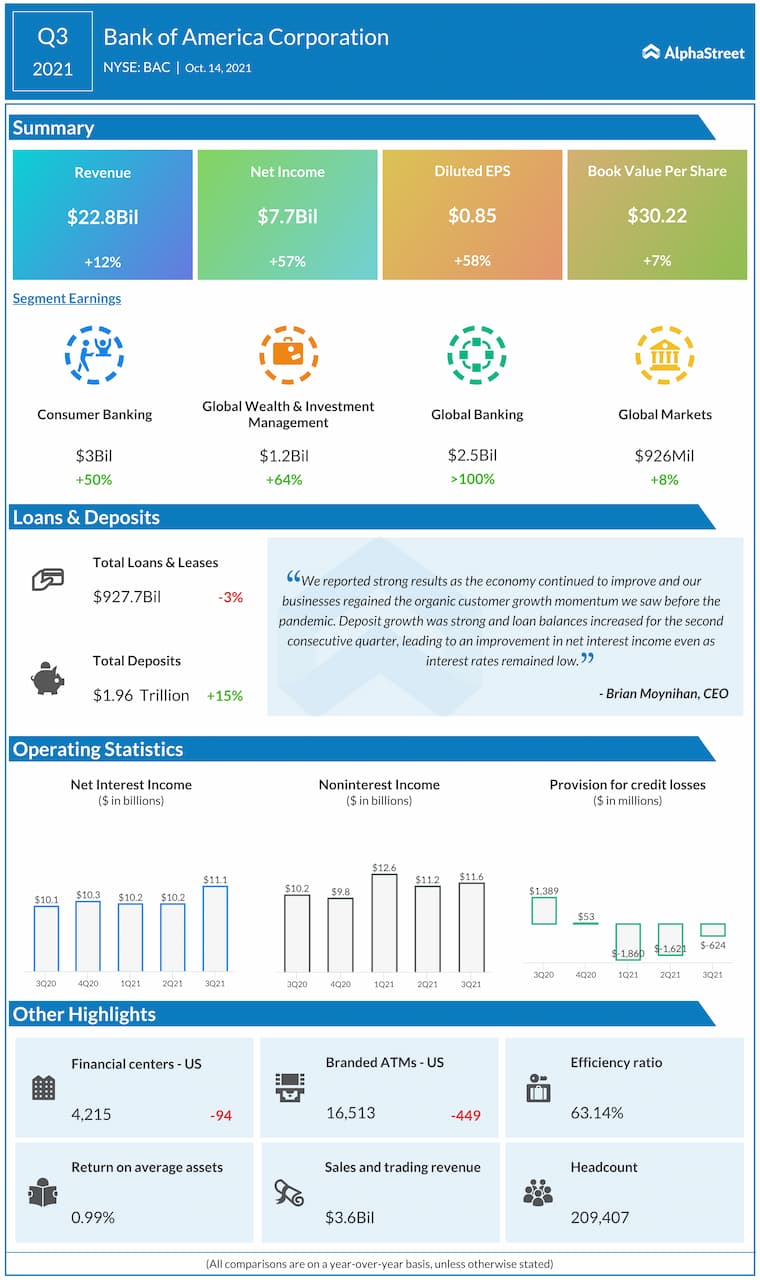

Bank of America Corporation (NYSE: BAC) reported third quarter 2021 earnings results today.

Revenue, net of interest expense, increased 12% year-over-year to $22.8 billion.

Net income rose 58% to $7.7 billion, or $0.85 per share, compared to the year-ago quarter.

Average deposits were up 15% to $1.9 trillion.

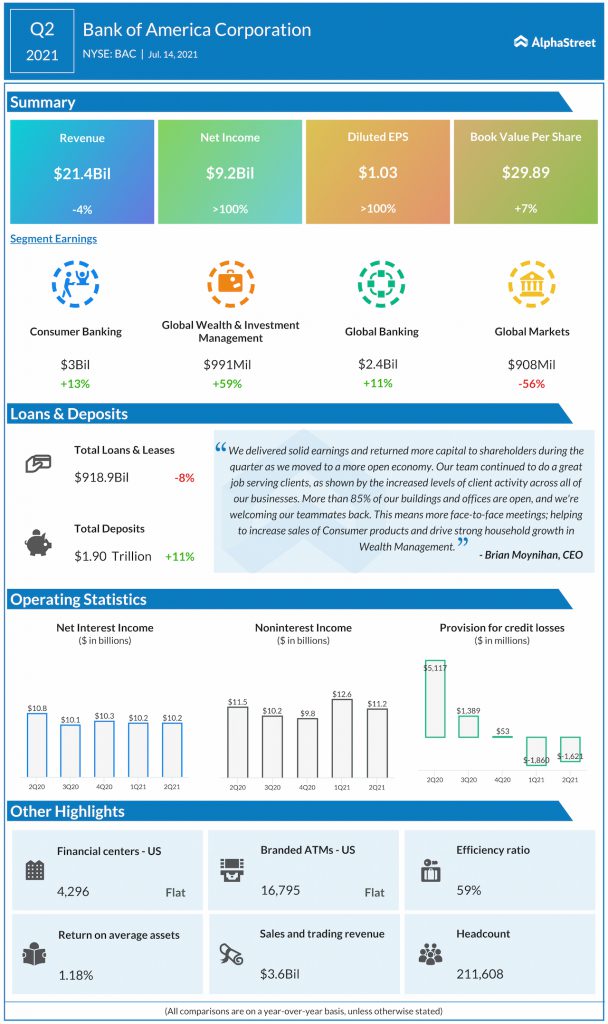

Prior performance