Shares of Southwest Airlines (NYSE: LUV) dipped slightly on Thursday, despite the company delivering fourth quarter 2023 earnings results that beat expectations. Although the airline expects cost pressures in the coming fiscal year, it plans on countering them through network adjustments and strategic initiatives.

Quarterly performance

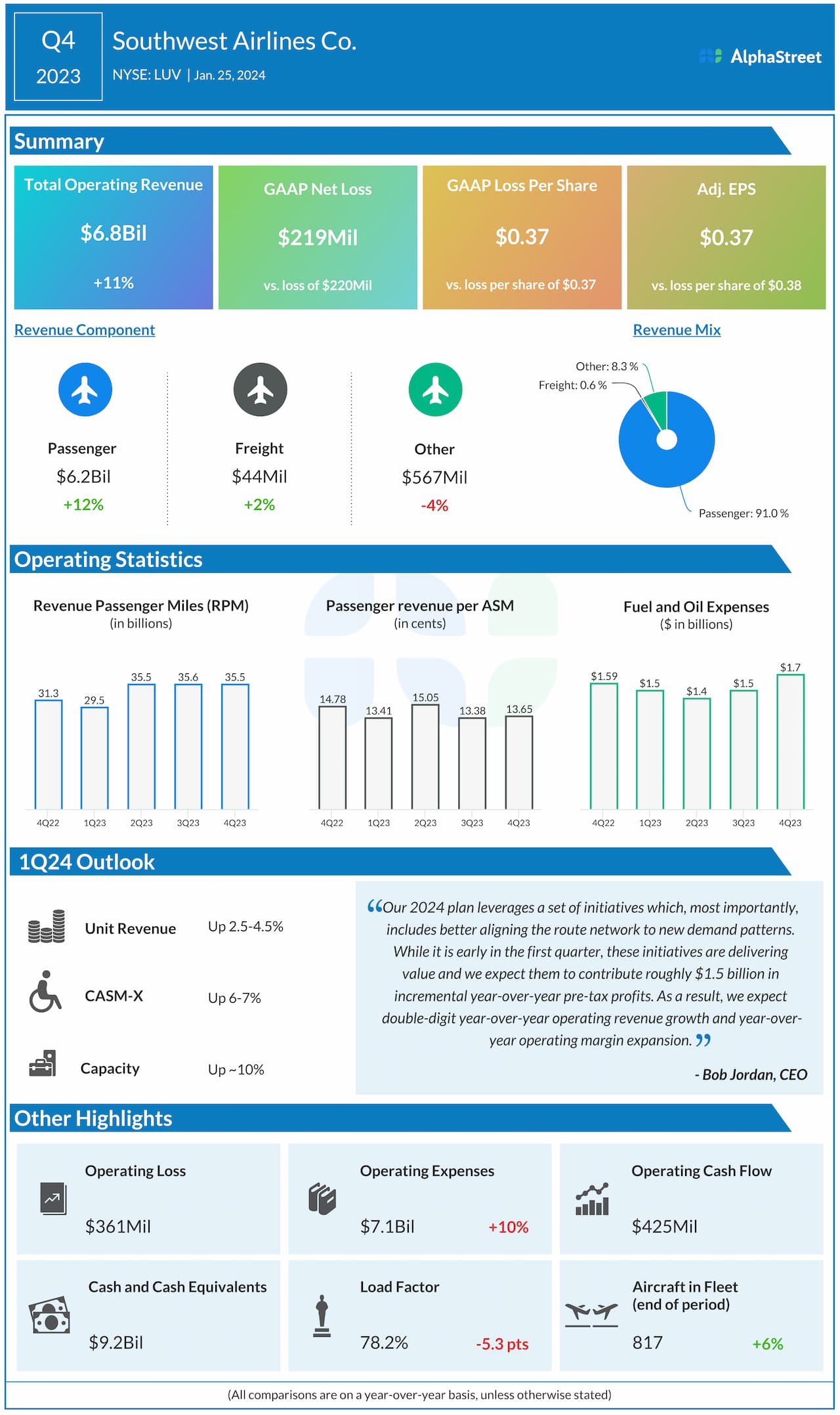

Southwest’s operating revenues in Q4 2023 increased nearly 11% year-over-year to $6.8 billion, beating estimates of $6.7 billion. GAAP net loss per share remained flat YoY at $0.37. Adjusted EPS amounted to $0.37, surpassing projections of $0.12.

Trends

Southwest’s top line performance in the fourth quarter benefited from healthy leisure demand and continued yield strength, particularly during the holidays, as well as ancillary and loyalty program revenues. Close-in bookings, including managed business bookings, performed better than expected in November and December, leading to unit revenues outperforming the company’s previous outlook.

Revenue per available seat mile (RASM) was down 8.9% in Q4 while passenger revenue per available seat mile (PRASM) was down 7.6%. Capacity was up 21.4% while load factor was 78.2%. Cost per available seat mile, excluding fuel and other items, (CASM-X) was down 18.1%. Economic fuel costs were $3.00 per gallon in the quarter.

Outlook

For the first quarter of 2024, Southwest expects unit revenues to be up 2.5-4.5% while capacity is expected to be up around 10% YoY. CASM-X is expected to be up 6-7% YoY and economic fuel costs per gallon are expected to range between $2.70-2.80.

For the full year of 2024, capacity is expected to be up around 6% YoY. CASM-X is expected to be up 6-7% and economic fuel costs per gallon are expected to range between $2.55-2.65.

“Despite inflationary unit cost pressures from new labor agreements and a planned increase in aircraft maintenance, we plan to counter some of those cost pressures through strategic initiatives and already actioned network adjustments, creating operating margin expansion, excluding special items, in 2024. We also expect to make notable progress regaining efficiencies, with planned headcount at the end of 2024 flat to down year-over-year as we slow hiring to levels below attrition.” – Bob Jordan, President and CEO