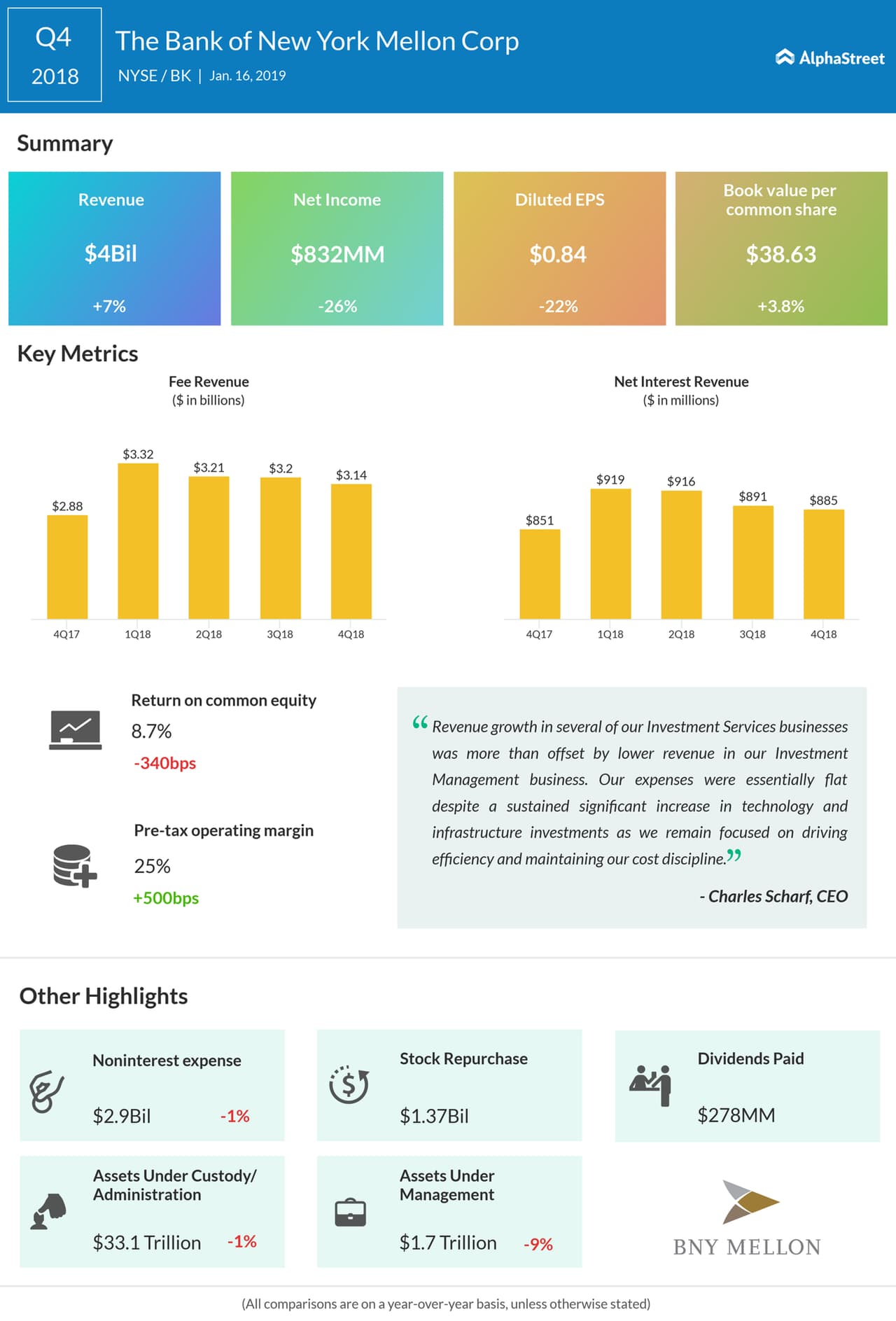

The Bank of New York Mellon Corp. (BK) reported lower earnings for the fourth quarter, despite an increase in revenues. Meanwhile, adjusted earnings increased from last year aided by a decline in expenses. The bank’s stock gained modestly in premarket trading Wednesday.

Reported earnings were $0.84 per share, down from $1.08 per share recorded in the fourth quarter of 2017. Adjusted net profit, excluding special items, rose to $987 million or $0.99 per share from $945 million or $0.91 per share a year earlier. The bottom line benefitted from the management’s cost-cutting initiatives and lower tax rates.

Total revenues of the financial services firm advanced 7% year-on-year to $4.01 billion. Fee revenue and net interest revenue grew 9% and 4% respectively. Revenues in the Investment Services business increased 3%, while the Investment Management business registered an 8% decline. Total adjusted revenues, meanwhile, dropped 1%.

At $3 billion, noninterest expenses were down 1% compared to the prior year as lower ‘other expenses’ more than offset the costs related to investments in technology. The bank repurchased 28.9 million shares for $1.37 billion in the fourth quarter and paid $278 million to shareholders as dividends.

During the fourth quarter, the bottom line benefitted from the management’s cost-cutting initiatives and lower tax rates

“As we look forward, we are cautious regarding how the economic and market environment will impact our business in 2019. Our ongoing drive toward efficiency will allow us to continue to increase our investment in technology and infrastructure without meaningfully impacting the total cost base,” Said CEO Charlie Scharf.

First Republic Bank stock rallies after Q4 results beat estimates

Among others, Bank of America (BAC) reported a sharp rise in earnings for the most recent quarter, supported by an 11% increase in revenues amidst strong interest income growth. Earlier, Citigroup (C) posted better than expected earnings for the fourth quarter, despite a 2% decline in revenues. First Republic Bank (FRC) reported double-digit growth in earnings and revenues, triggering a stock rally Tuesday.

Shares of BNY Mellon gained modestly in the pre-market trading Wednesday following the earnings report, after closing the last trading session higher.