“We are still very early in the evolution of the digital asset ecosystem. We have really started seeing over the last couple of years an influx of institutional investors and high net worth investors getting involved in the sector.”

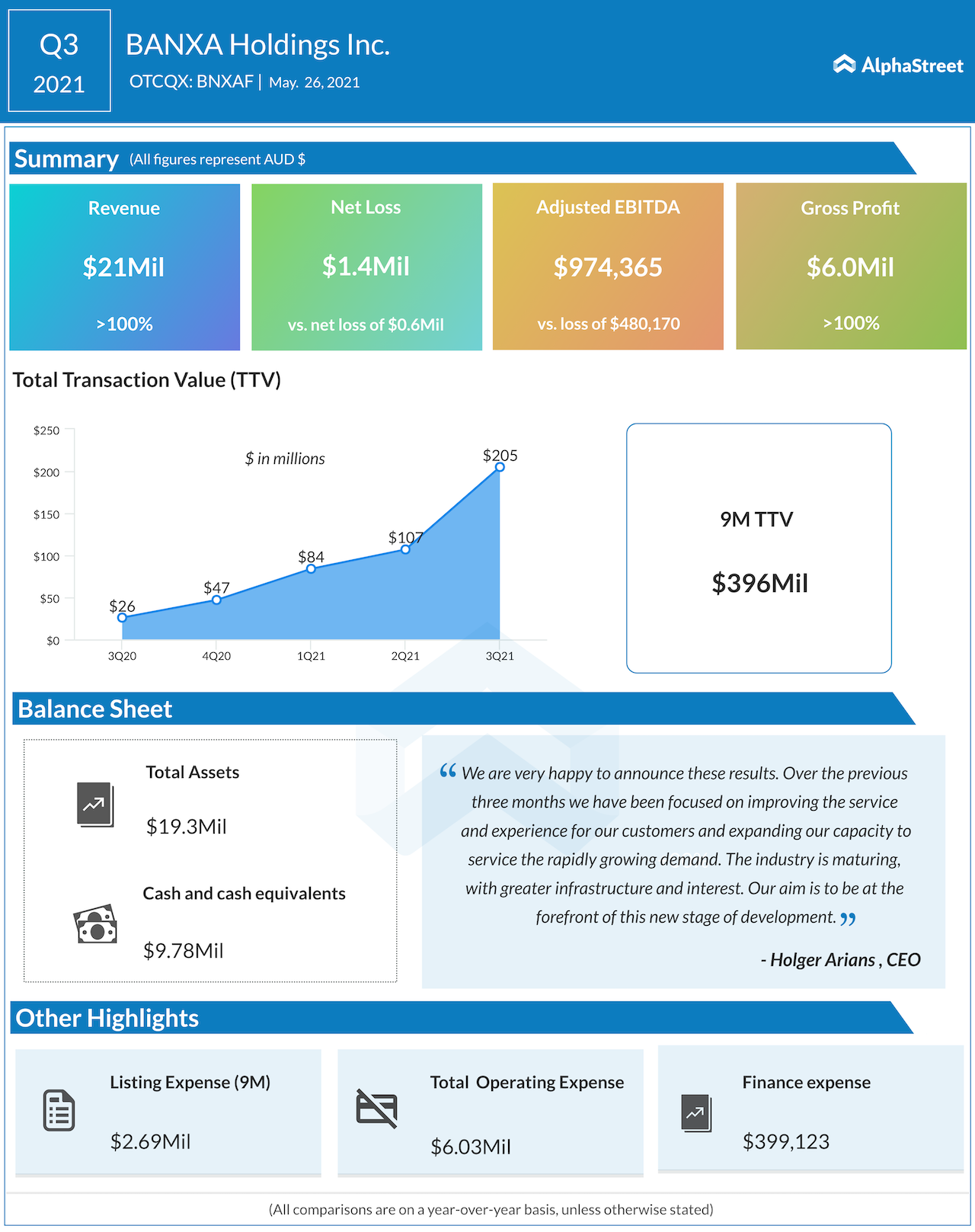

Banxa is a Canadian payment service provider that helps investors convert fiat currency into cryptocurrency. The company, which primarily operates in the US and Canada, had reported a total transaction value of $205 million for the quarter ended March 31, 2021, representing a whopping growth of over 680% from the same period last year.

Speaking to AlphaStreet, Carosa said the platform is likely to see further growth as the whole ecosystem expands. Unlike the times when the company was founded, the executive pointed out, the crypto industry has become highly regulated leading to compliance requirements. Banxa has numerous licenses around the world, more than any competitor, making it one of the safest and compliant platforms for crypto purchase, Carosa added.

The company has established partnerships with various global crypto platforms including Binance, Bithumb, and Abra. The management expects to ink more partnerships this year, as well as add support for more coins on the platform.

Elaborating on the growth strategy, Carosa said, “In the short to medium term, our focus is on organic growth. We are expanding rapidly in the DeFi space and making some inroads in the NFT space. We are growing faster now and so there are no acquisitions in the pipeline at this stage.”

The company is currently listed on the Toronto Stock Exchange and expects to list in NASDAQ sometime next year. “One of the reasons that we selected TSX is because once we have been listed there for 12 months, there is an opportunity for us to uplist to NASDAQ. And it is on our radar for 2022.”

If Banxa delivers on the promise of organic growth, the company could offer plenty of upside to investors. The liquidity in the market will lead to more transactions, and the platform will continue to generate revenues irrespective of the direction of the currency movements. Meanwhile, investors will need to be wary of government regulations surrounding the digital assets as these could have a huge impact on Banxa’s operations.

Economic recovery gives 360 DigiTech further room for growth: CFO Alex Xu

BNXA was trading at just above C$4 on Wednesday. Fundamental Research Corp, which covers the stock, has a Buy rating on it with a Fair Value of C$11.76.

(Written by Arjun Vijay)

_______