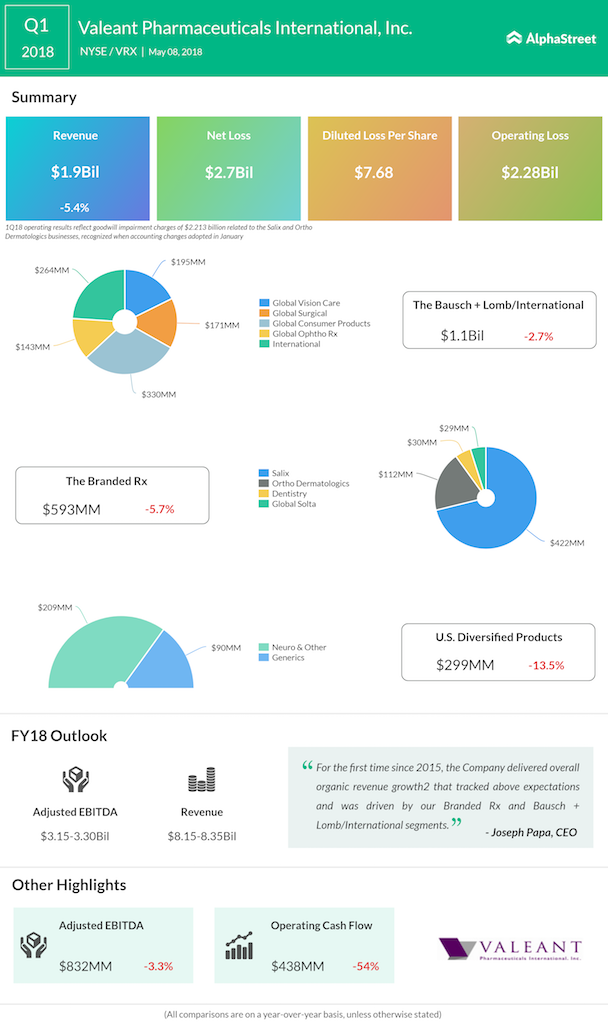

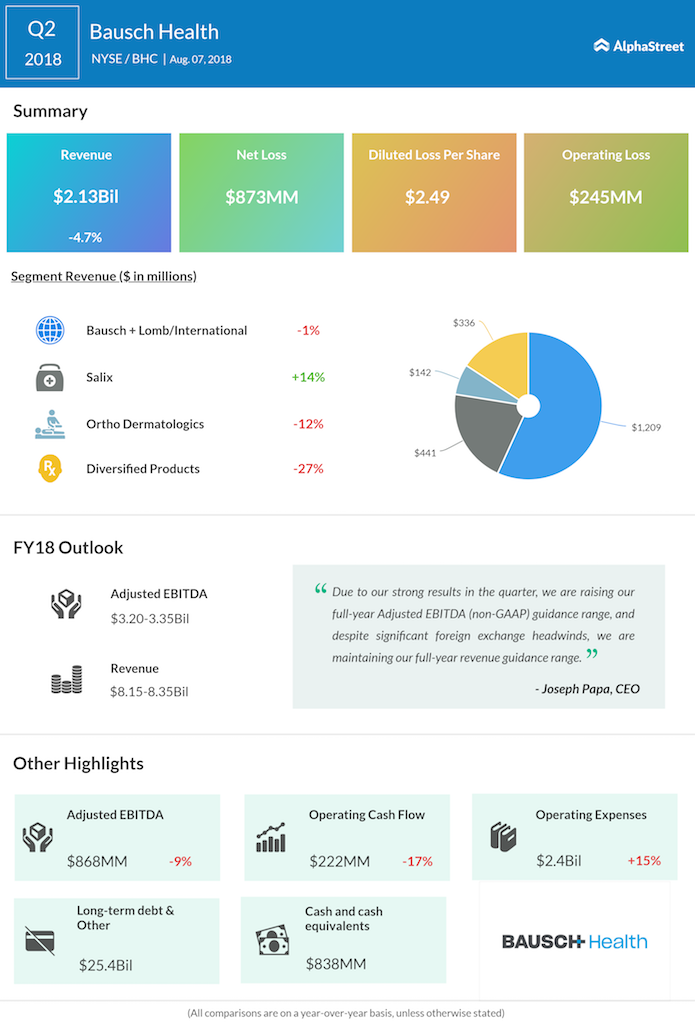

Bausch Health Companies (BHC) reported a 5% decline in revenues to $2.12 billion for the second quarter of 2018 compared to the same period last year. Organic revenue grew 3%. The company managed to beat analyst expectations on revenue numbers. Shares rose over 2% premarket.

Net loss for the quarter was $873 million or $2.49 per share compared to $38 million or $0.11 per share in the prior-year period, impacted by a bigger operating loss and a higher provision for income taxes. Adjusted net income was $327 million.

Bausch maintained its revenue guidance for full-year 2018 while raising the outlook for adjusted EBITDA. The company expects revenues to be $8.15 billion to $8.35 billion. Adjusted EBITDA is now expected to come in at $3.20 billion to $3.35 billion in 2018 versus the prior range of $3.15 billion to $3.30 billion.

During the quarter, the company completed its name change to Bausch Health Companies Inc. and realigned into four reporting segments – Bausch + Lomb/International, Salix, Ortho Dermatologics and Diversified Products.

Bausch Health saw revenue declines across all its segments expect Salix. Revenues in Salix grew 14% mainly driven by higher sales of XIFAXAN, RELISTOR and other promoted products across the segment. XIFAXAN revenue grew 26% while RELISTOR franchise revenue rose 43% during the quarter. Revenue in the Global Solta business improved by 14% during Q2 2018.

The FDA accepted the New Drug Application for loteprednol etabonate ophthalmic gel with a PDUFA action date of February 25, 2019.

Related: Earnings Preview: Bausch Health looks for cure in Q3

Related: Q1 Earnings Infographic