— Baozun Inc. (NASDAQ: BZUN) reported its fourth-quarter 2019 adjusted earnings of RMB2.71 ($0.39) per American Depository Share, versus RMB3.19 per ADS expected.

— Total net revenues jumped by 26.4% year-over-year to RMB2.78 billion ($399.9 million), versus RMB2.74 billion expected.

— Services revenue grew by 22% to RMB1.49 billion ($214.2 million), primarily attributable to the rapid growth of its consignment model and service fee model.

— Product sales climbed by 33% to RMB1.29 billion ($185.7 million), driven by the acquisition of new brand partners, the increased popularity of brand partners’ products, and Baozun’s increasingly effective marketing and promotional campaigns.

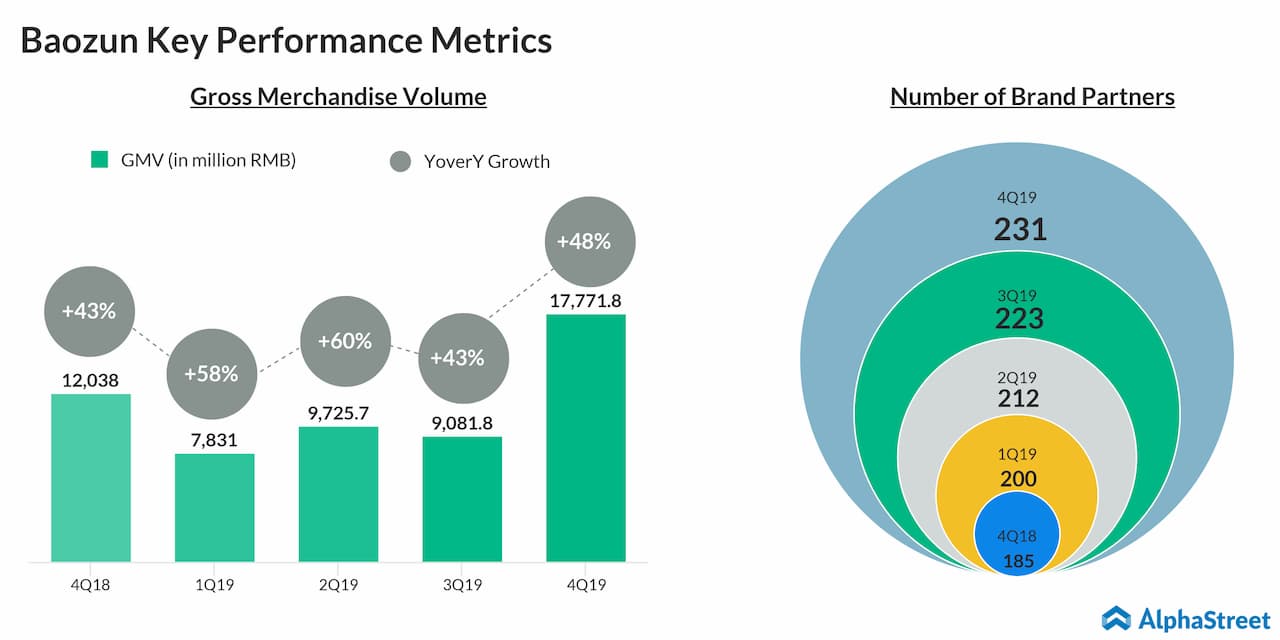

— Total Gross Merchandise Volume (GMV) surged by 48% year-over-year to RMB17.77 billion. Distribution GMV jumped by 30% and non-distribution GMV climbed by 50%.

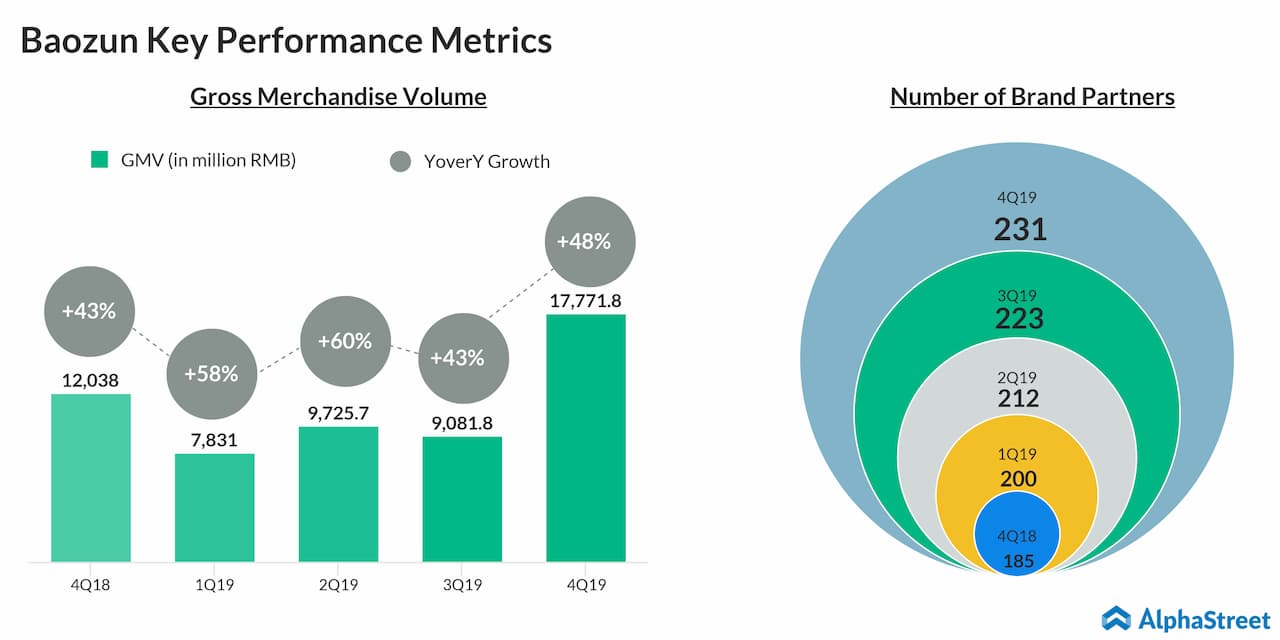

— The number of brand partners increased to 231 as of December 31, 2019, from 185 as of December 31, 2018. The number of GMV brand partners increased to 222 from 178 last year.

— Looking ahead into the first quarter of 2020, the company expects total net revenues in the range of RMB1.4-1.45 billion, which represents a year-over-year growth rate of 9-13%. This is lower than the consensus view of RMB1.64 billion.

— Despite the global economic impact the outbreak of COVID-19 is having, China’s e-commerce sector continues to demonstrate tremendous resilience. The company believes its strategy will ultimately yield more balanced and sustainable growth with operating profitability expansion.

— Provided the macroeconomic environment does not deteriorate further, the company anticipates that GMV for the first quarter to grow by at least 10% and reaffirms its expectation to achieve steady operating margin recovery for the full year 2020.