Most tested food

AquaBounty claims that its genetically modified (GM) salmons, currently being grown in its farms in Indiana in the US and Canada, are capable of accelerated growth and produce 1.7 times more fish at 25% less feed. The salmons have received approval from Health Canada and the US FDA and have been selling in Canada for the past four years.

Rejecting concerns surrounding genetically modified food, the

management stresses that their salmons are safe and nutritious. Sylvia said:

“There is no food safety issue. With 25 years of testing, we are the most tested food in the history of the FDA. The tastings have shown that the gene construct was stable and that with the exception of one Chinook salmon gene, it’s identical to the Atlantic salmon.”

ADVERTISEMENT

She added that their land-based salmon cultivation drastically

cuts down the time to consumers, thereby maintaining the fatty acid profiles

expected out of it.

Besides salmon, the biotech firm is also doing some preliminary research on other species including shrimps and whitefish.

Financials and expansion plans

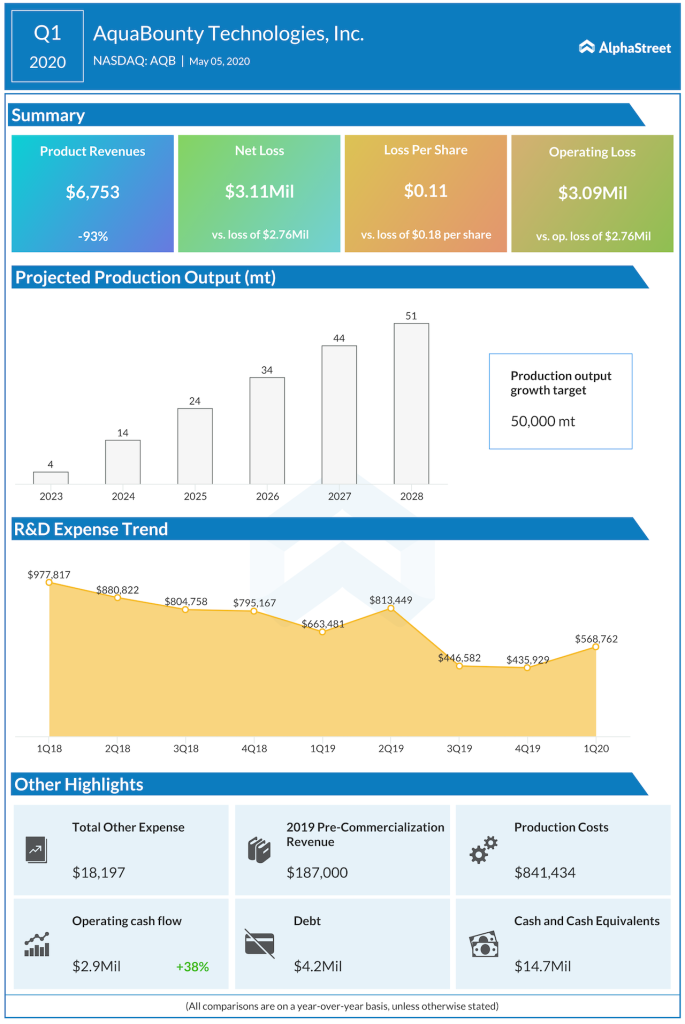

In 2019, the company had incurred $13.2 million in net loss. However, with the harvest and cultivation of salmon in the US facility, the financials are expected to get much better with this year.

AquaBounty has 1,200 metric tonnes of production capacity in Indiana. Separately, the management is on the hunt for a large-scale farm, with 10 times the capacity of the Indiana facility. Sylvia said the produce would be sold at commodity pricing with margins of 35% to 40%.

[irp posts=”64486″]

Depending on the commodity pricing, the company expects a revenue stream of approximately $10 million from the Indiana facility.

AquaBounty’s initial phase of international expansion is aimed

at Brazil, Argentina, China and Israel. It has filed a regulatory dossier for approval

in Brazil, following the successful completion of field trials. The CEO sees no

more challenges from Brazil and expects approval by the third quarter. In China,

the company had received approvals for field trials in 2018.

Future of food

Sylvia said the fear surrounding genetically modified food is

primarily due to misperception created around modifications that aren’t based

on science. She stated:

“I really do think that we’ve got to embrace science and technology because without it, I just don’t understand how we’re going to be able to address climate change and feeding nine billion people with healthy protein. Biotechnology can be very specific in addressing things like methane production and animal health.”

AQB shares have gained 32% so far this year. The stock has a 12-month average price target of $4.25, suggesting a 30% upside from Thursday’s trading price.

_____

[irp posts=”64296″]