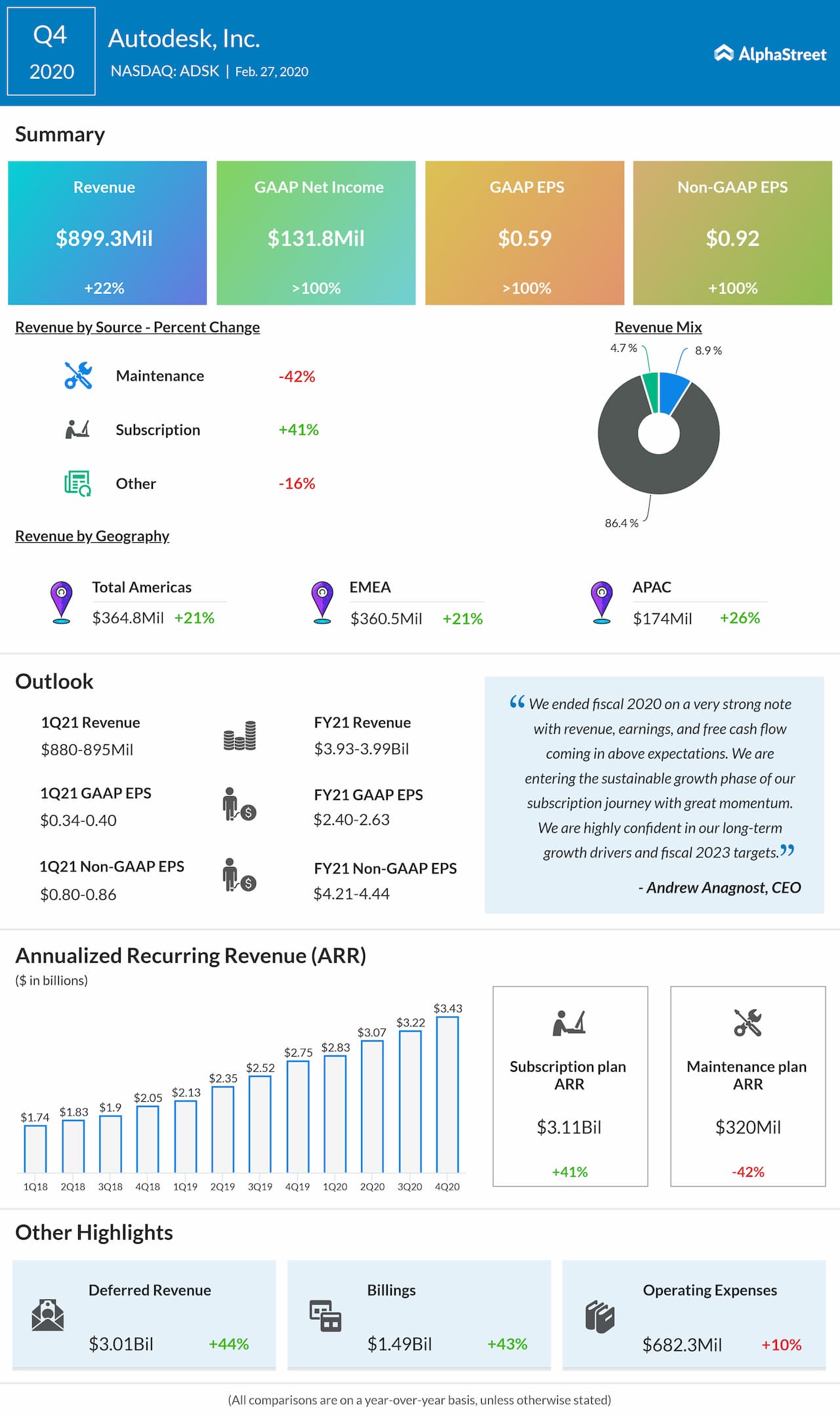

— Autodesk (NASDAQ: ADSK) reported its fourth-quarter 2020 adjusted earnings of $0.92 per share versus $0.89 per share expected.

— Revenue climbed by 22% to $899 million versus $890.19 million expected.

— Annualized recurring revenue (ARR) rose 25%, billings jumped 43% and deferred revenue recorded a 44% jump over the prior year. The revenue retention rate was healthier between 110-120%.

— Remaining performance obligations (RPO), or the sum of total billed and unbilled deferred revenue, totaled $3.56 billion, an increase of 33%. The current RPO totaled $2.37 billion, up 23%.

— Looking ahead into the first quarter of 2021, the company expects revenue in the range of $880-895 million and adjusted earnings of $0.80-0.86 per share. The consensus estimates EPS of $0.88 on revenue of $909.99 million.

— For the full year 2021, the company sees revenue to grow by 20-22% to the range of $3.93-3.99 billion and adjusted earnings in the range of $4.21-4.44 per share. The consensus estimates EPS of $4.41 on revenue of $3.98 billion.

— Billings are anticipated to increase by 11-13% year-over-year to the range of $4.635-4.715 billion for the full year 2021.