Amazon.com Inc. (NASDAQ: AMZN)

saw a pretty significant shake-up due to the COVID-19 outbreak. In early March,

the company saw a massive spike in demand for household staples, essential

products and even home office supplies while demand for items such as apparel and

shoes declined. This sudden surge created headwinds within the company’s

network and among its suppliers and sellers.

To tackle this demand, Amazon increased its grocery delivery

capacity by over 60% and expanded its in-store pickup facility to over 150

Whole Foods stores from the previous number of 80 stores. The company also

hired 175,000 new employees and increased the pay for its existing workforce.

On its quarterly conference call, the company stated that the investment in increased pay for hourly employees and partners during the COVID-19 pandemic will be nearly $700 million through May 16.

Amazon invested over $600 million in COVID-related costs during

the first quarter and these expenses are likely to reach or exceed $4 billion

in the second quarter. In Q1, the company had an additional $400 million in

costs related to higher reserves for doubtful accounts.

COVID-19 testing

capabilities

Amazon plans to invest a significant amount of money to

develop its own COVID-19 testing capabilities. This amount is currently

estimated to be about $300 million in the second quarter if the company is successful.

Amazon’s main concern at this point is to make the testing available to its own

employees. The company is still working on this and there is not much clarity

on future opportunities.

Prime

Prime was one of the winners in the quarter. Amazon saw good

traction in Prime shopping benefits with customers shopping more often and

increasing their basket sizes. The company also saw higher usage of video and

digital benefits during the lockdown period, with the number of first-time

viewers nearly doubling in March. Beyond Prime Video, the company’s channels

and video rentals also saw a pickup.

Amazon believes the current shelter-in-place situation gives

people a good time and reason to use the Prime benefits that they did not in

the past. It also gives them the opportunity to explore these benefits and find

out what content and features are available in music, video and other services.

Amazon launched Prime Video Cinema in the US, UK and Germany

where movies are being released directly to pay-per-view platforms as theaters

remain closed. The company has received positive responses to this initiative.

AWS

Amazon stated on its call that AWS has created data lakes to

assist healthcare workers, researchers, scientists, and public health officials

who are working to understand and fight the coronavirus. The company’s AWS

products are not only helping the government in dealing with the crisis but it

is also enabling companies cope with the spike in video conferencing, remote

learning and online health services.

Amazon has also seen an increase in gaming and entertainment

during this period. The company has seen healthy adoption and usage of AWS both

domestically and internationally. Its backlog of future contracts is increasing

and Amazon believes the basic value proposition of AWS has not been hindered by

the crisis.

Ad revenue

Amazon stated that it had a very strong quarter in terms of ad revenue. The advertising growth rate remained consistent with last quarter but in March, advertisers pulled back slightly and there was some downward pressure on price. Despite this slight setback, the rate of advertising has continued at a high pace.

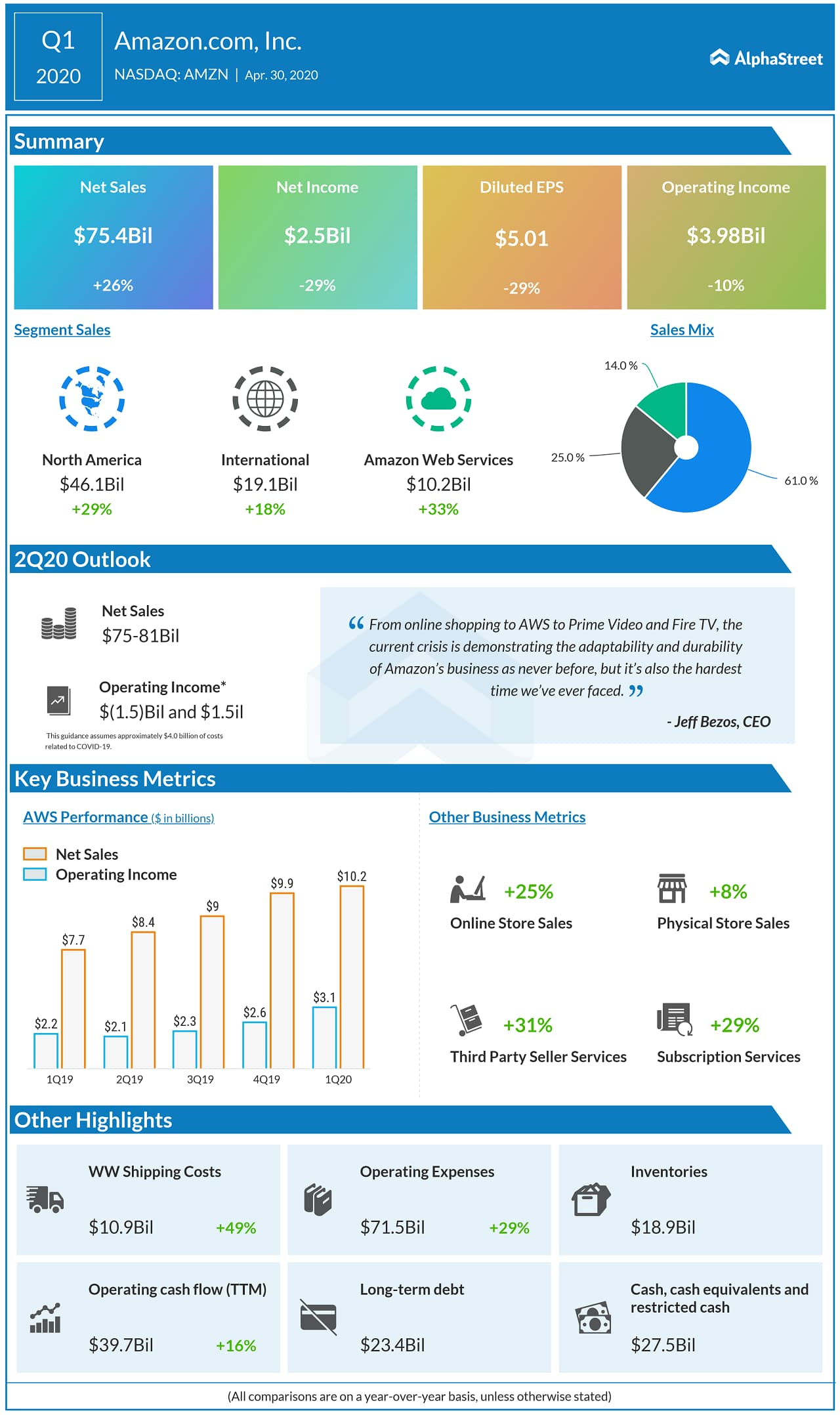

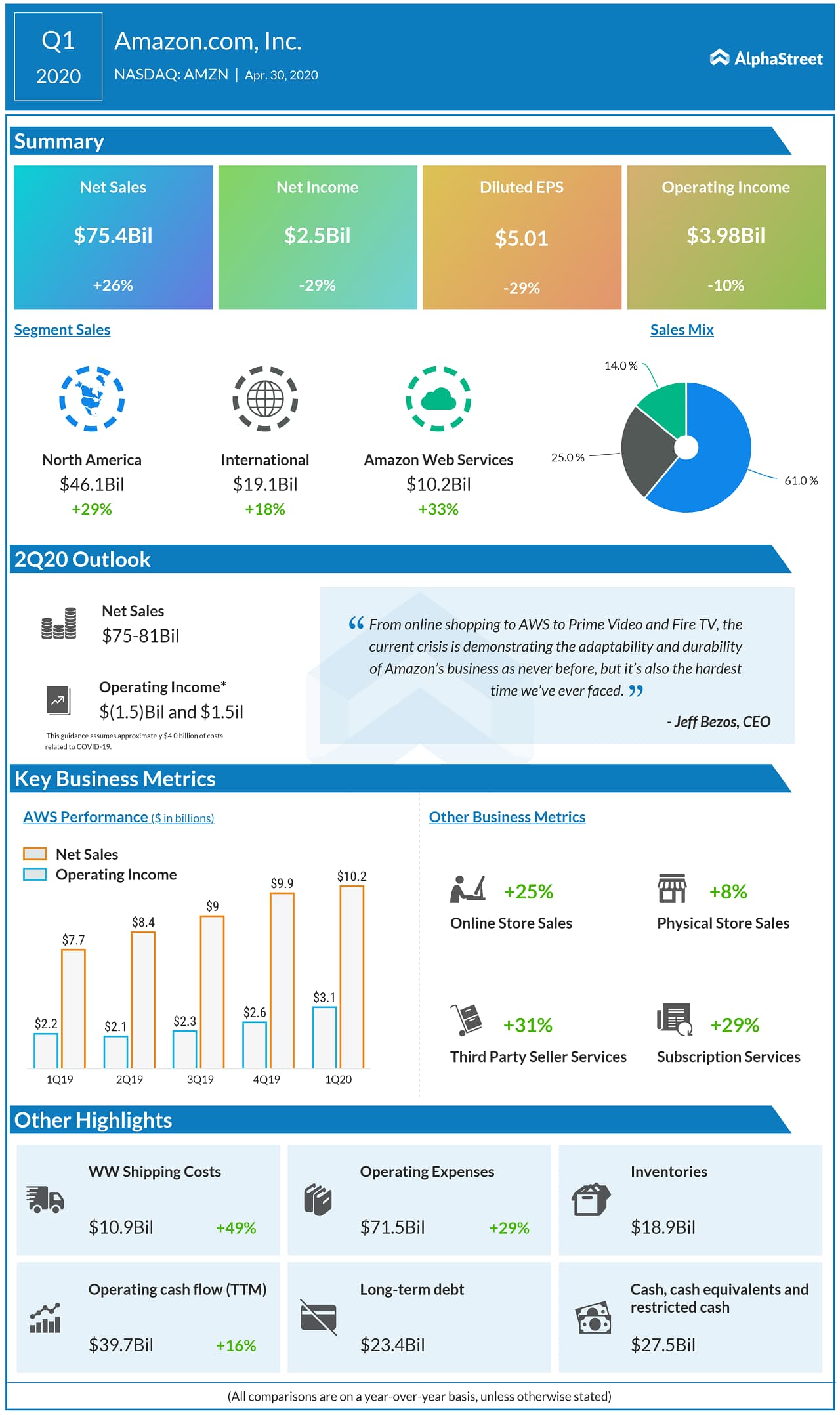

Outlook

For the second quarter of 2020, Amazon expects net sales to

grow 18-28% year-over-year to a range of $75-81 billion. Operating income is

expected to range from a loss of $1.5 billion to an income of $1.5 billion,

assuming approx. $4 billion of COVID-19-related costs.

Looking ahead, the company expects to face challenges related to the cost structure, the ability to get products, and the capacity for shipping and delivering, and believes there is quite a level of uncertainty in this area.