It’s been a testing time for the entire retail industry, which is shattered by the pandemic. Market observers predict a wave of bankruptcy filings in the near future, particularly in the hard-hit retail industry. This is evident from the year-to-date Chapter 11 filings of retailers including J. Crew, Neiman Marcus, Stage Stores, J.C. Penney and Tuesday Morning. In this article, let’s analyze omnichannel retailer Bed Bath & Beyond’s (NASDAQ: BBBY) recent performance and its future.

Overview

The Union, New Jersey-based firm sells domestic merchandise and home furnishings. Domestic merchandise includes bed linens and related items, bath items and kitchen textiles. Home furnishings include categories such as kitchen and tabletop items, fine tabletop, basic housewares, general home furnishings and consumables. BBB sells its products through in-store, online, mobile devices and customer contact centers.

FY19 performance

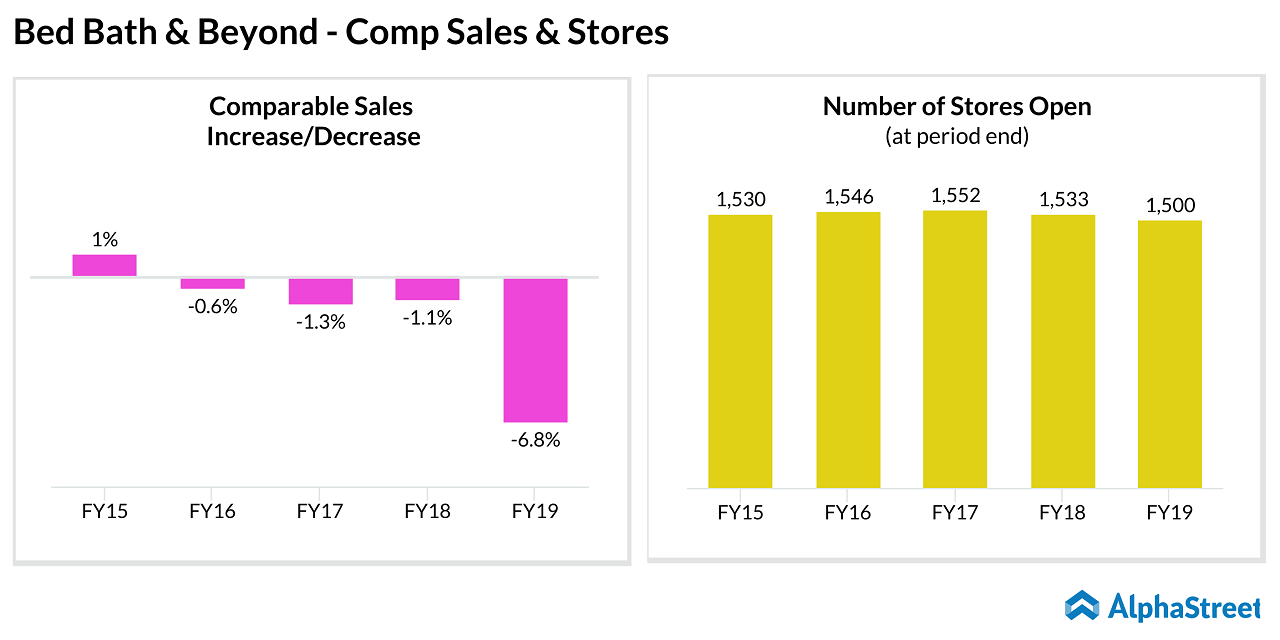

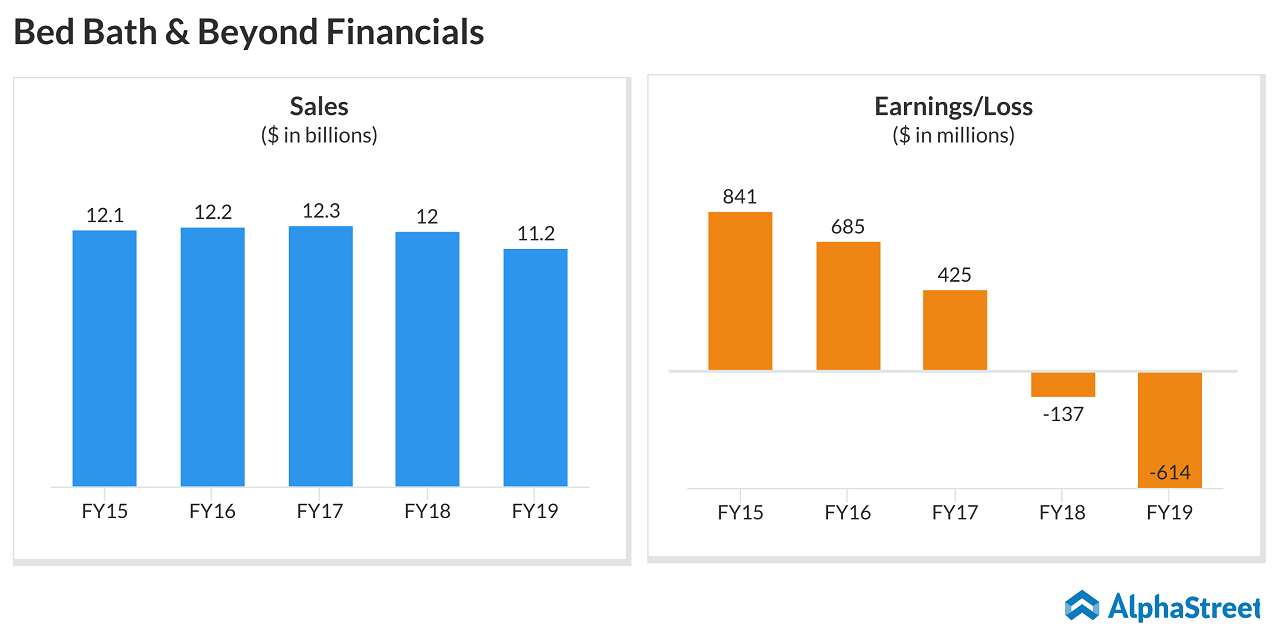

For the fiscal year ended February 29, 2020, Bed Bath &

Beyond’s loss expanded to $614 million or $4.94 per share from a loss of $137

million or $1.02 per share in the prior-year period. Sales dropped 7% to $11.2

billion. Comparable sales declined by 6.8%. At the end of FY19, the company

operated 1,500 stores.

Outcome of COVID-19

At the end of March, Bed Bath & Beyond closed 1,330 stores, leaving about 170 stores open to provide essential items. On May 22, BBB announced that it would reopen about 600 stores in North America by June 13. This equates to around 50% of the company’s total store fleet. But the company hasn’t confirmed these 600 stores reopening till the writing of this article.

Update: In an email communication to AlphaStreet on June 22, the company spokesperson stated,

“In recent weeks, the pace of store re-openings has accelerated in line with changing local and state regulations, market data and the wider retail landscape. The Company expects approximately 95% of its total store fleet to re-open by the end of this week and nearly all stores to re-open by July 2020, subject to state and local regulations.”

As of February 29, 2020, BBB employed approximately 55,000 regular full-time and part-time associates. In connection with the temporary store closures, the majority of store associates and a portion of corporate associates were furloughed. On May 22, the company announced that it will bring back around 11,000 associates from furlough as stores re-open to the public.

[irp posts=”55958″]

BBB has deferred the remodeling of stores due to the outbreak

of coronavirus and the timing issues it created. The company didn’t want to

interfere with the critical third quarter and fourth quarter holiday period in

2020.

During the fourth quarter earnings call, Bed Bath & Beyond didn’t provide the fiscal 2020 outlook due to the consequences of the outbreak. It also postponed the share repurchases, future dividends and debt reduction to preserve the financial position and retain financial flexibility.

Transformation efforts

Even before COVID-19, the home furnishings retailer had planned

the strategic actions for fiscal 2020. The company generated over $250 million

in net proceeds from the sale-leaseback transaction in the fourth quarter of 2019.

BBB entered into a definitive agreement to sell its personalizationmall.com

business to 1-800-Flowers for $252 million. This transaction was required to

close on March 30, but the buyer breached its obligation.

The company plans to invest about $250 million, focusing on digital and omnichannel fulfillment capabilities, including Buy Online Pick Up In Store (BOPIS), curbside pickup, omnichannel inventory management as well as digital marketing and personalization. The $150 million of planned capital expenditures were postponed by the company, which included some store remodels.

[irp posts=”64085″]

As part of the leadership restructuring, the Board appointed Mark Tritton as CEO in October 2019. In redefining the structure and roles of the new leadership team, six senior executives resigned from the company in December 2019. In the last three months, Bed Bath & Beyond appointed Joe Hartsig as the Chief Merchandising Officer, John Hartmann as the COO, Gustavo Arnal as CFO, and Cindy Davis as Chief Brand Officer. The company expects the new executives to re-establish its authority in the home space.

What’s next

After reaching a 52-week high ($17.79) in December last year, BBBY stock plunged to a yearly low ($3.43) in less than four months. From its 52-week low, shares of Bed Bath & Beyond have almost tripled now. On June 16, BBBY stock soared 15% as the US retail sales jumped 17.7% in May from April. However, we need to watch out this momentum and monitor how the new leadership is transforming the company and whether the company’s business transformation efforts will be fruitful to it.

On May 22, CEO Mark Tritton said:

Over recent weeks in the US, traffic to our Bed Bath & Beyond website and mobile app is up approximately 30% and digital sales have doubled.

Bed Bath & Beyond has bolstered its online sales recently even though it’s not on par with Walmart (NYSE: WMT) or Amazon (NASDAQ: AMZN). But it’s worth noting that shares of BBBY showed a negative trend even before the impact of the deadly virus. A long-term investor can wait and check whether Bath & Beyond is able to pass through the trough in the next few quarters and then decide on buying BBBY stock.