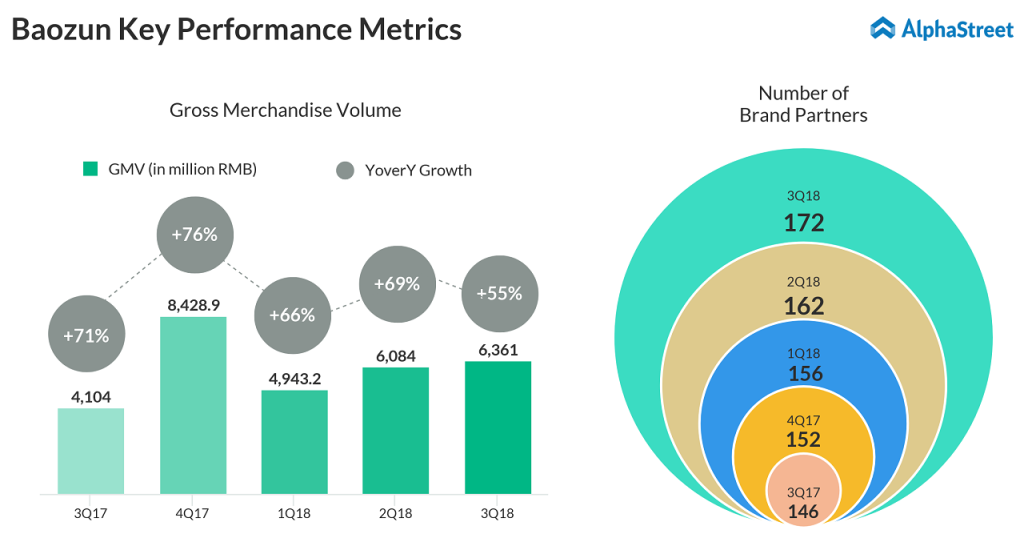

Total gross merchandise volume (GMV) surged 55% annually to RMB6.4 billion. The number of brand partners increased to 172 from 146 as of September 30, 2017, and 162 as of June 30, 2018.

The Shanghai, China-based company expects total net revenues to be between RMB2.200 billion and RMB2.250 billion for the fourth quarter of 2018.

“We are pleased to report another quarter of solid growth across the board, driven primarily by growth from our existing online stores and improving operational efficiency as we invest further in developing new and innovative products and tools,” said CEO Vincent Qiu.

On November 12, Baozun announced the results of Singles Day 2018. Total order value increased to RMB6.55 billion compared to RMB4.99 billion in 2017. However, the growth rate was below compared to the years 2016 and 2017. Fearing that this slowdown might reflect in the company’s fourth quarter results, the stock plunged about 20% on that day.

“Our daily sales momentum during the fourth quarter of 2018 continues to remain strong and outpace the growth on Singles Day this year. As such, we expect our GMV for the fourth quarter of 2018 to grow 40-45% on a year-over-year basis while our services revenue during the fourth quarter of 2018 will grow faster than the GMV growth,” said CFO Beck Chen.

Baozun helps its brand partners to establish market presence and launch products on official brand stores, and major online marketplaces like Alibaba’s (BABA) Tmall and JD.com (JD), and major social media platforms like WeChat and Weibo, in China. Some notable brand partners include Philips, Nike (NKE) and Microsoft (MSFT).

Analysts expect that trade war noises might affect Baozun in the future. But Baozun is doing the e-commerce business mainly in China. Since Baozun has got limited cross-border businesses, the impact from the trade war is expected to be very little in the near term for the company.

The stock ended Tuesday’s regular trading session on Nasdaq at $30.13, down 3.06%. Shares of Baozun have dropped 5% so far in this year and 17% in the past 52-weeks.