JPMorgan

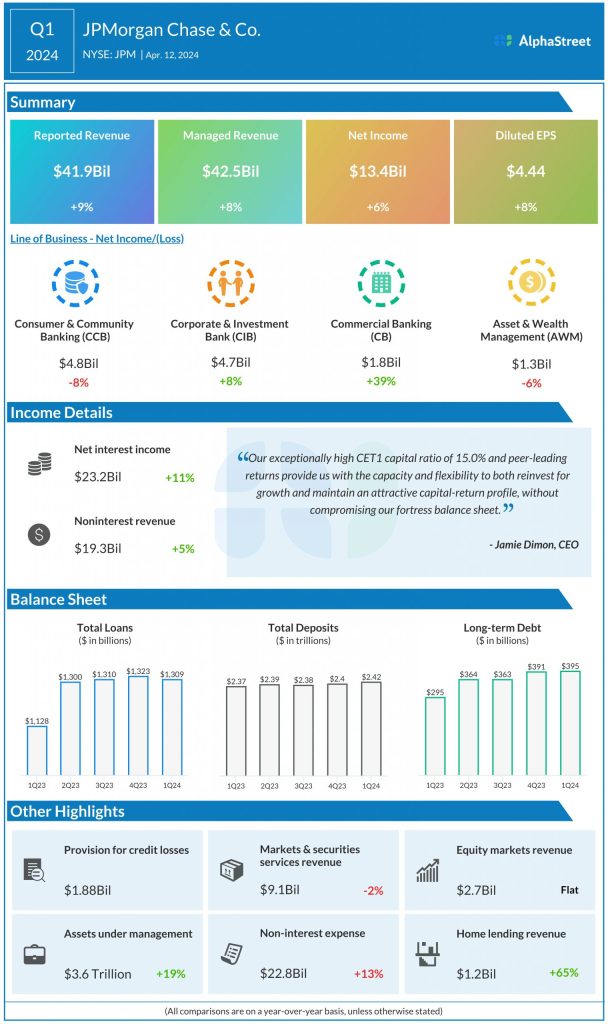

Analysts are projecting earnings of $4.26 per share on revenue of $39.5 billion for JPMorgan for the second quarter of 2024. This compares to earnings of $4.75 per share on revenue of $41.3 billion reported in the same period a year ago. In the first quarter of 2024, the company delivered EPS of $4.44 on revenue of $41.9 billion.

Wells Fargo

The consensus estimate is for earnings of $1.28 per share on revenue of $20.23 billion for Wells Fargo in Q2 2024, which compares to earnings of $1.25 per share on revenue of $20.5 billion reported in the prior-year quarter. In Q1 2024, Wells Fargo reported earnings of $1.20 per share on revenue of $20.8 billion.

Citigroup

Analysts are predicting EPS of $1.41 on revenue of $20.08 billion for Citigroup in Q2 2024. This compares to EPS of $1.33 on revenue of $19.4 billion reported in Q2 2023. In Q1 2024, the company reported EPS of $1.58 on revenue of $21.1 billion.

Goldman Sachs

Goldman Sachs is expected to report earnings of $8.61 per share on revenue of $11.64 billion in the second quarter of 2024. This compares to EPS of $3.08 on revenue of $10.9 billion reported in Q2 2023. In Q1 2024, the company reported EPS of $11.58 on revenue of $14.2 billion.

Morgan Stanley

Analysts expect Morgan Stanley to report earnings of $1.65 per share on revenue of $14.3 billion in Q2 2024. This compares to EPS of $1.24 on revenue of $13.5 billion reported in Q2 2023. In Q1 2024, the company reported EPS of $2.02 on revenues of $15.1 billion.