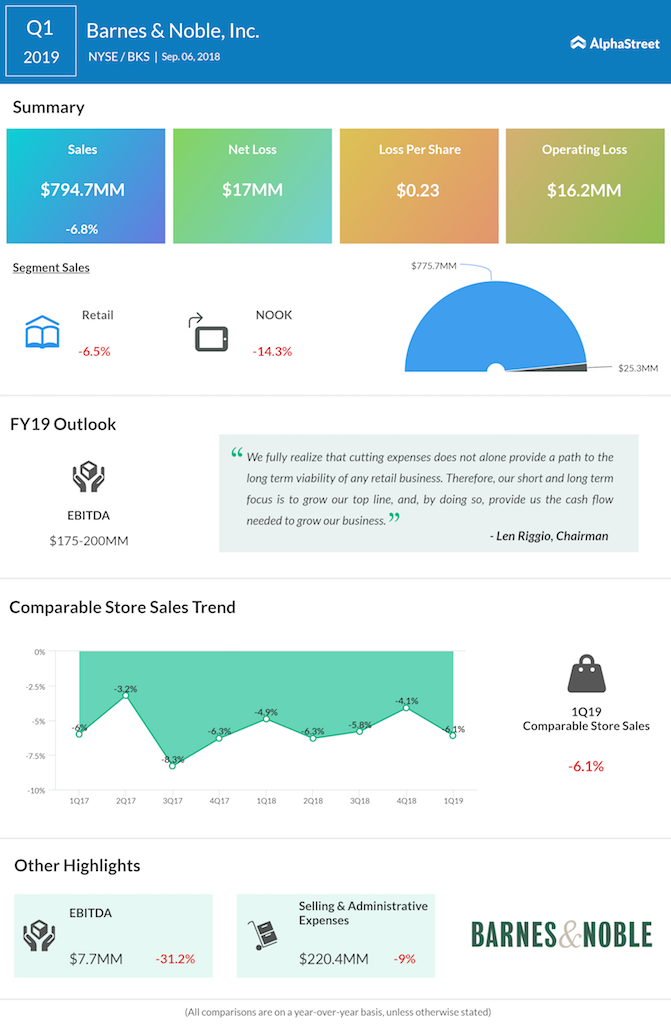

Comparable sales showed an improving trend through each month of the first quarter, declining 7.8%, 6.1% and 4.5%. This trend continued into the second quarter with a decline of 0.8% in August.

The company stated that expense reduction alone was not viable for the business and its focus, both for the long and short terms, is to increase revenues which in turn would bring in the cash flow required for growth.

Barnes & Noble is getting ready for the upcoming holiday season and the retailer is encouraged by its improving sales trend as well as its fall title line-up. For fiscal 2019, the company anticipates EBITDA to come in the range of $175 million to $200 million.

Barnes & Noble continues to struggle in a retail environment dominated by Amazon and the company is now facing a lawsuit from former CEO Demos Parneros who was laid off in July over policy violations.

The stock dropped over 7% in premarket hours after the results release.