Schond: When you really think about the name Avalo, it really conveys passion. And our focus is actually being able to develop these therapeutics in some of the hard-to-treat areas.

You have a late-stage therapy for COVID-induced respiratory condition (acute respiratory distress syndrome). Tell us a bit about that. And do you think that you joined the party late as there are other biotech companies coming up with their own versions of similar therapies?

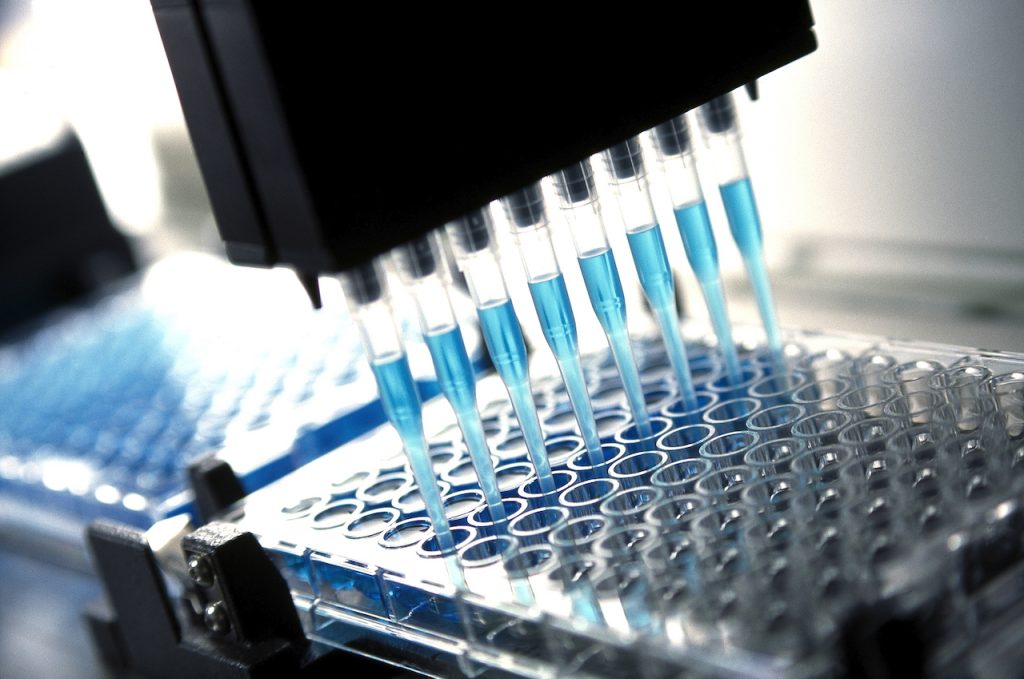

Mike: Yes, we have a monoclonal antibody. And we had very compelling data that came from Hackensack Meridian in-patients that had severe Covid and were heading towards respirator back in the spring of 2020. Our global clinical trial read out very positively in the first part of this year, showing a benefit at 28 days; and it has been a trend towards a 50% reduction in mortality.

We saw a very good safety profile with tremendous clinical benefits. But yeah, we are still in discussions figuring out a way to forward with the FDA and also potential partners.

There are a lot of other programs out there. I don’t know that we are late. Unfortunately, the Covid pandemic continues to roll on. We are up to 1,500 people a day dying again. Obviously, not everyone has agreed to get vaccinated. So I think there’s really a need for these therapies.

Tell us a bit about your progress in rare diseases. What’s the unmet need and market potential there?

Mike: So, in complex lymphatic malformations, we think there’s a significant unmet need. The number of patients is maybe as many as 30,000 in the United States. We are focused on pediatric populations, and we know there are patients in the thousands in the United States. There is a tremendous need for new therapies. There have been a number of attempts but the safety and tolerability of the profile really keep it from being used as a standard of care.

The other programs are the monosaccharides (AVTX-) 801, 802, and 803 for a rare set of congenital diseases. Our goal here is to provide an FDA-approved source of monosaccharide for all three sets of patients. These are relatively ultra-rare diseases. There may be less than 100 of these patients in the United States. The trial should be quite small.

ALSO READ Paysafe CEO Philip McHugh on the future of payments, NFL season and expansion

How do you see your balance sheet? Should investors expect any fundraising in the near future?

Schond: As a rule, we typically don’t make forward-looking statements about funding and financing, but in general, we have put in place a $150 million out shelf. In addition to that shelf, we have also put in place a $50 million equity selling program. And subsequently, we have also put in place a debt credit facility that provided us access to capital up to about $35 million, of which we have been able to pull down $30 million based on achieving some successful milestones.

_______

ALSO READ Predictmedix COO Rahul Kushwah: We aim to be a major player in workplace safety

ADVERTISEMENT