Market capitalization

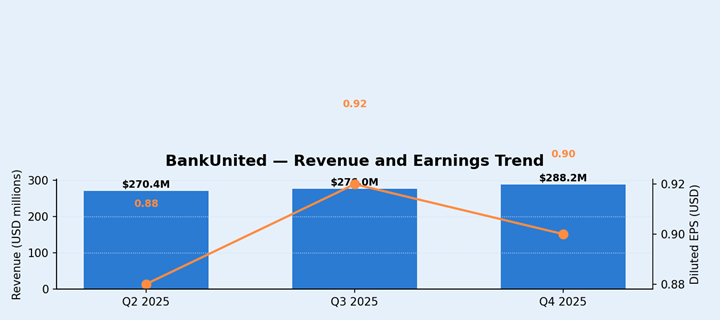

Latest quarterly results (Q4 2025)

• Consolidated revenue (net interest income plus non-interest income): $288.2 million.

• Net income: $69.3 million; diluted EPS: $0.90.

• Year-over-year: revenue rose about 9.1%; net income was broadly flat versus the year-earlier quarter.

Segment highlights

• Net interest income: $258.2 million in Q4 2025.

• Non-interest income: $30.0 million in Q4 2025.

• Deposits: $29.35 billion at Dec. 31, 2025; non-interest bearing deposits increased in the quarter.

• Loans: $24.27 billion at Dec. 31, 2025; core commercial portfolios $16.57 billion.

• Provision for credit losses: $25.6 million in Q4; ACL roughly 0.91% of loans.

Operating performance — Quarterly revenue (USD millions)

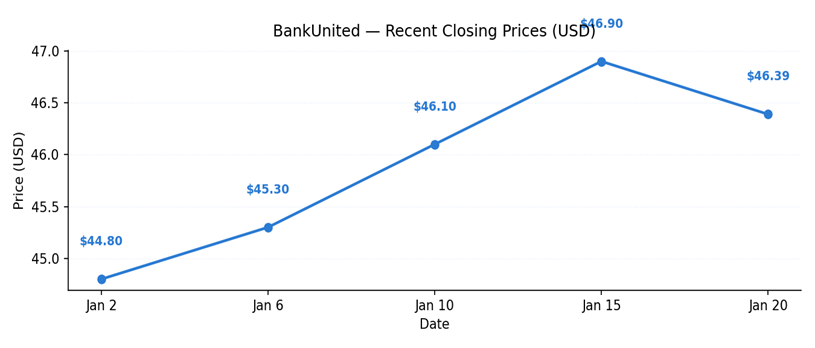

Market performance — Recent closing prices (USD)

Full-year results context

For the year ended December 31, 2025, the company reported higher annual revenue and broadly stable net income year over year.

Business & operations update

• Core deposit growth continued, with reductions in reliance on wholesale funding.

• Investments in personnel and technology contributed to higher compensation and technology expense in the quarter.

• Management highlighted ongoing loan repricing and funding-cost initiatives.

M&A or strategic moves

• The board authorized an incremental $200 million share repurchase program.

• The board increased the quarterly dividend by $0.02 to $0.33 per share.

Equity analyst commentary

• Analysts noted deposit inflows and loan growth as key themes following the quarter.

• Market commentary focused on the implications of the repurchase program and dividend change.

Guidance & outlook — what to watch for

• Watch management commentary on credit provisioning and the cadence of loan growth.

• Watch timing and execution of the repurchase program and dividend implementation.

• Watch deposit-cost trends as repricing flows through the balance sheet.

Performance summary

• Stock move: closed down 1.42% at $46.39.

• Key results: Q4 revenue $288.2m; net income $69.3m.

• Segment signals: deposit growth and ongoing loan repricing.