The company is also expected to benefit from its investments in areas like Internet of Things and artificial intelligence. Updates on the Kokusai acquisition are also worth watching. Kokusai’s wafer equipment is helpful in processing chips which are used in high-growth areas like self-driving cars, IoT, and artificial intelligence.

Applied gets a major portion of its revenue from the Asia Pacific region and China is a significant contributor. The impact of the US-China trade tensions on the results is a factor to watch.

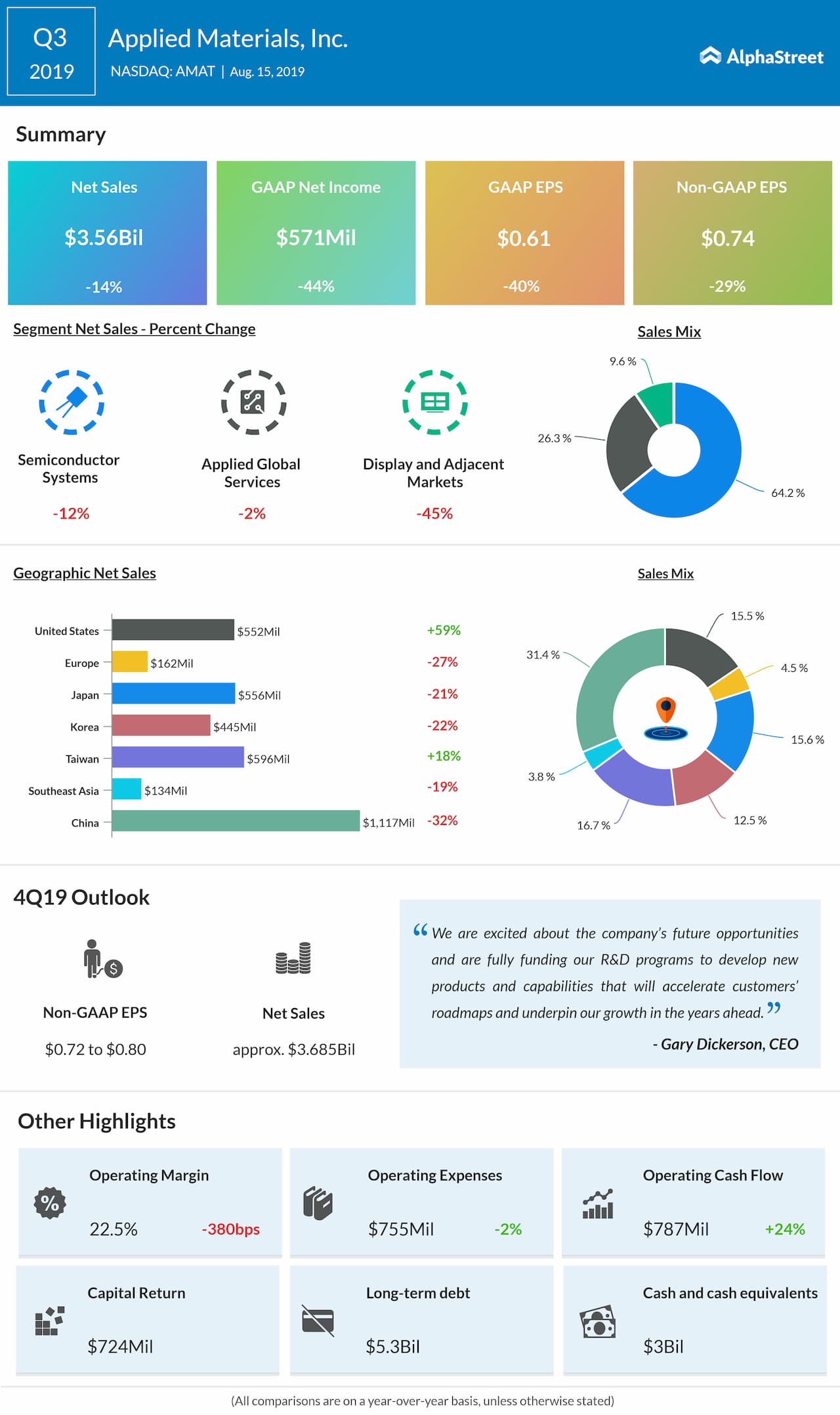

In the third quarter of 2019, Applied beat earnings expectations despite posting a year-over-year decline. Adjusted EPS fell 29% to $0.74 while sales dropped 14% to $3.56 billion.

For the fourth quarter, Applied Materials has guided for net sales of about $3.685 billion, plus or minus $150 million. Adjusted earnings are anticipated to be in the range of $0.72 to $0.80 per share.

Shares of Applied have gained 71% so far this year and 21% in the past three months.