Business software maker Atlassian Corporation (NASDAQ: TEAM) reported first quarter 2020 earnings results that beat market’s expectations. Atlassian posted non-IFRS earnings of $0.28 per share on revenue of $363.4 million for the first quarter ended September 30, 2019. Analysts had projected the company to earn $0.24 per share on revenue of $351.8 million.

TEAM stock dropped about 4% in the after-hours session immediately after the earnings announcement.

On IFRS basis, Atlassian’s net income was $69.3 million or $0.28 per share for the first quarter of fiscal 2020 compared to a net loss of $242.4 million or $1.03 per share in the prior-year quarter.

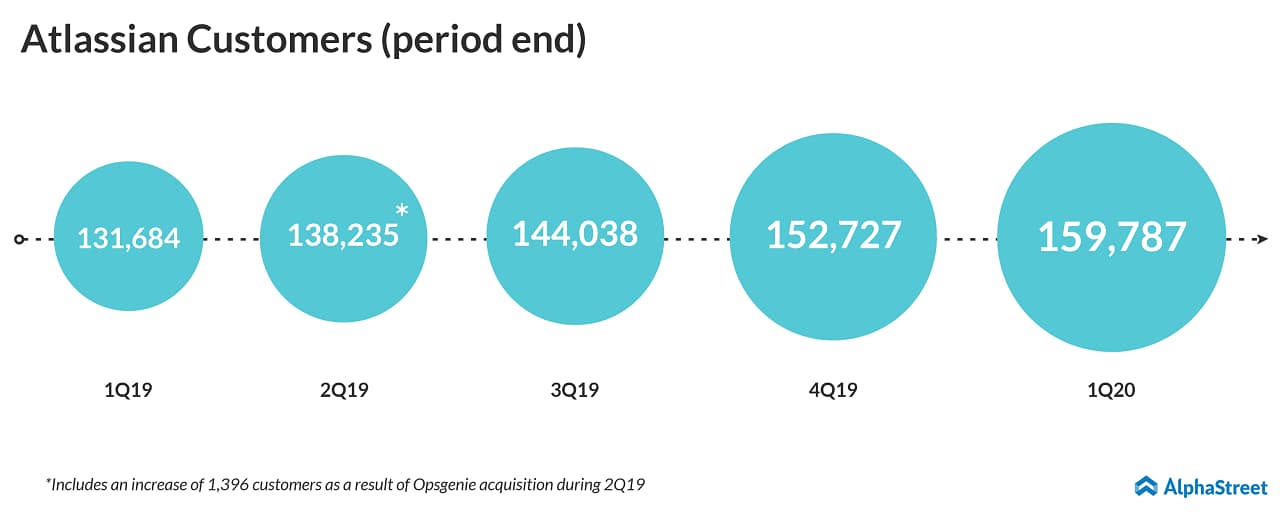

The Sydney, Australian-based firm added 7,060 net new customers during the three months ended September 30, 2019, and ended the quarter with a total customer count, on an active subscription or maintenance agreement basis, of 159,787.

For the second quarter of fiscal year 2020, Atlassian views revenue to be between $386 million and $390 million. Net loss per share is expected to be approximately $0.03 on an IFRS basis, and net income per share is expected to be approximately $0.27 on a non-IFRS basis.

For fiscal year 2020, Atlassian forecast revenue to be in the range of $1.560 billion to $1.574 billion. Net income per share is expected to be approximately $0.01 on an IFRS basis and approximately $1.00 on a non-IFRS basis.

Also, Atlassian today announced that it acquired Code Barrel, the maker of Automation for Jira, for an undisclosed amount.

On an IFRS basis, operating expenses increased 38% to $305.7 million and 36% to $229.4 million in the first quarter of 2020. Total employee headcount was 3,927 at the end of 1Q20, an increase of 311 employees since the end of the fourth quarter of 2019. The increase was across all major organizations, with the majority in R&D.

Shares of the cloud-based software companies including ServiceNow (NYSE: NOW), Okta Inc (NASDAQ: OKTA), Splunk (NASDAQ: SPLK) and Atlassian traded in the negative territory after Workday (NASDAQ: WDAY) announced on Wednesday that its human capital management software is expected to end the year with a weaker-than-expected growth. The iShares Expanded Tech-Software Sector ETF was down 2.31% on Wednesday.

Atlassian stock, which closed down 1.32% at $122.64 today, surged 38% since the beginning of this year and 47% from this time last year.