Return of Capital

Buoyed by the healthy cash flow, the management recently raised the dividend and approved a new $10 billion share repurchase program. The quarterly dividend is $0.32 per share now, which is up 23% from the prior quarter. The future looks bright for the company, considering the steady demand from top manufacturers like Intel and Taiwan Semiconductor Manufacturing Company. The stock should benefit from the stable demand for chips in areas like IoT, communications, automotive, power, and sensor.

While certain areas of the microprocessor market – mainly the memory chip segment — are experiencing a downturn the foundry-logic segment, where Applied Materials has significant exposure, is performing well. Going forward, the company’s sales would get a boost from the high backlog, due to shipment delays in the past. In an effort to tap into new opportunities and further enhance its diversified portfolio, the company is making major investments in infrastructure and research & development.

Tailwinds

Those initiatives could allow Applied Materials to gain a competitive advantage in an industry where the complexity of chip technology is constantly increasing. The company’s resilient performance can be attributed mainly to its broad exposure to secular trends, the strong portfolio that is well aligned with new trends in the technology industry, and the growing service business.

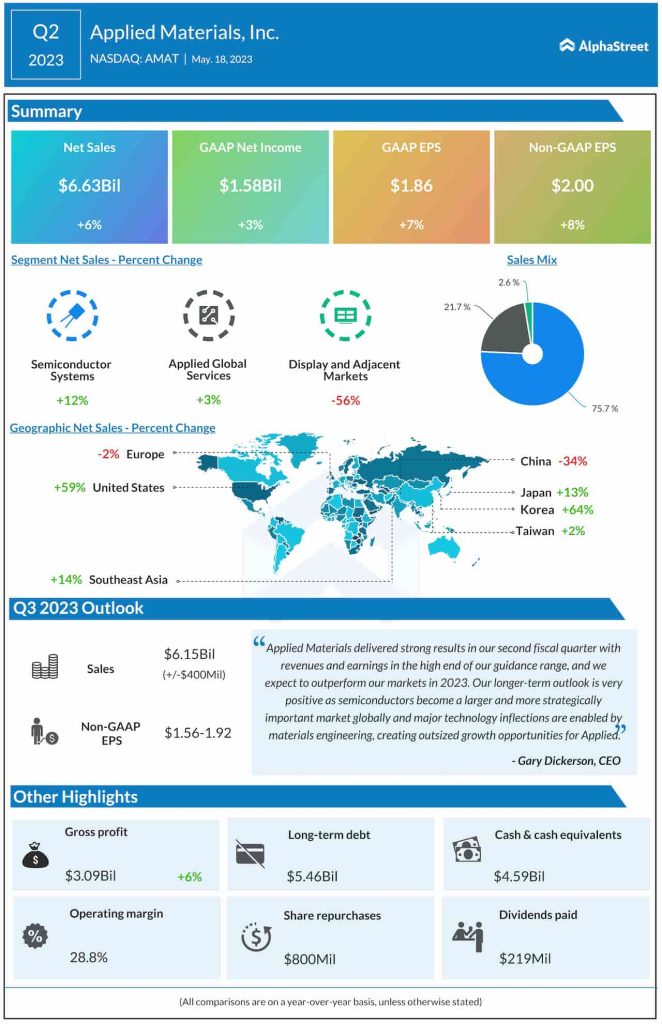

Gary Dickerson, Applied Materials’ chief executive officer, said during an interaction with analysts this week, “While 2023 is a challenging year for the economy in areas of the semiconductor market, Applied’s business performance remains resilient, thanks to our broad exposure to secular trends, strong product positions at key technology inflections, and our growing service business. Our longer-term outlook is very positive as semiconductors become a larger and more strategically important market globally, and industry trends create outsized opportunities for Applied.”

Good Results

Continued strong performance by the core Semiconductor Systems business pushed up total revenues by 6% to $6.63 billion in the second quarter. That translated into an 8% increase in adjusted profit to $2.00 per share. The numbers also exceeded estimates, marking the fourth consecutive beat. Sales dropped slightly in Europe, while all the other markets registered growth, except China where the economy is experiencing a slowdown due to the lingering effects of the pandemic.

For the third quarter, the management forecasts earnings in the range of $1.56 per share to $1.92 per share, which represents a modest decline from the prior-year number but is above analysts’ estimates. The sales outlook is $5.75-$6.55 billion, while Wall Street’s projection is below the mid-point of the guidance.

AMAT has traded above its 52-week average since the beginning of 2023, gaining an impressive 30% during that period.