A statement from WhatsApp Wednesday said that each message with confirmed delivery would be charged between 0.5 cents and 9 cents, depending on the geographic location. The charges will be applicable to companies that use the WhatsApp Business API for sending official messages like delivery notifications and tickets. It will be slightly higher than the prevailing SMS charges.

The plan to charge business customers was first revealed when WhatsApp opened its Business API for enterprise accounts

The Business API is the only product from WhatsApp that generates revenue directly. However, business entities will be able to message only people who contact them. Initially, the company plans to charge only replies sent 24 hours after the users’ last message. Once the trend catches up, all messages might be charged in the long term.

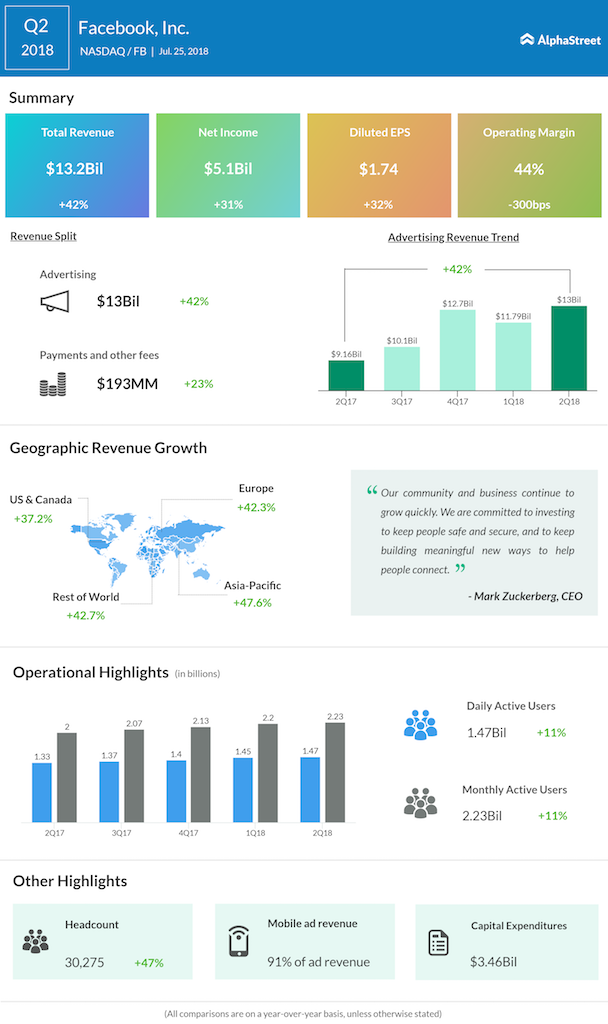

Passing through one of the worst phases in its history, Facebook is facing multiple challenges such as a falling user base and muted revenue growth. Those factors have added to the financial liability brought on by a series of lawsuits and huge penalties. Things took a turn for the worse last week when the company’s market value fell by more than $100 billion after its downbeat financial guidance triggered s stock sell-off.

RELATED: Facebook unfriends data sharing partner

Meanwhile, acting on its commitment to address the menace of social media addiction, Facebook has rolled out features that would allow users to keep track of the time they spend on its platform and to stop receiving notifications from for a set period of time.

After suffering a dramatic fall following last week’s unimpressive financial results, Facebook shares have been trading at historic lows. The stock lost nearly 1% during Wednesday’s regular session.

RELATED: Facebook’s topline misses in Q2