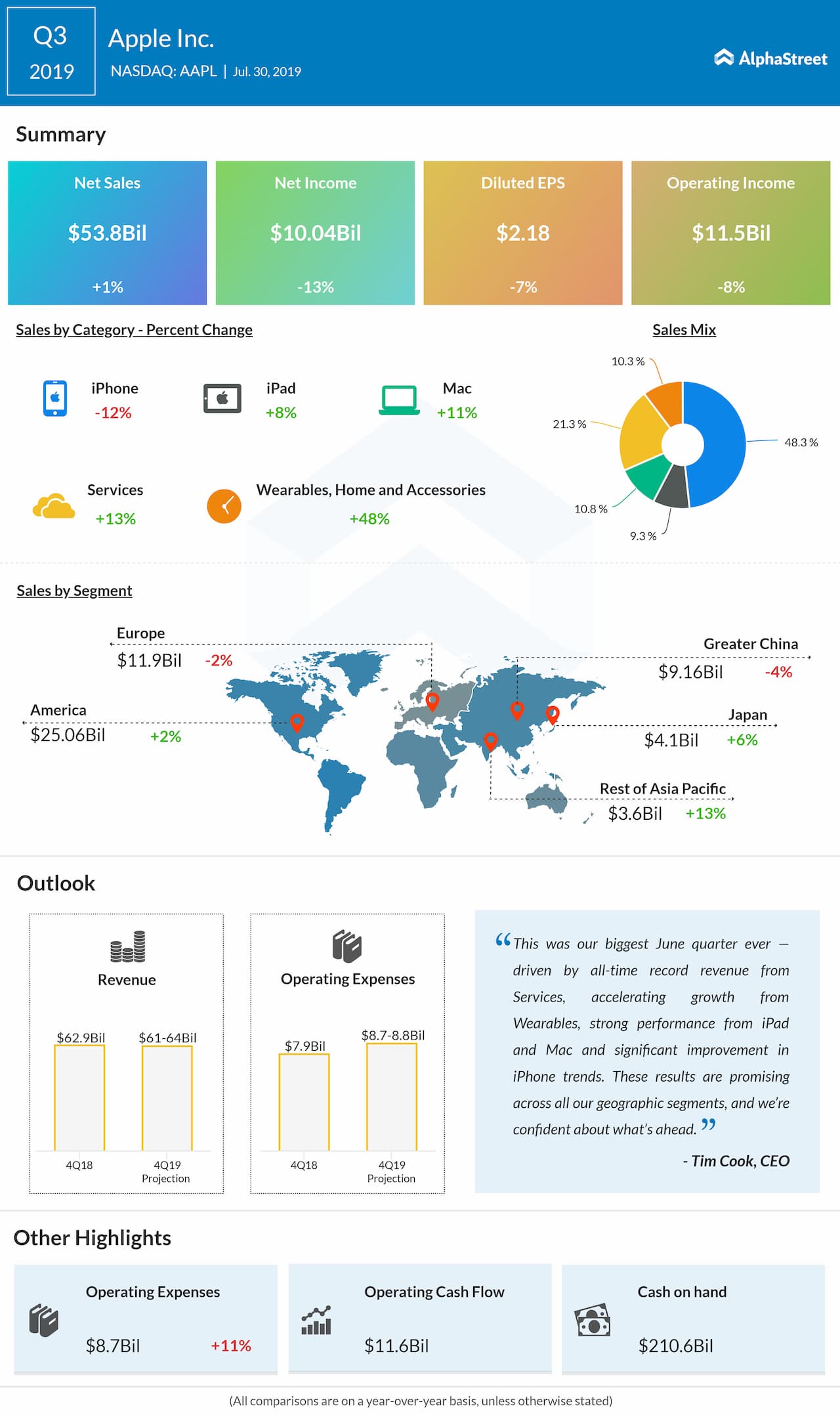

The weakness its flagship product weighed on the overall revenues, which edged up just 1% to $53.8 billion. However, this still came in slightly above the street consensus of $53.4 billion. International sales accounted for 59% of the quarter’s revenue.

Earnings fell 7% to $2.18 per share, while analysts had projected it at $2.10 per share. The better-than-expected earnings sent AAPL shares up 4% during after-market trading on Tuesday.

Meanwhile, Apple’s services segment slightly offset the weakness in the products side with a 12.6% year-over-year growth to $11.45 billion, an all-time high.

Apple has been witnessing tremendous success with its services segment, where revenue growth has exceeded that of products in six out of the past seven quarters. However, quite notably, Q3 marked the third consecutive quarter of services revenue growth deceleration.

Apple CEO Tim

Cook said, “This was our biggest June quarter ever — driven by all-time record

revenue from Services, accelerating growth from Wearables, strong performance

from iPad and Mac and significant improvement in iPhone trends.”

READ: What Alphabet executives discussed during Q2 2019 earnings call

Outlook

For the fourth

quarter of 2019, the iPhone maker expects revenue between $61 billion and $64

billion. Gross margin is projected to be in the range of 37.5% to 38.5%.

AAPL stock has gained 32.2% since the beginning of this year, compared to 20% gains recorded by the S&P 500 index.

The

earnings come days after announcing a massive deal to acquire Intel Corp.’s (NASDAQ: INTC) smartphone modem business for $1 billion. The deal

is expected to give Apple an alternative against the warring former supplier

Qualcomm (NASDAQ:

QCOM).

The latest version of the iPhone is expected to be launched in September. As per the hitherto leaks, the upcoming iPhone, now lovingly called iPhone 11, does not have any pathbreaking features, except for a third camera, for ultra-wide photographs.

According

to market observers, 5G adaptability is still a far-fetched idea.

Korean rival Samsung will report quarterly results tomorrow.

Get access to timely and accurate verbatim transcripts that are published within hours of the event.