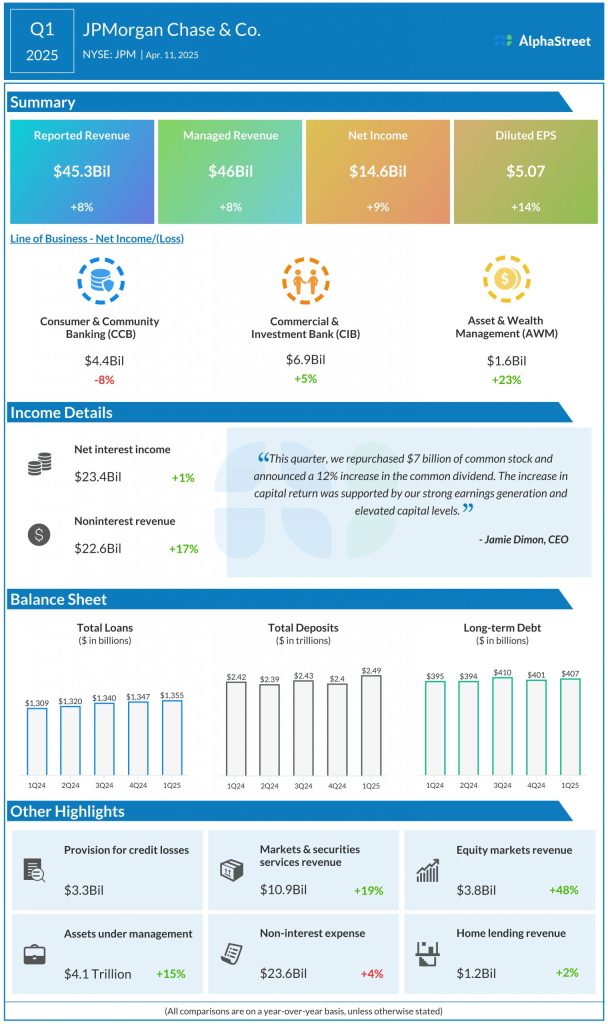

JPMorgan

Citigroup

Citigroup is expected to report earnings of $1.63 per share on revenue of $20.83 billion for Q2 2025. This compares to EPS of $1.52 on revenue of $20.1 billion reported in Q2 2024. In Q1 2025, revenues increased 3% to $21.6 billion and EPS grew 24% to $1.96 compared to last year.

Wells Fargo

Analysts predict earnings of $1.40 per share on revenue of $20.8 billion for Wells Fargo in Q2 2025. This compares to EPS of $1.33 on revenue of $20.7 billion reported in the year-ago quarter. In the first quarter of 2025, revenue decreased 3% YoY to $20.1 billion while EPS rose 16% to $1.39.

Bank of America

Bank of America is projected to report revenue of $26.8 billion for Q2 2025, which implies a growth of over 5% YoY. EPS is estimated to be $0.87, which compares to $0.83 last year. In Q1 2025, revenue grew 6% to $27.4 billion and EPS rose 18% to $0.90 YoY.

Goldman Sachs

Analysts are projecting earnings of $9.68 per share on revenue of $13.54 billion for the second quarter of 2025. This compares to earnings of $8.62 per share on revenue of $12.73 billion reported in the second quarter of 2024. In the first quarter of 2025, revenues increased 6% to $15.06 billion while EPS rose 22% to $14.12 YoY.

Morgan Stanley

Morgan Stanley is expected to report revenue of $16.04 billion in Q2 2025, which indicates a YoY growth of over 6%. EPS is projected to be $2.01, which implies a 10% rise from the previous year. In Q1 2025, net revenues increased 17% YoY to $17.7 billion while EPS grew 29% to $2.60.