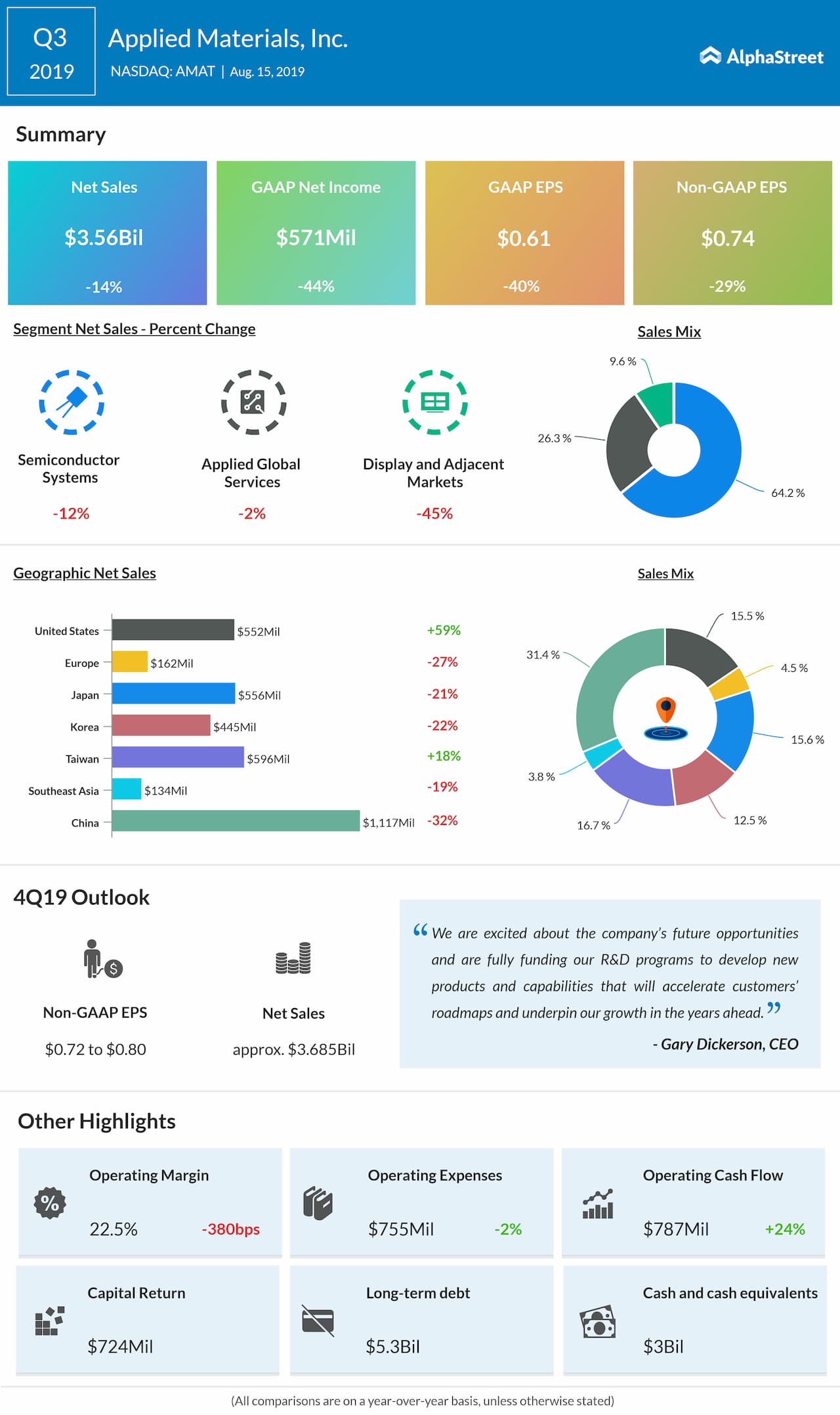

Looking ahead into the fourth quarter, the company expects net sales to be about $3.685 billion, plus or minus $150 million. Adjusted earnings are anticipated to be in the range of $0.72 to $0.80 per share.

Applied Materials is fully funding its research and development programs to develop new products and capabilities that will accelerate customers’ roadmaps and underpin its growth in the years ahead.

During the third quarter, sales declined in the all the three segments: Semiconductor Systems, Applied Global Services, and Display and Adjacent Markets. From a geography perspective, the double-digit sales growth in the US and Taiwan were hampered by weak sales from other regions.

The company has been struggling in the challenging market environment. Applied Materials gets majority of the revenue contribution from Asia Pacific region, with China being a significant benefactor. However, the trade war between the US and China turned out to be a major headwind in the contribution from China.

Read: Sina Q2 earnings preview

For the second quarter, the company reported a 41% dip in adjusted earnings due to a 23% drop in the top line. The weak industry macros resulted in a muted performance of its semiconductor and display segments.

At the conference call, investors expect the company’s management to focus on the purchase of Kokusai Electric from Kohlberg Kravis Roberts (KKR) for $2.2 billion. Applied Materials is likely to stand beneficial from Kokusai’s wafer equipments that are helpful in processing chips which will be used for self-driving cars, 5G network deployment, Internet of Things (IoT), and artificial intelligence.