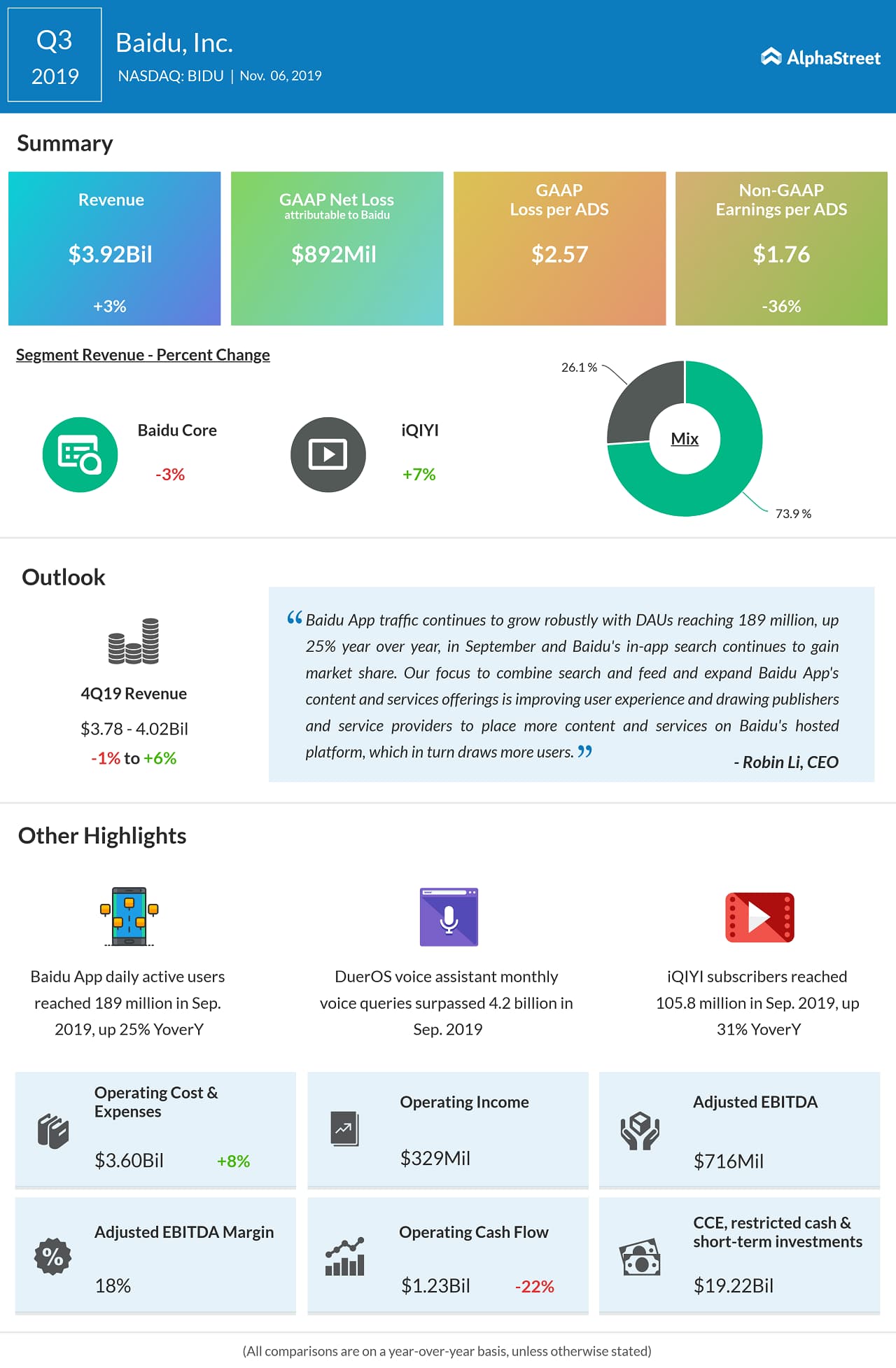

Revenue decreased by 4% to $3.93 billion. Revenue from the online marketing services was down 9% to $2.86 billion. Baidu’s core marketing services performance continued to be impacted by several headwinds.

Looking ahead into the fourth quarter, Baidu expects revenues in the range of $3.78 billion to $4.02 billion, representing a down 1% to 6% increase year-over-year. This assumes that Baidu Core revenue will grow between 0% to 6%.

Baidu App traffic continues to grow robustly with average daily active users (DAUs) reaching 189 million, up 25% year-over-year, in September 2019. Baijiahao, Baidu’s newsfeed network, grew by 57% to 2.4 million publisher accounts. Baidu Smart Mini Program’s monthly active users (MAUs) soared by 157% to reach 290 million.

Monthly voice queries on DuerOS, a leading voice assistant for the Chinese language, surpassed 4.2 billion, up over 4.5 fold year-over-year, in September 2019. In September 2019, China’s first robotaxi pilot program was made available to the public in Changsha, Hunan, with an initial fleet of 45 autonomous driving vehicles powered by Apollo.

iQiyi subscribers reached 105.8 million, up 31% year over year, in September 2019, further strengthening iQiyi’s foundation to produce entertainment-based blockbuster originals. Revenue in iQiyi rose by 7% to $1.04 billion while that in Baidu Core declined by 3% to $2.94 billion.